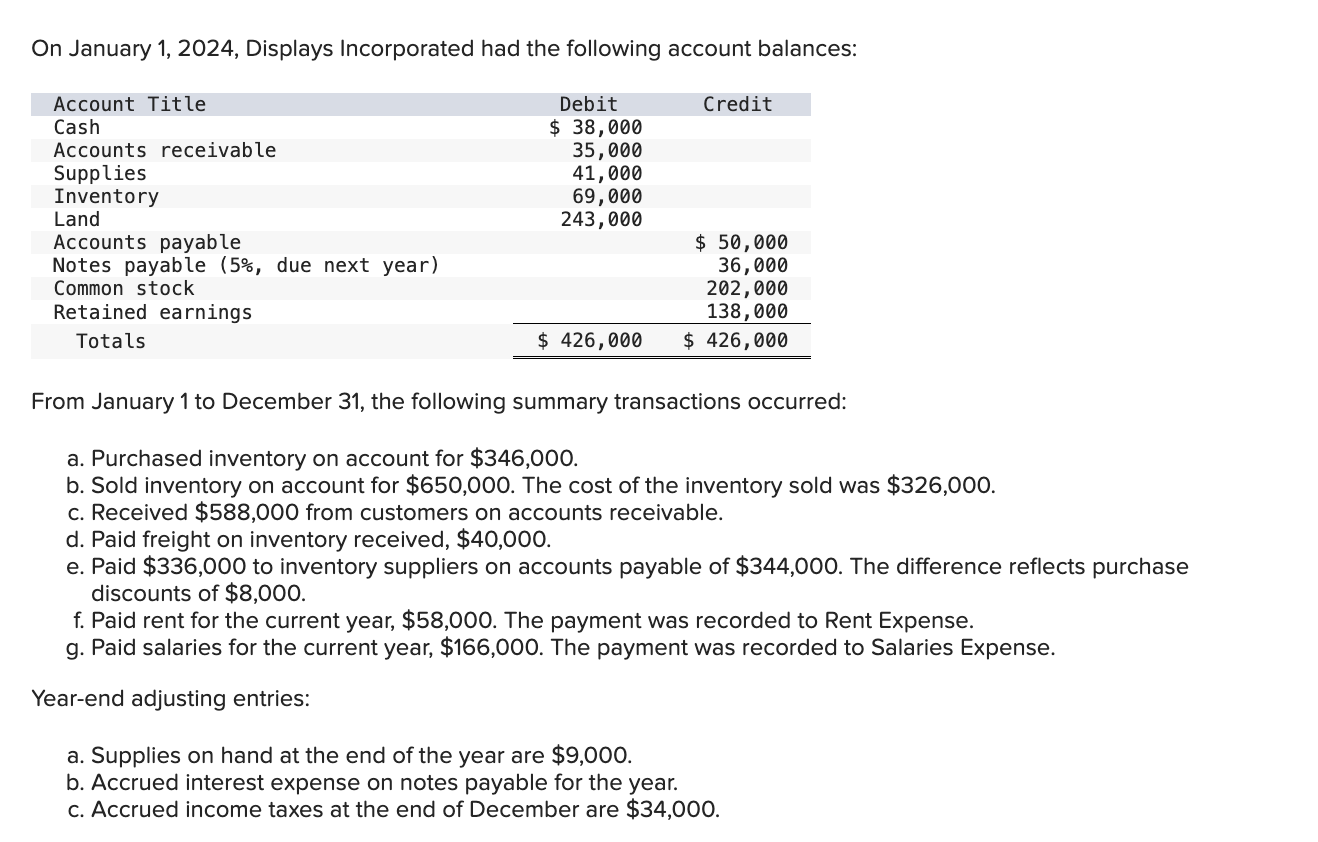

Question: O n January 1 , 2 0 2 4 , Displays Incorporated had the following account balances: Account TitleDebitCreditCash$ 3 8 , 0 0 0

January Displays Incorporated had the following account balances: Account TitleDebitCreditCash$ Accounts receivable Supplies Inventory Land Accounts payable $ Notes payable due next yearCommon stock Retained earnings Totals$ $ From January December the following summary transactions occurred: Purchased inventory account for $ Sold inventory account for $ The cost the inventory sold was $ Received $ from customers accounts receivable. Paid freight inventory received, $ Paid $ inventory suppliers accounts payable $ The difference reflects purchase discounts $ Paid rent for the current year, $ The payment was recorded Rent Expense. Paid salaries for the current year, $ The payment was recorded Salaries Expense. Yearend adjusting entries: Supplies hand the end the year are $ Accrued interest expense notes payable for the year. Accrued income taxes the end December are $

January Displays Incorporated had the following account balances:

From January December the following summary transactions occurred:

Purchased inventory account for $

Sold inventory account for $ The cost the inventory sold was $

Received $ from customers accounts receivable.

Paid freight inventory received, $

Paid $ inventory suppliers accounts payable $ The difference reflects purchase

discounts $

Paid rent for the current year, $ The payment was recorded Rent Expense.

Paid salaries for the current year, $ The payment was recorded Salaries Expense.

Yearend adjusting entries:

Supplies hand the end the year are $

Accrued interest expense notes payable for the year.

Accrued income taxes the end December are $ Supplies hand the end the year are $

Accrued interest expense notes payable for the year.

Accrued income taxes the end December are $ Supplies hand the end the year are $

Accrued interest expense notes payable for the year.

Accrued income taxes the end December are $ Paid salaries for the current year, $ The payment was recorded Salaries Expense.

Yearend adjusting entries:

Supplies hand the end the year are $

Accrued interest expense notes payable for the year.

Accrued income taxes the end December are $

Complete this question entering your answers the below.

General

Journal

General

Ledger

Income

Statement

Balance Sheet

Analysis

Using the information from the requirements above, complete the 'Analysis'.

Analyze the following for Displays Incorporated:

Suppo

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock