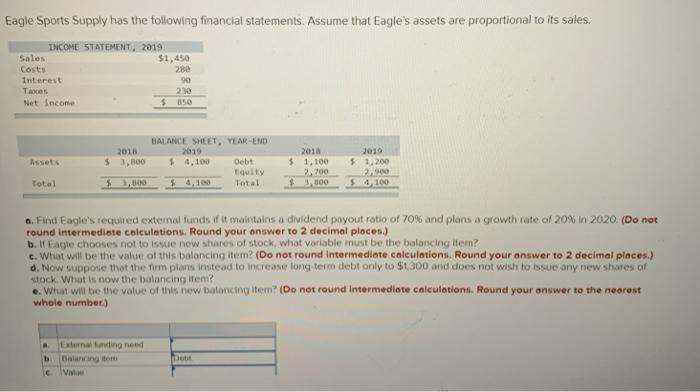

Question: o. Find Eagle's required external funds if it maintains a dividend payout ratio of 70% and plans a growth rate of 20% in 2020. (Do

o. Find Eagle's required external funds if it maintains a dividend payout ratio of 70% and plans a growth rate of 20% in 2020. (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If Eagle chooses not to issue new shares of stock. what variable must be the balancing item? c. What will be the value of this balancing item? (Do not round intermediate calculations. Round your answer to 2 decimal places.) d. Now suppose that the fimplans instead to increase long-term debt only to $1.300 and does not wish to issue any new shares of stock. What is now the balancing item? e. What will be the value of this new balancing item? (Do not round Intermediate calculations. Round your answer to the nearest whole number.) Debt a External funding need b. Balancing om C.Value a Balancing om e Valle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts