Question: Numbe e5 Short Answer Questions (7 points each, 28 points total aragraphresponse (3-5 sentences) to each question, write answers on separote paper. 1. Explain the

Numbe e5

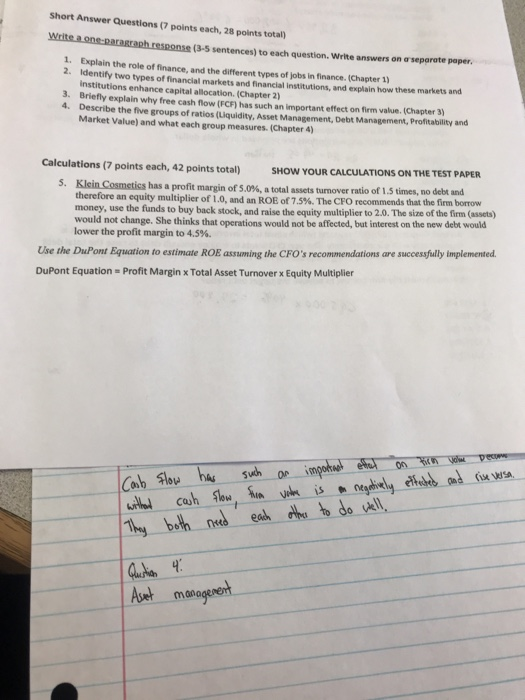

Numbe e5 Short Answer Questions (7 points each, 28 points total aragraphresponse (3-5 sentences) to each question, write answers on separote paper. 1. Explain the role of finance, and the different types of jobs in finance.(Chapter 1 2. I dentify two types of financial markets and financial institutions, and explain how these markets and institutions enhance capital allocation. (Chapter 2) 3. Briefly explain why free cash flow (FCF) has such an important effect on firm value. (Chapter 3) 4. Describe the five groups of ratios (Liquidity, Asset Management, Debt Management, Profitabilty and Market Value) and what each group measures. (Chapter 4) Calculations (7 points each, 42 points total)SHOW YOUR CALCULATIONS ON THE TEST PAPER has a profit margin of 5.0%, a total assets turnover ratio of 1.5 times, no debt and therefore an equity multiplier of 1.0, and an ROE of 7.5%. The CFO recommends that the firm borrow money, use the funds to buy back stock, and raise the equity multiplier to 2.0. The size of the firm (assets) would not change. She thinks that operations would not be affected, but interest on the new debt would lower the profit margin to 4.5%. Use the DuPont Equation to estimate ROE assuming the CFO's recommendations are successfully implemented. DuPont Equation Profit Margin x Total Asset Turnover x Equity Multiplier Aveh mana

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts