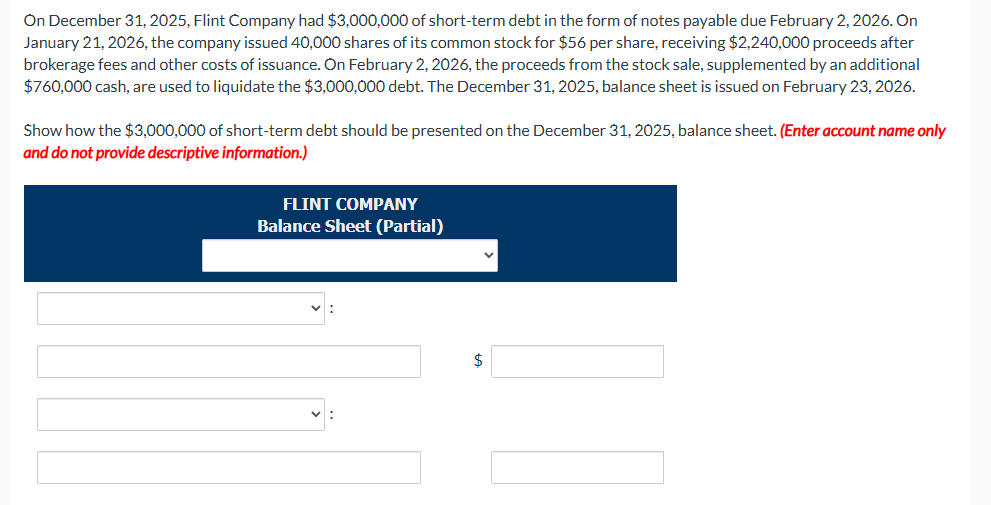

Question: O n December 3 1 , 2 0 2 5 , Flint Company had $ 3 , 0 0 0 , 0 0 0 o

December Flint Company had $ shortterm debt the form notes payable due February

January the company issued shares its common stock for $ per share, receiving $ proceeds after

brokerage fees and other costs issuance. February the proceeds from the stock sale, supplemented additional

$ cash, are used liquidate the $ debt. The December balance sheet issued February

Show how the $ shortterm debt should presented the December balance sheet. account name only

and not provide descriptive information.

FLINT COMPANY

Balance Sheet FLINT COMPANY

Balance Sheet

December

For the Month Ended December

For the Year Ended December Accounts Payable

Accounts Receivable

Accumulated DepreciationDepot

Allowance from Expropriation

Asset Retirement Obligation

Cash

Depot

Depreciation Expense

Dividends Payable

Due Customer

Discount Notes Payable

FICA Taxes Payable

Freight

Federal Unemployment Tax Payable

Insurance Premium Payable

Interest Expense

Interest Payable

Inventory

Land Improvements

Lawsuit Liability

Lawsuit Loss

Litigation Expense Loss

Litigation Liability

Loss from Expropriation

Loss Settlement ARO

Entry Notes Payable

Oil Platform

Payroll Tax Expense

Premium Expense

Premium Inventory

Premium Liability

Purchases

Purchase Discounts

Purchase Returns and Allowances

Refundable Deposit Liability

Retained Earnings

Salaries and Wages Expense

Salaries and Wages Payable

Sales Revenue

Sales Taxes Payable

State Unemployment Tax Payable

Trucks

Unearned Sales

Unearned Warranty Revenue

Union Dues Payable

Warranty Expense

Warranty Liability

Warranty Revenue

Withholding Taxes Payable

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock