Question: NY Precision Inc. is considering a four-year project to improve its production efficiency. Six months ago, it contracted with Dr. Wright to provide a thorough

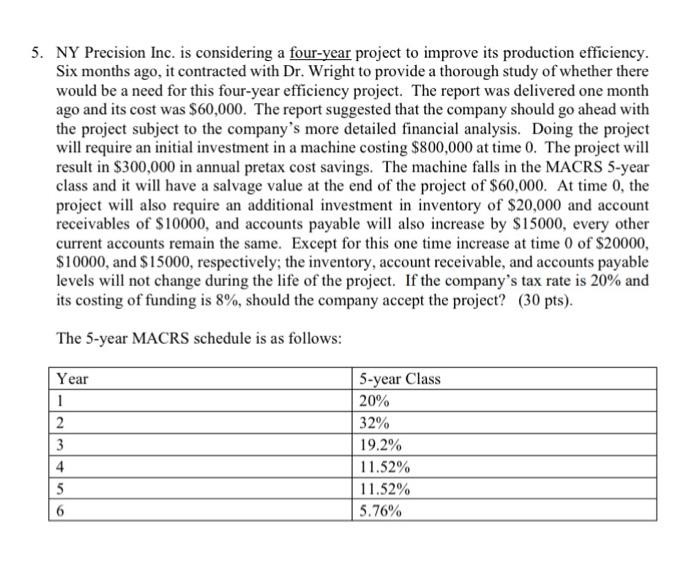

5. NY Precision Inc. is considering a four-year project to improve its production efficiency. Six months ago, it contracted with Dr. Wright to provide a thorough study of whether there would be a need for this four-year efficiency project. The report was delivered one month ago and its cost was $60,000. The report suggested that the company should go ahead with the project subject to the company's more detailed financial analysis. Doing the project will require an initial investment in a machine costing $800,000 at time 0 . The project will result in $300,000 in annual pretax cost savings. The machine falls in the MACRS 5-year class and it will have a salvage value at the end of the project of $60,000. At time 0 , the project will also require an additional investment in inventory of $20,000 and account receivables of $10000, and accounts payable will also increase by $15000, every other current accounts remain the same. Except for this one time increase at time 0 of $20000, $10000, and $15000, respectively; the inventory, account receivable, and accounts payable levels will not change during the life of the project. If the company's tax rate is 20% and its costing of funding is 8%, should the company accept the project? (30 pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts