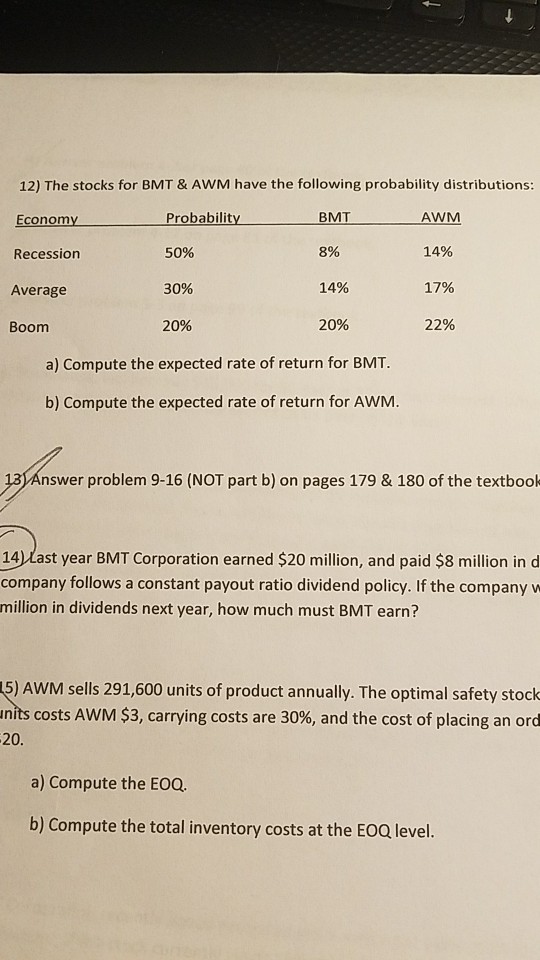

Question: number 2 help please. 12) The stocks for BMT & AWM have the following probability distributions Recession Average Boom Probabilit 50% 30% 20% 8% 14%

number 2 help please.

12) The stocks for BMT & AWM have the following probability distributions Recession Average Boom Probabilit 50% 30% 20% 8% 14% 20% AWM 14% 17% 22% a) Compute the expected rate of return for BMT b) Compute the expected rate of return for AWM 13 Answer problem 9-16 (NOT part b) on pages 179 & 180 of the textbook 14) Last year BMT Corporation earned $20 million, and paid $8 million in d company follows a constant payout ratio dividend policy. If the company w million in dividends next year, how much must BMT earn? 5) AWM sells 291,600 units of product annually. The optimal safety stock inits costs AVVM $3, carrying costs are 30%, and the cost of placing an ord 20 a) Compute the EOQ. b) Compute the total inventory costs at the EOQ level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts