Question: number 8 Blackboard De DO Show Timer * Question Completion Status: QUESTION 8 Some of a portfolio consists of stock A, which has an expected

number 8

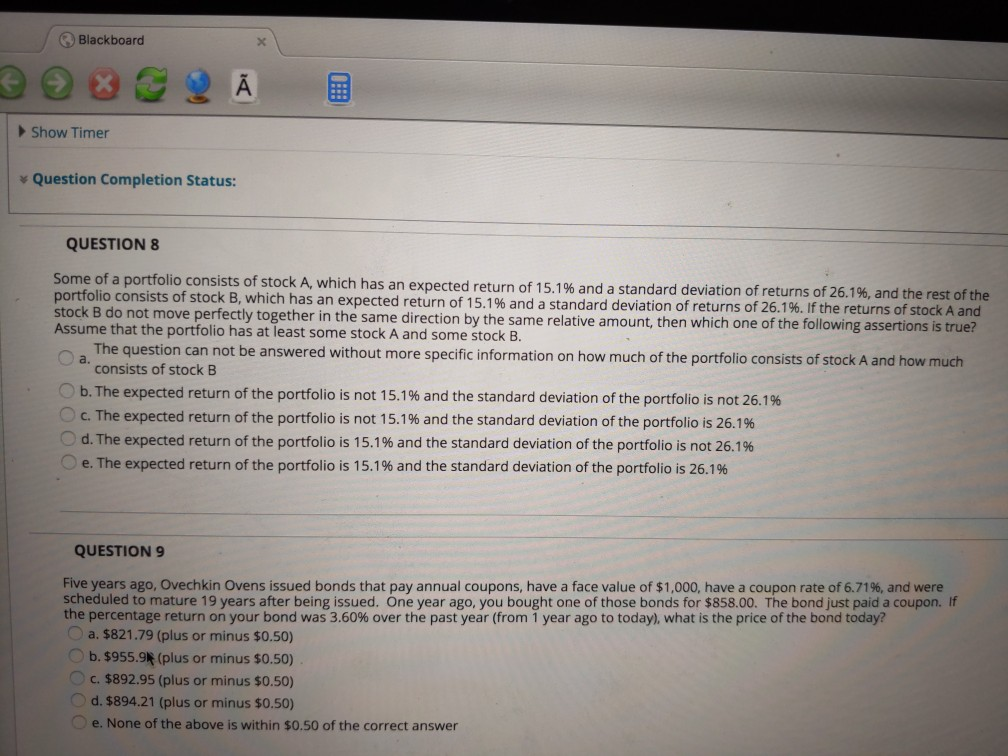

Blackboard De DO Show Timer * Question Completion Status: QUESTION 8 Some of a portfolio consists of stock A, which has an expected return of 15.1% and a standard deviation of returns of 26.1%, and the rest of the portfolio consists of stock B, which has an expected return of 15.1% and a standard deviation of returns of 26.1%. If the returns of stock A and stock B do not move perfectly together in the same direction by the same relative amount, then which one of the following assertions is true? Assume that the portfolio has at least some stock A and some stock B. a. The question can not be answered without more specific information on how much of the portfolio consists of stock A and how much consists of stock B b. The expected return of the portfolio is not 15.1% and the standard deviation of the portfolio is not 26.1% c. The expected return of the portfolio is not 15.1% and the standard deviation of the portfolio is 26.1% d. The expected return of the portfolio is 15.1% and the standard deviation of the portfolio is not 26.1% e. The expected return of the portfolio is 15.1% and the standard deviation of the portfolio is 26.1% QUESTION 9 Five years ago, Ovechkin Ovens issued bonds that pay annual coupons, have a face value of $1,000, have a coupon rate of 6.71%, and were scheduled to mature 19 years after being issued. One year ago, you bought one of those bonds for $858.00. The bond just paid a coupon. If the percentage return on your bond was 3.60% over the past year (from 1 year ago to today), what is the price of the bond today? a. $821.79 (plus or minus $0.50) b. $955.9 (plus or minus $0.50) c. $892.95 (plus or minus $0.50) d. $894.21 (plus or minus $0.50) e. None of the above is within $0.50 of the correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts