Question: Numbers 4, 5, 6 , 7, and 8 Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and

Numbers 4, 5, 6 , 7, and 8

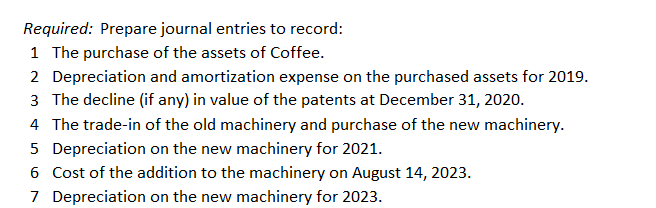

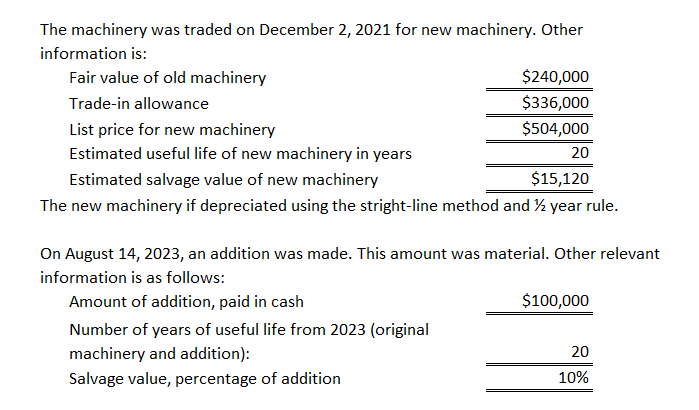

Required: Prepare journal entries to record: 1 The purchase of the assets of Coffee. 2 Depreciation and amortization expense on the purchased assets for 2019 3 The decline (if any) in value of the patents at December 31, 2020. 4 The trade-in of the old machinery and purchase of the new machinery. 5 Depreciation on the new machinery for 2021. 6 Cost of the addition to the machinery on August 14, 2023. 7 Depreciation on the new machinery for 2023. The machinery was traded on December 2, 2021 for new machinery. Other information is: Fair value of old machinery Trade-in allowance List price for new machinery Estimated useful life of new machinery in years Estimated salvage value of new machinery $240,000 S336,000 $504,000 20 $15,120 The new machinery if depreciated using the stright-line method and year rule On August 14, 2023, an addition was made. This amount was material. Other relevant information is as follows: $100,000 Amount of addition, paid in cash Number of years of useful life from 2023 (original machinery and addition) Salvage value, percentage of addition 20 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts