Question: O = Homework: Lab #7 Question 13, Problem 13-4 Part 1 of 4 HW Score: 38.46%, 15 of 39 points O Points: 0 of 6

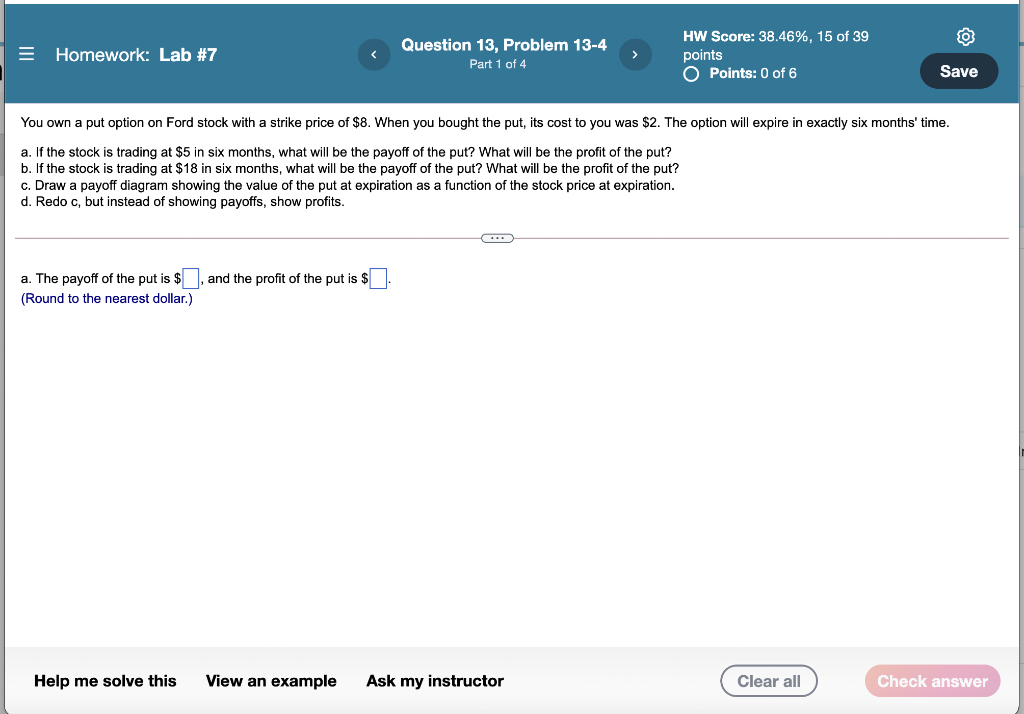

O = Homework: Lab #7 Question 13, Problem 13-4 Part 1 of 4 HW Score: 38.46%, 15 of 39 points O Points: 0 of 6 Save You own a put option on Ford stock with a strike price of $8. When you bought the put, its cost to you was $2. The option will expire in exactly six months' time. a. If the stock is trading at $5 in six months, what will be the payoff of the put? What will be the profit of the put? b. If the stock is trading at $18 in six months, what will be the payoff of the put? What will be the profit of the put? c. Draw a payoff diagram showing the value of the put at expiration as a function of the stock price at expiration. d. Redoc, but instead of showing payoffs, show profits. a. The payoff of the put is $, and the profit of the put is $ (Round to the nearest dollar.) Help me solve this View an example Ask my instructor Clear all Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts