Question: O= Assignment - Case 12-2 - Comparing Financial Information A Refer to the financial statements of The Home Depot in Appendix A and Lowe's in

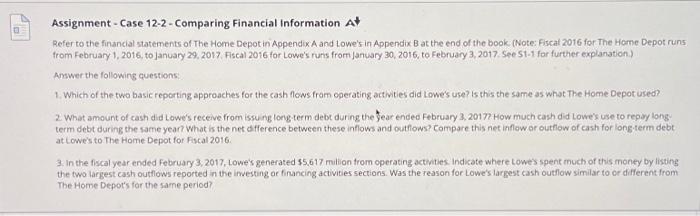

Assignment - Case 12-2 - Comparing Financial information At Refer to the financial statements of The Home Depotin Appendix A and Lowe's in Appendix B at the end of the book (Note: Fiscat 2016 for The Home Depot runs from February 1, 2016, to January 29, 2017. Fiscal 2016 for Lowe's runs from january 30, 2016, to Felbruary 3, 2017. See S1-1 for further explanation.) Anwer the following questions: 1. Which of the two basic reporting approaches for the cash flows fram ogerating activities did lowes use? is this the same as what The Home Depot used? 2. What amount of cash did Lowe's receive from issung long teem debe during the bear ended February 3 , 2017h How much cash did Lowe's use to regay longs term debt during the same yean What is the net dfference between these inflows and outfows? Compare this net inflow or outhow of eash for longterm debt at Lowe's to The Home Depot for Ascal 2016. 3. In the fiscal year ended february 3, 2017, Lowe's generated 55.617 milion from operating actwies. Indicate where towes spent much of this money by listing the two largest cash outflows reported in the investing or financing activities sections. Was the reason for Lowe's largest cash outflow similar to or different from The Home Depor's for the same period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts