Question: O Enter ($340) on Part I, line 2. column B. Enter (585) on Part I, line 2 column B. O Enter $85 on Part I

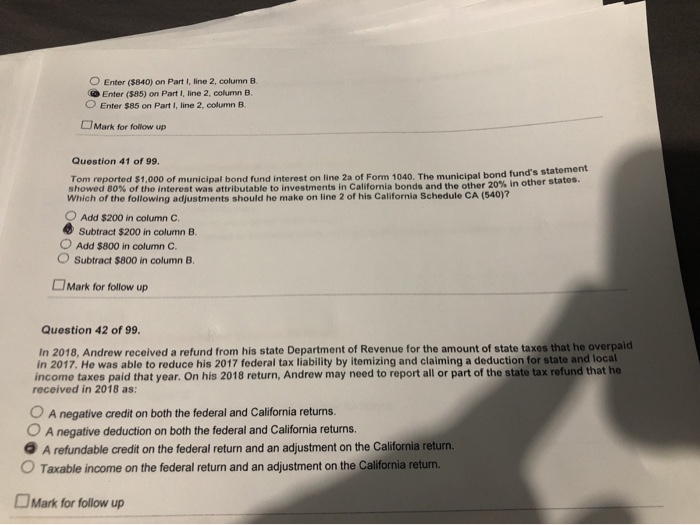

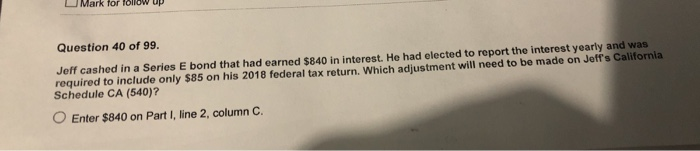

O Enter ($340) on Part I, line 2. column B. Enter (585) on Part I, line 2 column B. O Enter $85 on Part I line 2 column B Mark for follow up Question 41 of 99. Tom reported $1.000 of municipal bond fund interest on line 2a of Form 1040. The municipal bond fund's stateme showed 80% of the interest was attributable to investments in California bonds and the other 20% in other states. Which of the following adjustments should he make on line 2 of his California Schedule CA (540)? O Add $200 in column C. Subtract $200 in column B. O Add $800 in column C. O Subtract $800 in column B. Mark for follow up Question 42 of 99. In 2018, Andrew received a refund from his state Department of Revenue for the amount of state taxes that he overpaid in 2017. He was able to reduce his 2017 federal tax liability by itemizing and claiming a deduction for state and local income taxes paid that year. On his 2018 return, Andrew may need to report all or part of the state tax refund that he received in 2018 as: O A negative credit on both the federal and California returns O A negative deduction on both the federal and California returns. A refundable credit on the federal return and an adjustment on the California return Taxable income on the federal return and an adjustment on the California return. Mark for follow up

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts