Question: O No, the expected return is 13%, and the required return is 13.75% Question 17 11 pts You are running trying to decide which assisted

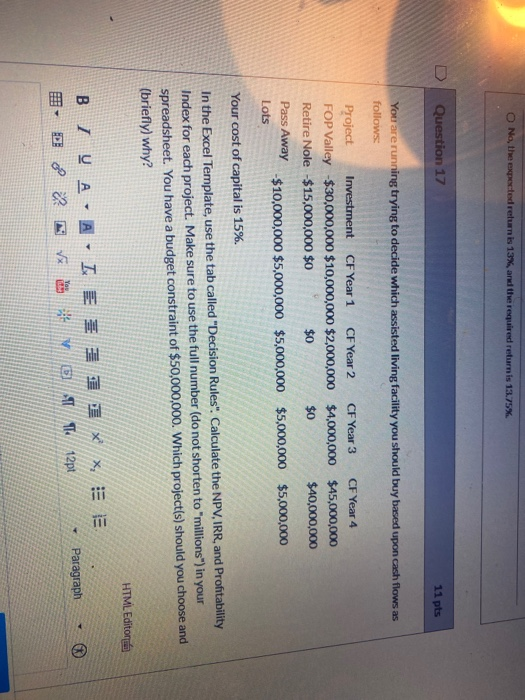

O No, the expected return is 13%, and the required return is 13.75% Question 17 11 pts You are running trying to decide which assisted living facility you should buy based upon cash flows as follows: Project Investment CF Year 1 CF Year 2 CF Year 3 CF Year 4 FOP Valley $30,000,000 $10,000,000 $2,000,000 $4,000,000 $45,000,000 Retire Nole $15,000,000 $0 $0 $0 $40,000,000 Pass Away -$10,000,000 $5,000,000 $5,000,000 $5,000,000 $5,000,000 Lots Your cost of capital is 15%. In the Excel Template, use the tab called "Decision Rules". Calculate the NPV, IRR, and Profitability Index for each project. Make sure to use the full number (do not shorten to "millions") in your spreadsheet. You have a budget constraint of $50,000,000. Which project(s) should you choose and (briefly) why? HTML Editoru BIU A DI - I E31 1 XX, V 12pt Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts