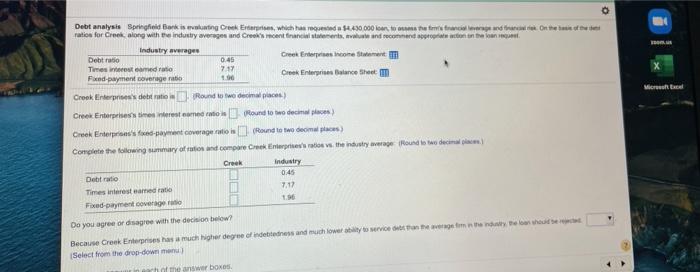

Question: o . 0.45 X Microsoft Excel Debt analysis Springfield Basis wing Cock Ers, which has seda 4430 000, torcedores ration for Creek along with the

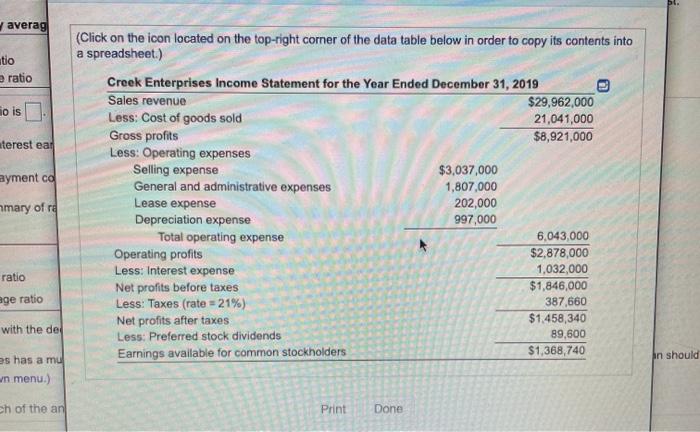

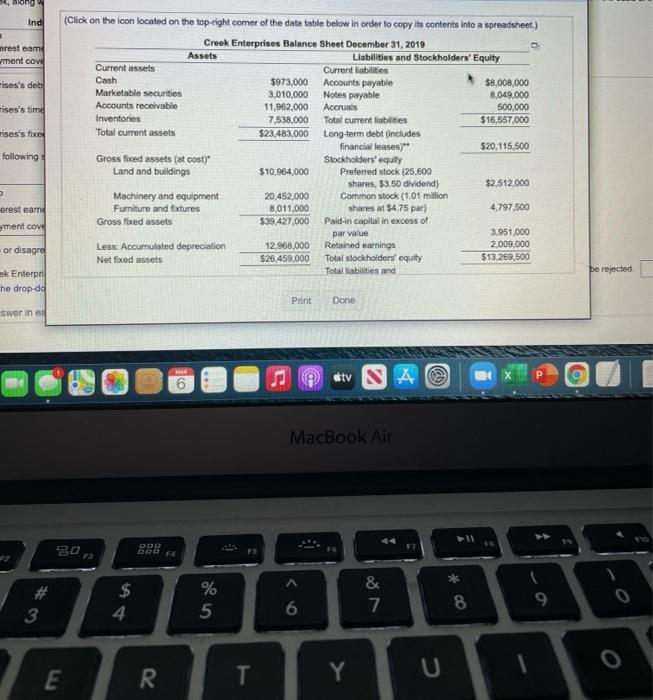

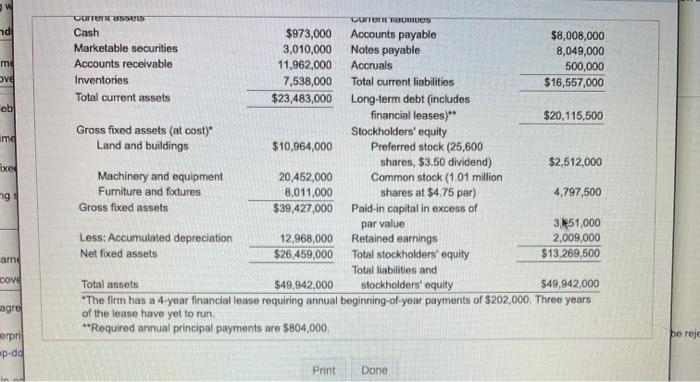

o . 0.45 X Microsoft Excel Debt analysis Springfield Basis wing Cock Ers, which has seda 4430 000, torcedores ration for Creek along with the industry averages and Crescent financial statements, and recommand production on the Industry average Debt ratio Creek Enterprises Income Start Tiesit came to 7.17 Fixed-payment coverage ratio 1.00 Creek Enterprise Balance them Creek Enterprises de Round towe domes) Creek Enterpretimes restore to found to decine Creek Enterpris's face-payment coverage (Round to two decimal places) Complete the following summary of ratione compare Creek Enterparties the industry average found to we decom) Creek Industry Debt ratio 0:45 Times interest and ratio Fixed-payment coverage ratio 7.12 Do you agree or disagree with the decision below Because Creek Enterprises has a much higher degree of indebtedness and much lower to VI get the base Select from the drop-down menu mower box averag tio ratio aterest ear ayment co (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Creek Enterprises Income Statement for the Year Ended December 31, 2019 Sales revenue $29,962,000 Less: Cost of goods sold 21,041,000 Gross profits $8,921,000 Less: Operating expenses Selling expense $3,037,000 General and administrative expenses 1,807,000 Lease expense 202,000 Depreciation expense 997,000 Total operating expense 6,043,000 Operating profits $2,878,000 Less: Interest expense 1,032,000 Net profits before taxes $1,846,000 Less: Taxes (rate=21%) 387,660 Net profits after taxes $1.458,340 Less: Preferred stock dividends 89,600 Earnings available for common stockholders $1,368,740 mary of ra ratio age ratio with the del In should es has a mu wn menu.) Eh of the an Print Done 1, Blong Ind mrest eam ment cove rises's deb rises's tim rises's fixe (Click on the icon located on the top right comer of the date table below in order to copy its contents into a spreadsheet.) Creek Enterprises Balance Sheet December 31, 2019 0 Assets Liabilities and Stockholders' Equity Current assets Current liabilities Cash $973,000 Accounts payable $8,008,000 Marketable securities 3.010,000 Notes payable 8,049,000 Accounts receivable 11,962,000 Accruals 500,000 Inventories 7,538,000 Total current liabilities $16,557,000 Total current assets $23,483,000 Long-term debt (includes financial leases)" $20,115,500 Gross foxed assets (at cost) Stockholders' equity Land and buildings $10,964,000 Preferred stock (25,600 shares, $3.50 dividend) $2,512,000 Machinery and equipment 20.452,000 Common stock (1.01 million Furniture and fixtures 8,011,000 shares at $475 par) 4,797,500 Gross foxed assets $39.427.000 Paid-in capital in excess of 3951,000 Less. Accumulated depreciation 12.968,000 Retained earnings 2,009,000 Net foxed assets $26.459,000 Total stockholders' equity $13,269,500 Total liabilities and following erest eam yment cove par value or disagre ek Enterpri he drop-do Print Done swer in etv NA @ MacBook Air 30 DOG Go0f4 A $ 4 % 5 & 7 3 8 6 E R T U Y id md ave eb im Fixed ge UTUI CUITUTI TRINIS Cash $973,000 Accounts payable $8,008,000 Marketable securities 3,010,000 Notes payable 8,049,000 Accounts receivable 11,962,000 Accruals 500,000 Inventories 7,538,000 Total current liabilities $16,557,000 Total current assets $23,483,000 Long-term debt (includes financial leases) $20,115,500 Gross fixed assets (at cost) Stockholders' equity Land and buildings $10,964,000 Preferred stock (25,600 shares, $3.50 dividend) $2,512,000 Machinery and equipment 20,452,000 Common stock (1.01 million Furniture and fixtures 8,011,000 shares at $4.75 par) 4,797,500 Gross fixed assets $39,427,000 Paid in capital in excess of par value 3.51,000 Less: Accumulated depreciation 12,968,000 Retained earnings 2,009,000 Net fixed assets $26,459,000 Total stockholders' equity $13,269,500 Total liabilities and Total assets $49,942,000 stockholders' equity $49,942,000 *The firm has a 4-year financial lease requiring annual beginning-ofyear payments of $202,000. Three years of the lease have yet to run **Required annual principal payments are $804,000 arnd cove agre erpri e reja ep-dd Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts