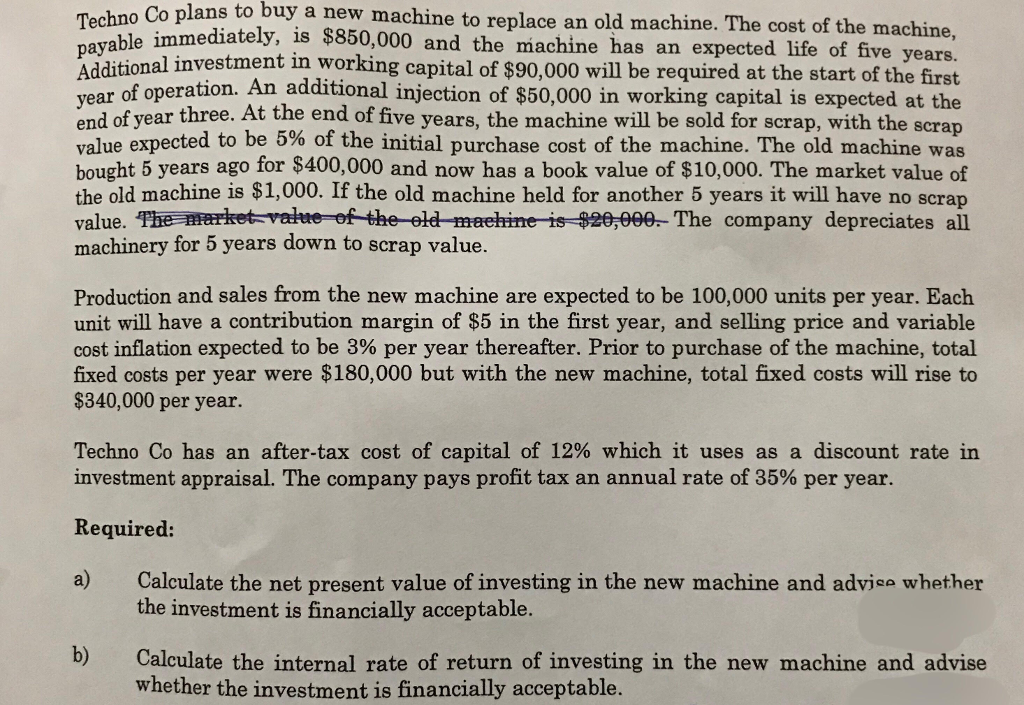

Question: o Co plans to buy a new machine to replace an old machine. The cost of the machine, payable immediately, is Additional investment in working

o Co plans to buy a new machine to replace an old machine. The cost of the machine, payable immediately, is Additional investment in working capital of $90,000 will be required at the start of the first vear of operation. An additional injection of $50,000 in working capital is expected at the end of year three. At the end of five years, the machine will be sold for scrap, with the scrap value expected to be 5% of the initial purchase cost of the machine. The old machine was bought 5 years ago for $400,000 and now has a book value of $10,000. The market value of the old machine is $1,000. If the old machine held for another 5 years it will have no scrap value. The market- value -of the-eld-maehine is $20,900.- The company depreciates al machinery for 5 years down to scrap value. $850,000 and the machine has an expected life of five years. Production and sales from the new machine are expected to be 100,000 units per year. Each unit will have a contribution margin of $5 in the first year, and selling price and variable cost inflation expected to be 3% per year thereafter. Prior to purchase of the machine, total fixed costs per year were $180,000 but with the new machine, total fixed costs will rise to $340,000 per year. Techno Co has an after-tax cost of capital of 12% which it uses as a discount rate in investment appraisal. The company pays profit tax an annual rate of 35% per year. Required: a) Calculate the net present value of investing in the new machine and advise whether b) Calculate the internal rate of return of investing in the new machine and advise the investment is financially acceptable. whether the investment is financially acceptable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts