Question: number 9 b. $85.36 c. $87.24 d. $76.92 e. $93.81 8 Nachman Industries just paid a dividend of Do $3.75. Analysts expect the company's dividend

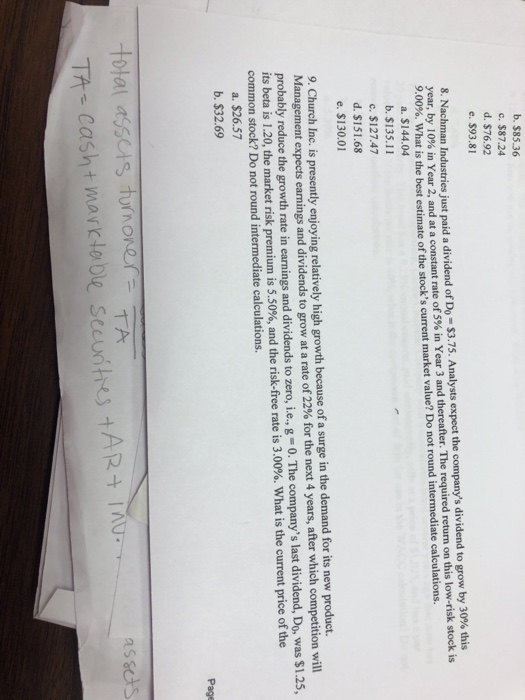

b. $85.36 c. $87.24 d. $76.92 e. $93.81 8 Nachman Industries just paid a dividend of Do $3.75. Analysts expect the company's dividend to grow by 30% this year, by 10% in Year 2, and at a constant rate of 5% in Year 3 and thereafter The required return on this low risk stock is 9.00%, what is the best estimate of the stock's current market value? Do not round intermediate calculations. a. $144.04 b. $135.11 c. $127.47 d. $151.68 e.$130.01 9. Church Inc. is presently enjoying relatively high growth because of a surge in the demand for its new product. Management expects earnings and ividends to grow at a rate of 22% for the next 4 years, after which competition wil probably reduce the growth rate in earnings and dividends to zero, i.e., g 0. The company's last dividend, Do, was $1.25, its beta is 1.20, the market risk premium is 5.50%, and the risk-free rate is 3.00%, what is the current price of the common stock? Do not round intermediate calculations. a. $26.57 b. $32.69 total asses turnone

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts