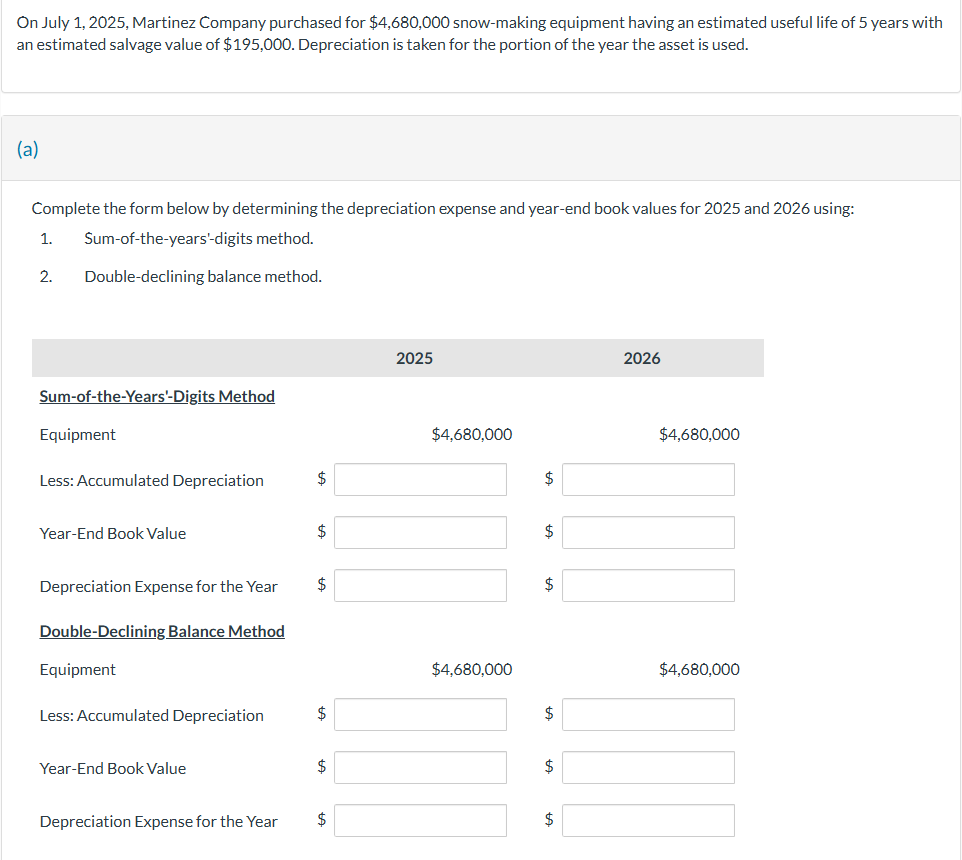

Question: O n July 1 , 2 0 2 5 , Martinez Company purchased for $ 4 , 6 8 0 , 0 0 0 snow

July Martinez Company purchased for $ snowmaking equipment having estimated useful life years with

estimated salvage value $ Depreciation taken for the portion the year the asset used.

Complete the form below determining the depreciation expense and yearend book values for and using:

Sumtheyears'digits method.

Doubledeclining balance method.

SumtheYears'Digits Method

Equipment

Less: Accumulated Depreciation

YearEnd Book Value

Depreciation Expense for the Year

DoubleDeclining Balance Method

Equipment

Less: Accumulated Depreciation

YearEnd Book Value

Depreciation Expense for the Year

$

Assume the company had used straightline depreciation during and the company determined that the

equipment would useful the company for only one more year beyond The salvage value estimated $

Compute the amount depreciation expense for the income statement.

Depreciation expense

Assume the company had used straightline depreciation during and During the company determined that the

equipment would useful the company for only one more year beyond Salvage value estimated $

What the depreciation base this asset the end

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock