Question: O 11.84% Question 22 9 pts A proposed project lasts 3 years, has the same risk as the firm's current operations, and has an initial

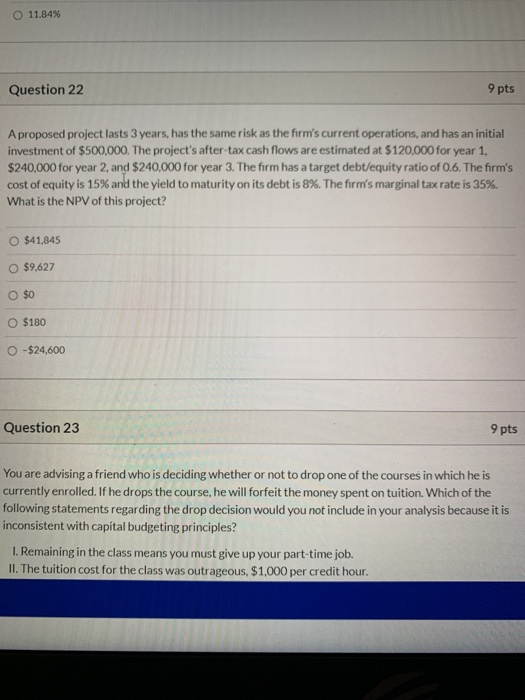

O 11.84% Question 22 9 pts A proposed project lasts 3 years, has the same risk as the firm's current operations, and has an initial investment of $500,000. The project's after-tax cash flows are estimated at $120,000 for year 1, $240,000 for year 2, and $240,000 for year 3. The firm has a target debt/equity ratio of 0.6. The firm's cost of equity is 15% and the yield to maturity on its debt is 8%. The firm's marginal tax rate is 35%. What is the NPV of this project? O $41,845 O $9.627 O $0 O $180 O-$24,600 Question 23 9 pts You are advising a friend who is deciding whether or not to drop one of the courses in which he is currently enrolled. If he drops the course, he will forfeit the money spent on tuition. Which of the following statements regarding the drop decision would you not include in your analysis because it is inconsistent with capital budgeting principles? 1. Remaining in the class means you must give up your part-time job. II. The tuition cost for the class was outrageous, $1,000 per credit hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts