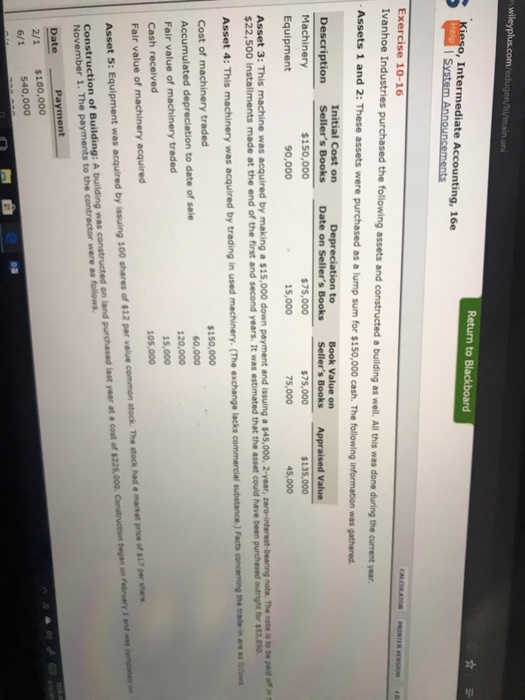

Question: o, Intermediate Accounting, 16e l System Announcements Exercise 10-16 Ivanhoe Industries purchased the following assets and constructed a building as well. A Assets 1 and

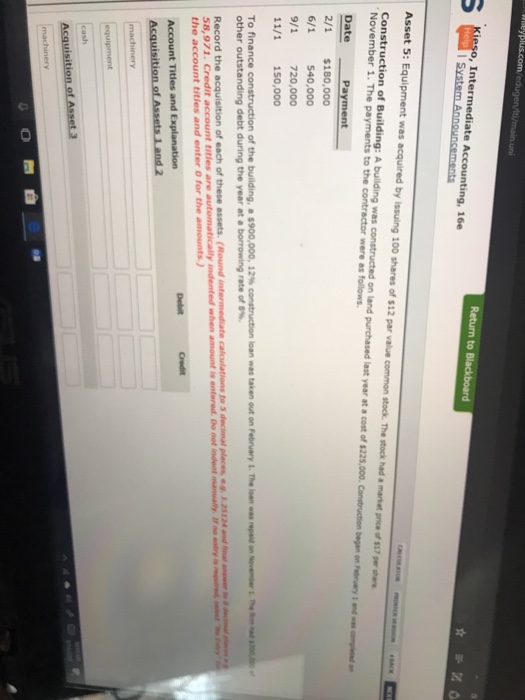

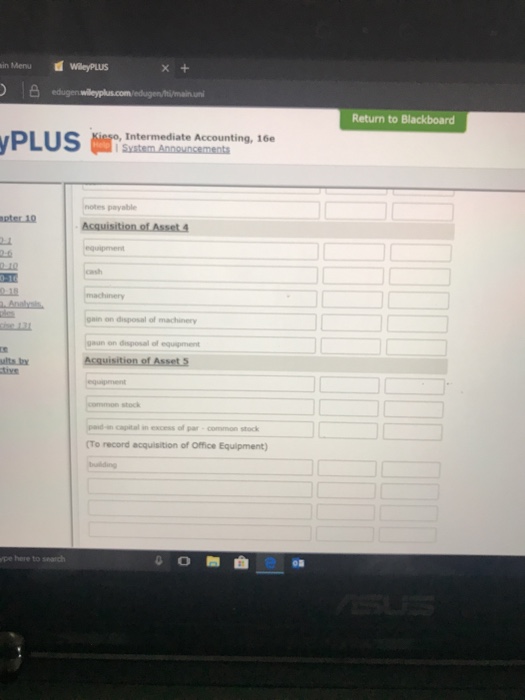

o, Intermediate Accounting, 16e l System Announcements Exercise 10-16 Ivanhoe Industries purchased the following assets and constructed a building as well. A Assets 1 and 2: These assets were purchased as a lump sum for $150,000 cash. The following information was gathered Initial Cost on Depreciation to Book Value on Machinery $150,000 90,000 $75,000 15,000 $75,000 75,000 $135,000 Equipment 45,000 Asset 3: This machine was acquired by making a $15,000 down payment and issuing a $45,000, 2-year, zero-interest-bearing note $22,500 installiments made at the end of the first and second years. It was estimated that the asset Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Pacts concening the tradeia $150,000 Cost of machinery traded Accumulated depreciation to date of sale Fair value of machinery traded Cash received Fair value of machinery acquired 120,000 15,000 105,000 Asset S: Equipment was acquired by issuing 100 shares of $12 par vaue connon stock. The .tock hadmarket reed", Date 2/1 $180,000 540,000 o, Intermediate Accounting, 16e l System Announcements Exercise 10-16 Ivanhoe Industries purchased the following assets and constructed a building as well. A Assets 1 and 2: These assets were purchased as a lump sum for $150,000 cash. The following information was gathered Initial Cost on Depreciation to Book Value on Machinery $150,000 90,000 $75,000 15,000 $75,000 75,000 $135,000 Equipment 45,000 Asset 3: This machine was acquired by making a $15,000 down payment and issuing a $45,000, 2-year, zero-interest-bearing note $22,500 installiments made at the end of the first and second years. It was estimated that the asset Asset 4: This machinery was acquired by trading in used machinery. (The exchange lacks commercial substance.) Pacts concening the tradeia $150,000 Cost of machinery traded Accumulated depreciation to date of sale Fair value of machinery traded Cash received Fair value of machinery acquired 120,000 15,000 105,000 Asset S: Equipment was acquired by issuing 100 shares of $12 par vaue connon stock. The .tock hadmarket reed", Date 2/1 $180,000 540,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts