Question: nts - Gocx Unit 4 Problemsn.pdf Problemsn.pdf 1/1 Unit 4 Problems (4, 7, 10, 18, and 20) - DO NOT DO #16 4. Calculating Interest

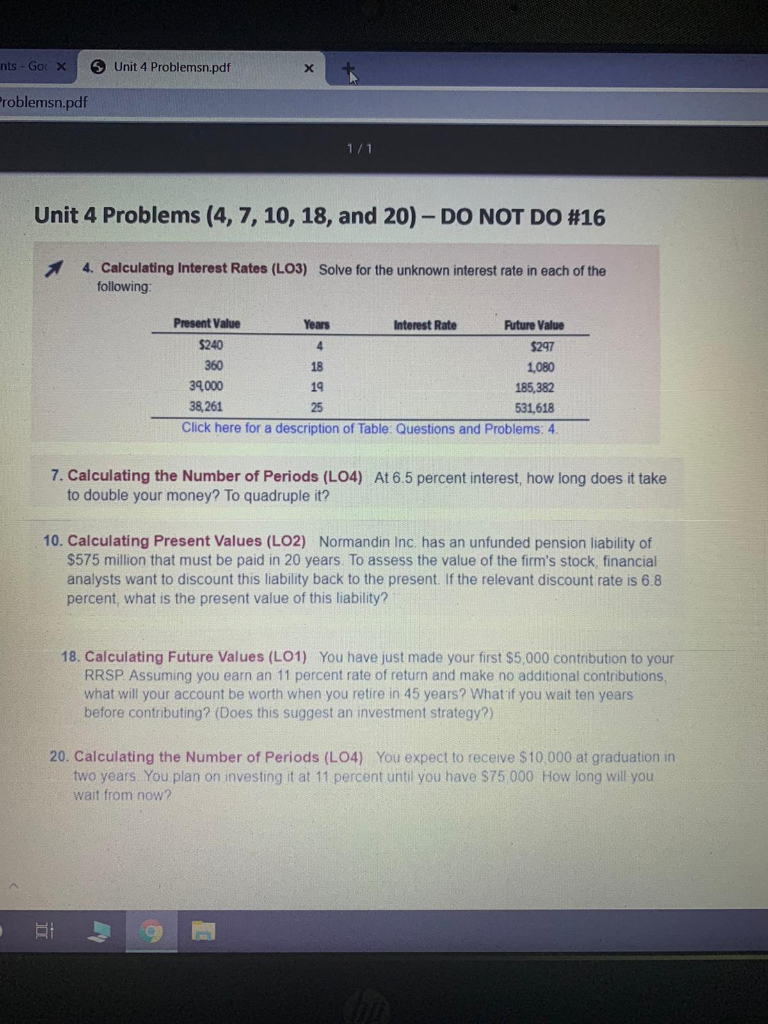

nts - Gocx Unit 4 Problemsn.pdf Problemsn.pdf 1/1 Unit 4 Problems (4, 7, 10, 18, and 20) - DO NOT DO #16 4. Calculating Interest Rates (L03) Solve for the unknown interest rate in each of the following Present Value Years Interest Rate Future Value $240 4 $297 360 18 1,080 39000 19 185,382 38,261 25 531,618 Click here for a description of Table: Questions and Problems: 4 7. Calculating the Number of Periods (L04) At 6.5 percent interest, how long does it take to double your money? To quadruple it? 10. Calculating Present Values (LO2) Normandin Inc. has an unfunded pension liability of $575 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 6.8 percent, what is the present value of this liability? 18. Calculating Future Values (L01) You have just made your first $5,000 contribution to your RRSP Assuming you earn an 11 percent rate of return and make no additional contributions, what will your account be worth when you retire in 45 years? What if you wait ten years before contributing? (Does this suggest an investment strategy?) 20. Calculating the Number of Periods (L04) You expect to receive $10 000 at graduation in two years. You plan on investing it at 11 percent until you have $75 000 How long will you wait from now? nts - Gocx Unit 4 Problemsn.pdf Problemsn.pdf 1/1 Unit 4 Problems (4, 7, 10, 18, and 20) - DO NOT DO #16 4. Calculating Interest Rates (L03) Solve for the unknown interest rate in each of the following Present Value Years Interest Rate Future Value $240 4 $297 360 18 1,080 39000 19 185,382 38,261 25 531,618 Click here for a description of Table: Questions and Problems: 4 7. Calculating the Number of Periods (L04) At 6.5 percent interest, how long does it take to double your money? To quadruple it? 10. Calculating Present Values (LO2) Normandin Inc. has an unfunded pension liability of $575 million that must be paid in 20 years. To assess the value of the firm's stock, financial analysts want to discount this liability back to the present. If the relevant discount rate is 6.8 percent, what is the present value of this liability? 18. Calculating Future Values (L01) You have just made your first $5,000 contribution to your RRSP Assuming you earn an 11 percent rate of return and make no additional contributions, what will your account be worth when you retire in 45 years? What if you wait ten years before contributing? (Does this suggest an investment strategy?) 20. Calculating the Number of Periods (L04) You expect to receive $10 000 at graduation in two years. You plan on investing it at 11 percent until you have $75 000 How long will you wait from now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts