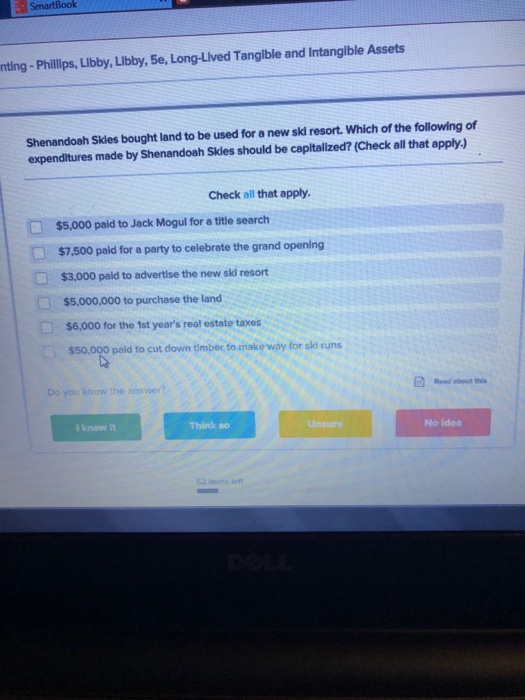

Question: nting-Phillips, Libby, Libby, 5e, Long-Lived Tangible and Intangible Assets Shenandoah Skies bought land to be used for a new ski resort. Which of the following

nting-Phillips, Libby, Libby, 5e, Long-Lived Tangible and Intangible Assets Shenandoah Skies bought land to be used for a new ski resort. Which of the following of expenditures made by Shenandoah Skies should be capitallzed? (Check all that apply.) Check all that apply. $5,000 paid to Jack Mogul for a title search $7.500 paid for a party to celebrate the grand opening $3,000 paid to advertise the new ski resort $5,000,000 to purchase the land $6,000 for the 1st years real estate taxes $50,000 pald to cut down timber fo make way for ski runs Read about this Do you know the answer? I know It Think so Unsur No idea 52 hens e

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts