Question: number 1 please FIN 370 Section VIII: Risk Management, Part C Exercises 1. Recall last time we calculated the SGAP for the bank below and

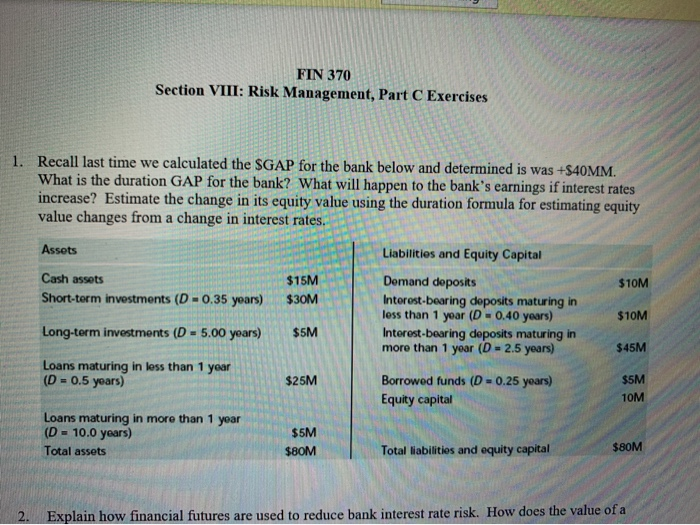

FIN 370 Section VIII: Risk Management, Part C Exercises 1. Recall last time we calculated the SGAP for the bank below and determined is was +S40MM. What is the duration GAP for the bank? What will happen to the bank's earnings if interest rates increase? Estimate the change in its equity value using the duration formula for estimating equity value changes from a change in interest rates. Assets Liabilities and Equity Capital Cash assets $15M Domand deposits $10M Short-term investments (D -0.35 years) $30M Interest-bearing deposits maturing in less than 1 year (D - 0.40 years) $10M Long-term investments (D = 5.00 years) $5M Interest-bearing deposits maturing in more than 1 year (D = 2.5 years) Loans maturing in less than 1 year (D - 0.5 years) Borrowed funds (D = 0.25 years) $5M Equity capital 10M Loans maturing in more than 1 year (D = 10.0 years) Total assets $80M Total liabilities and equity capital $80M $45M $25M $5M 2. Explain how financial futures are used to reduce bank interest rate risk. How does the value of a FIN 370 Section VIII: Risk Management, Part C Exercises 1. Recall last time we calculated the SGAP for the bank below and determined is was +S40MM. What is the duration GAP for the bank? What will happen to the bank's earnings if interest rates increase? Estimate the change in its equity value using the duration formula for estimating equity value changes from a change in interest rates. Assets Liabilities and Equity Capital Cash assets $15M Domand deposits $10M Short-term investments (D -0.35 years) $30M Interest-bearing deposits maturing in less than 1 year (D - 0.40 years) $10M Long-term investments (D = 5.00 years) $5M Interest-bearing deposits maturing in more than 1 year (D = 2.5 years) Loans maturing in less than 1 year (D - 0.5 years) Borrowed funds (D = 0.25 years) $5M Equity capital 10M Loans maturing in more than 1 year (D = 10.0 years) Total assets $80M Total liabilities and equity capital $80M $45M $25M $5M 2. Explain how financial futures are used to reduce bank interest rate risk. How does the value of a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts