Question: o D In Em Em Question 1: Pane purchased 126 million shares in Sour on 1 July 2020. Pane issued a total 80 million shares

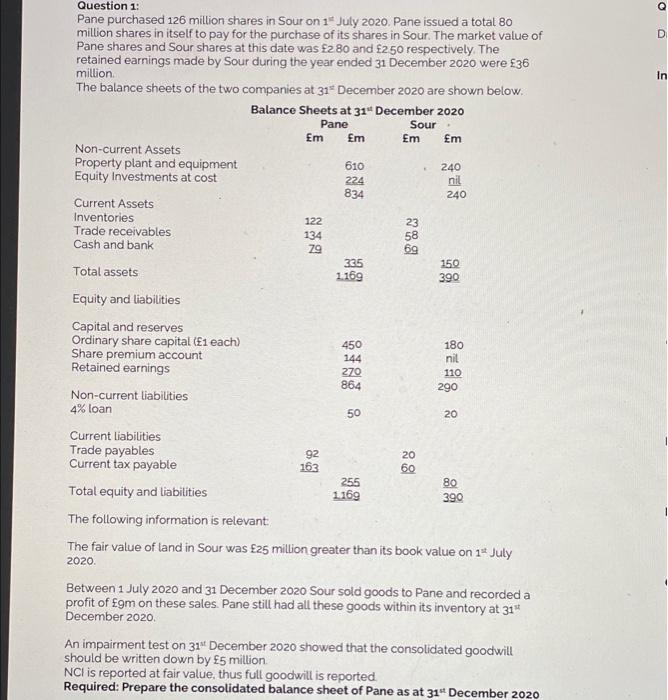

o D In Em Em Question 1: Pane purchased 126 million shares in Sour on 1 July 2020. Pane issued a total 80 million shares in itself to pay for the purchase of its shares in Sour. The market value of Pane shares and Sour shares at this date was 280 and 250 respectively. The retained earnings made by Sour during the year ended 31 December 2020 were 36 million The balance sheets of the two companies at 31 December 2020 are shown below. Balance Sheets at 31 December 2020 Pane Sour Em m Non-current Assets Property plant and equipment 610 240 Equity Investments at cost 224 nil 834 240 Current Assets Inventories Trade receivables 134 Cash and bank 79 335 150 Total assets 1169 390 Equity and liabilities Capital and reserves Ordinary share capital (1 each) 450 180 Share premium account 144 nil Retained earnings 270 864 290 Non-current liabilities 4% loan 122 23 8 110 50 20 255 80 Current liabilities Trade payables 92 20 Current tax payable 163 60 Total equity and liabilities 1169 390 The following information is relevant The fair value of land in Sour was 25 million greater than its book value on 1* July 2020. Between 1 July 2020 and 31 December 2020 Sour sold goods to Pane and recorded a profit of 9m on these sales. Pane still had all these goods within its inventory at 31* December 2020 An impairment test on 314 December 2020 showed that the consolidated goodwill should be written down by 5 million NCI is reported at fair value, thus full goodwill is reported Required: Prepare the consolidated balance sheet of Pane as at 31 December 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts