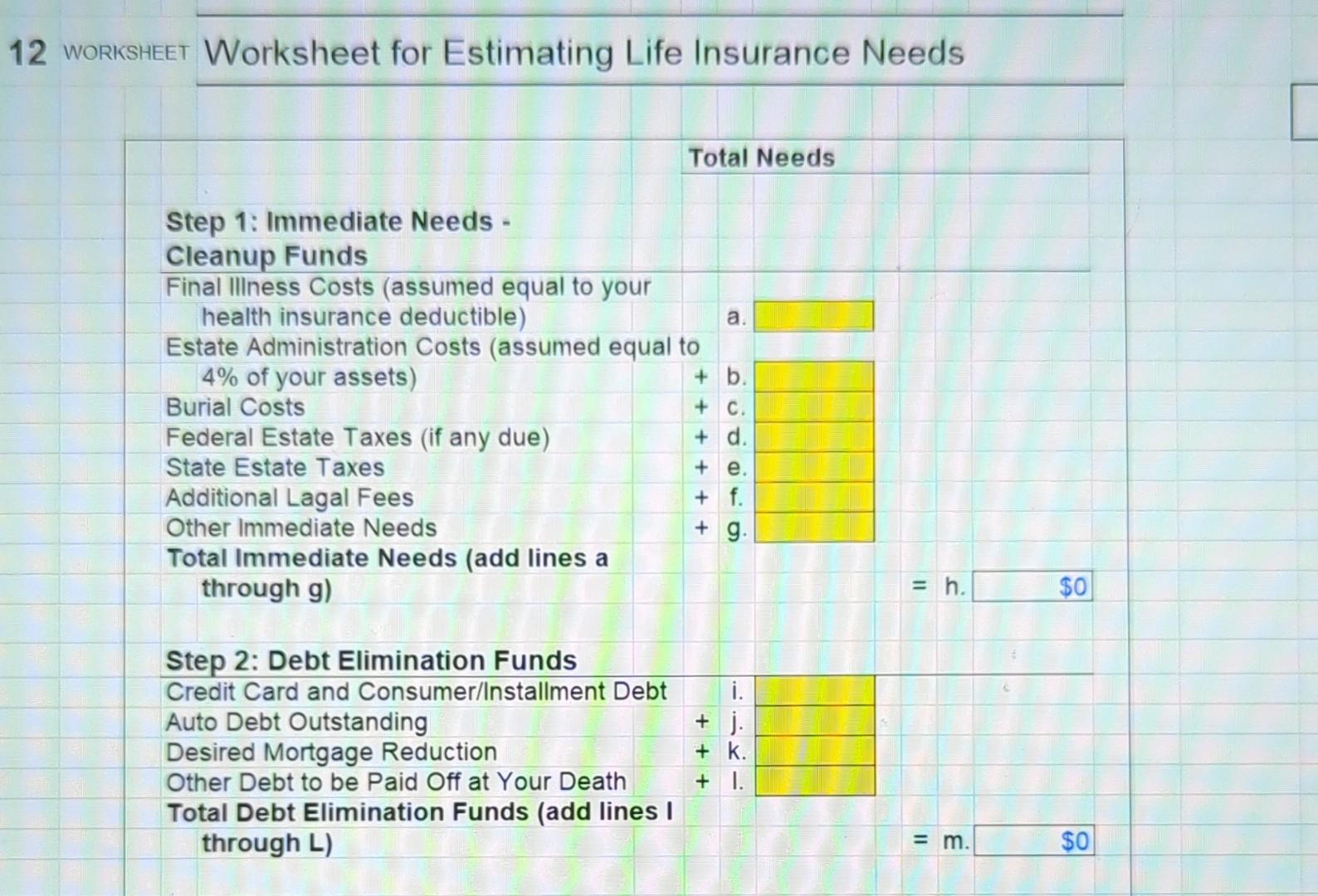

Question: numbers are based on best guess make up numbers, this is not based on actual income or insurance KSHEET Worksheet for Estimating Life Insurance Needs

numbers are based on best guess

make up numbers, this is not based on actual income or insurance

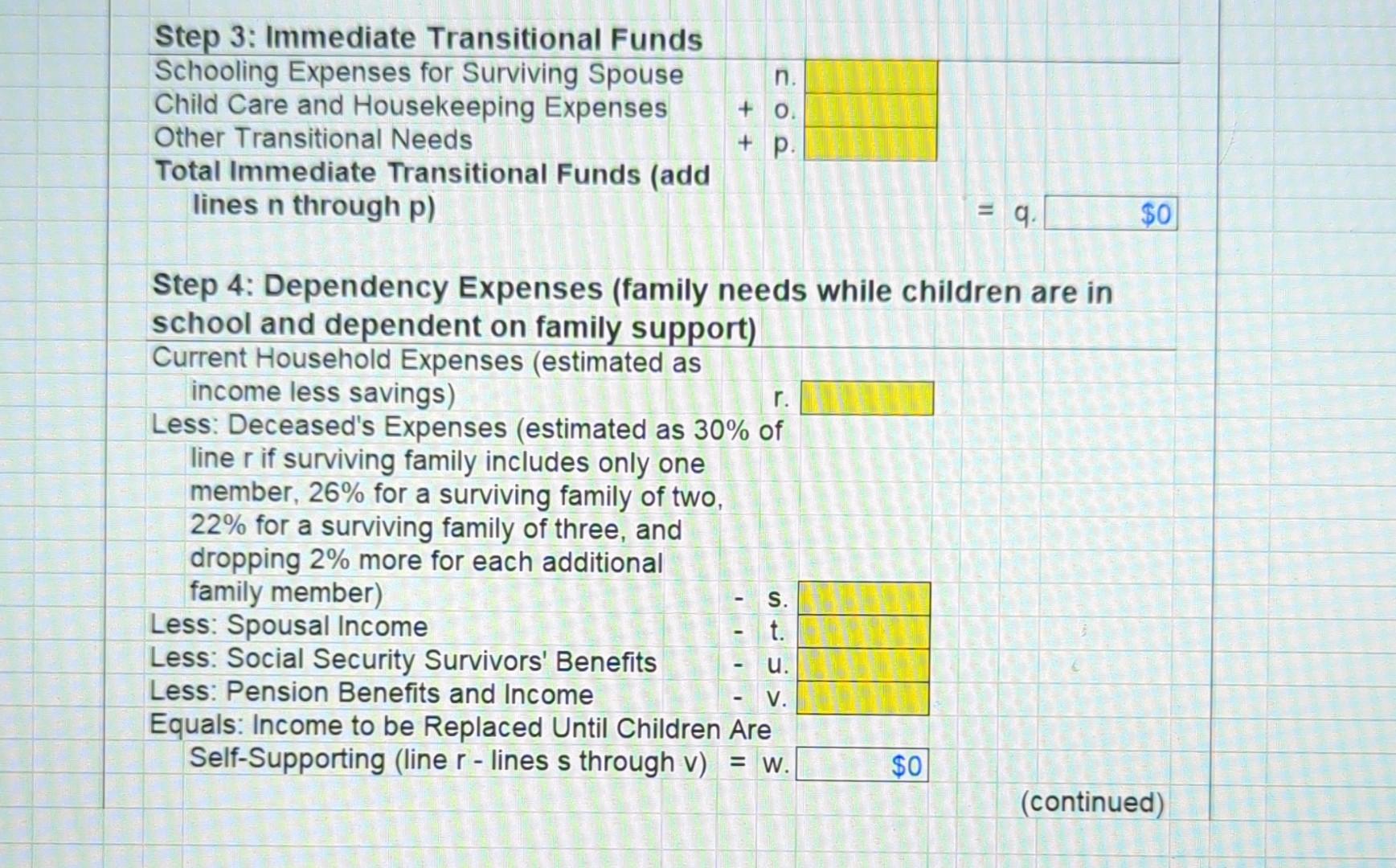

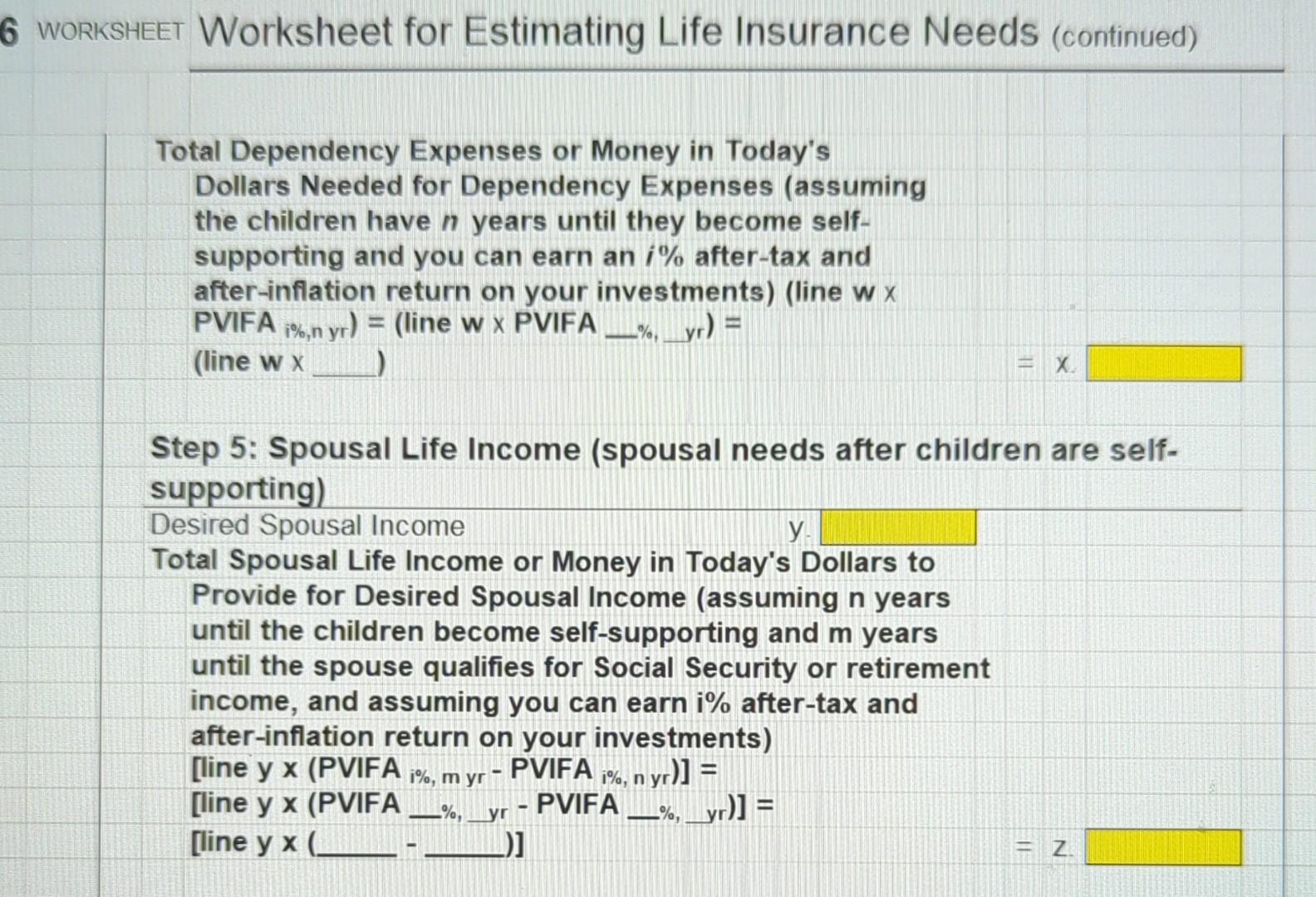

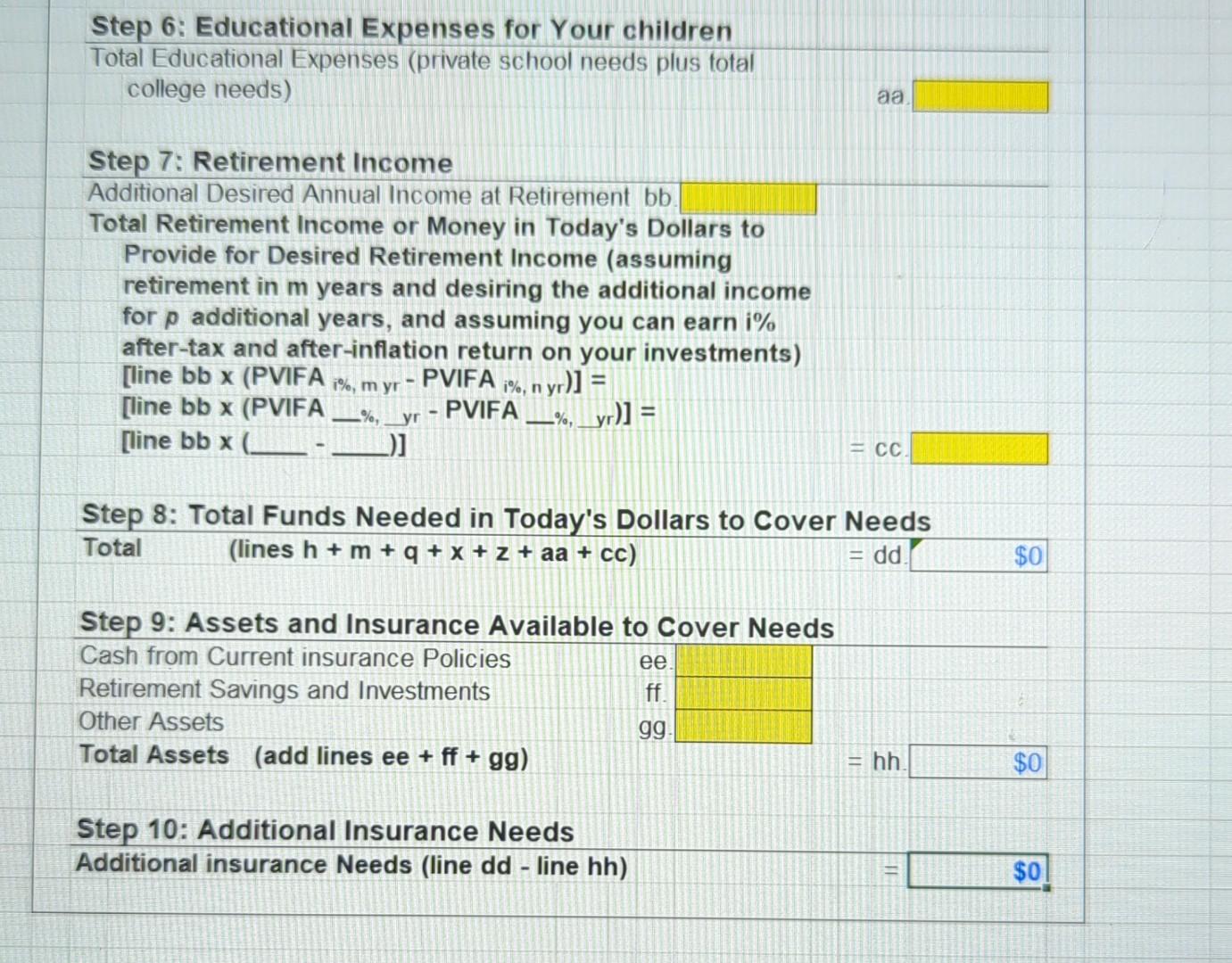

KSHEET Worksheet for Estimating Life Insurance Needs Step 3: Immediate Transitional Funds Schooling Expenses for Surviving Spouse Child Care and Housekeeping Expenses Other Transitional Needs Total Immediate Transitional Funds (add lines n through p) +p. Step 4: Dependency Expenses (family needs while children are in school and dependent on family support) Current Household Expenses (estimated as income less savings) Less: Deceased's Expenses (estimated as 30% of line r if surviving family includes only one member, 26% for a surviving family of two, 22% for a surviving family of three, and dropping 2% more for each additional family member) Less: Spousal Income Less: Social Security Survivors' Benefits Less: Pension Benefits and Income s. - t. - u. Equals: Income to be Replaced Until Children Are Self-Supporting (line r - lines s through v ) =w. (continued) Total Dependency Expenses or Money in Today's Dollars Needed for Dependency Expenses (assuming the children have n years until they become selfsupporting and you can earn an i% after-tax and after-inflation return on your investments) (line wx PVIFA i,nyr)=( line w PVIFA _ \%,, yr )= (line wX Step 5: Spousal Life Income (spousal needs after children are selfsupporting) Desired Spousal Income y. Total Spousal Life Income or Money in Today's Dollars to Provide for Desired Spousal Income (assuming n years until the children become self-supporting and m years until the spouse qualifies for Social Security or retirement income, and assuming you can earn i\% after-tax and after-inflation return on your investments) [line y x (PVIFA i,m yr - PVIFA i%,n yr )]= [line y x (PVIFA _ \%, yr - PVIFA ,yr)]= [line y( )] =Z Step 6: Educational Expenses for Your children Total Educational Expenses (private school needs plus total college needs) aa. Step 7: Retirement Income Additional Desired Annual Income at Retirement bb Total Retirement Income or Money in Today's Dollars to Provide for Desired Retirement Income (assuming retirement in m years and desiring the additional income for p additional years, and assuming you can earn i% after-tax and after-inflation return on your investments) [line bb x (PVIFA i%,m yr - PVIFA i%,nyr)]= [line bb x (PVIFA _\%, yr - PVIFA _\%, yr)]= [line bb x )] =cc. Step 8: Total Funds Needed in Today's Dollars to Cover Needs Total (lines h+m+q+x+z+aa+cc) =dd. KSHEET Worksheet for Estimating Life Insurance Needs Step 3: Immediate Transitional Funds Schooling Expenses for Surviving Spouse Child Care and Housekeeping Expenses Other Transitional Needs Total Immediate Transitional Funds (add lines n through p) +p. Step 4: Dependency Expenses (family needs while children are in school and dependent on family support) Current Household Expenses (estimated as income less savings) Less: Deceased's Expenses (estimated as 30% of line r if surviving family includes only one member, 26% for a surviving family of two, 22% for a surviving family of three, and dropping 2% more for each additional family member) Less: Spousal Income Less: Social Security Survivors' Benefits Less: Pension Benefits and Income s. - t. - u. Equals: Income to be Replaced Until Children Are Self-Supporting (line r - lines s through v ) =w. (continued) Total Dependency Expenses or Money in Today's Dollars Needed for Dependency Expenses (assuming the children have n years until they become selfsupporting and you can earn an i% after-tax and after-inflation return on your investments) (line wx PVIFA i,nyr)=( line w PVIFA _ \%,, yr )= (line wX Step 5: Spousal Life Income (spousal needs after children are selfsupporting) Desired Spousal Income y. Total Spousal Life Income or Money in Today's Dollars to Provide for Desired Spousal Income (assuming n years until the children become self-supporting and m years until the spouse qualifies for Social Security or retirement income, and assuming you can earn i\% after-tax and after-inflation return on your investments) [line y x (PVIFA i,m yr - PVIFA i%,n yr )]= [line y x (PVIFA _ \%, yr - PVIFA ,yr)]= [line y( )] =Z Step 6: Educational Expenses for Your children Total Educational Expenses (private school needs plus total college needs) aa. Step 7: Retirement Income Additional Desired Annual Income at Retirement bb Total Retirement Income or Money in Today's Dollars to Provide for Desired Retirement Income (assuming retirement in m years and desiring the additional income for p additional years, and assuming you can earn i% after-tax and after-inflation return on your investments) [line bb x (PVIFA i%,m yr - PVIFA i%,nyr)]= [line bb x (PVIFA _\%, yr - PVIFA _\%, yr)]= [line bb x )] =cc. Step 8: Total Funds Needed in Today's Dollars to Cover Needs Total (lines h+m+q+x+z+aa+cc) =dd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts