Question: O 82% Question 12 2 pts . Consider a bond that pays $10,000 in one year. Suppose that the market interest rate for savings is

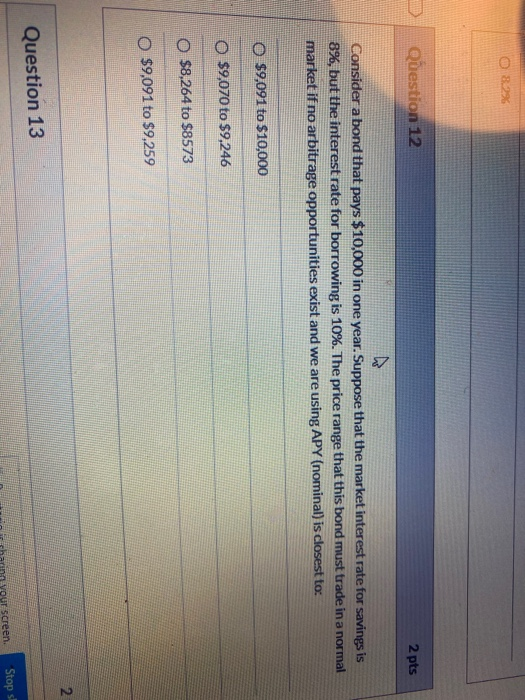

O 82% Question 12 2 pts . Consider a bond that pays $10,000 in one year. Suppose that the market interest rate for savings is 8%, but the interest rate for borrowing is 10%. The price range that this bond must trade in a normal market if no arbitrage opportunities exist and we are using APY (nominal) is closest to: O $9,091 to $10,000 $9,070 to $9,246 O $8,264 to $8573 0 $9,091 to $9,259 2 Question 13 screen Stop sl

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts