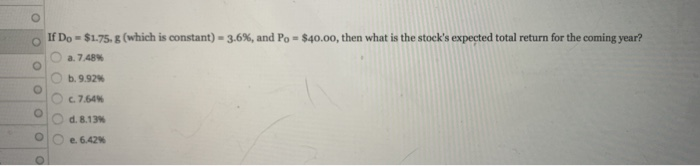

Question: o o o o If Do = $1.75.8 (which is constant) - 3.6%, and Po = $40.00, then what is the stock's expected total return

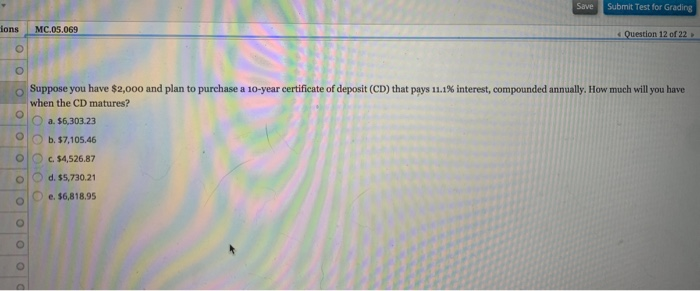

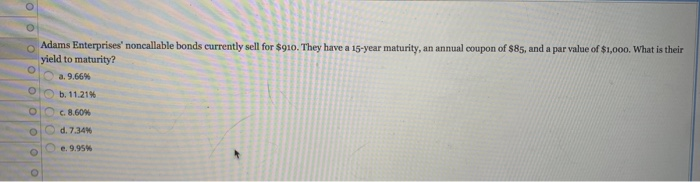

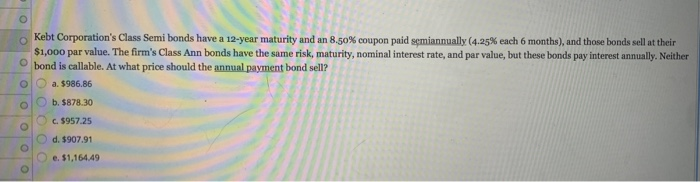

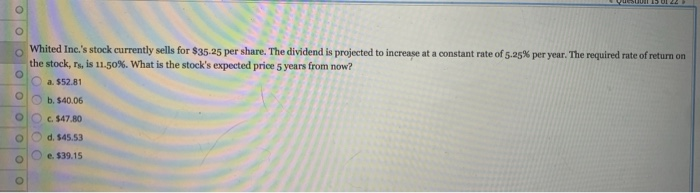

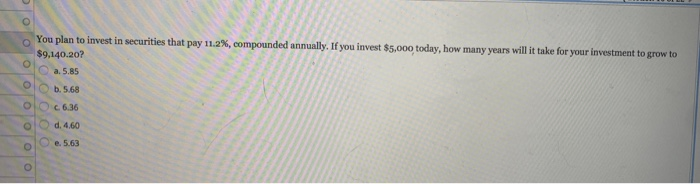

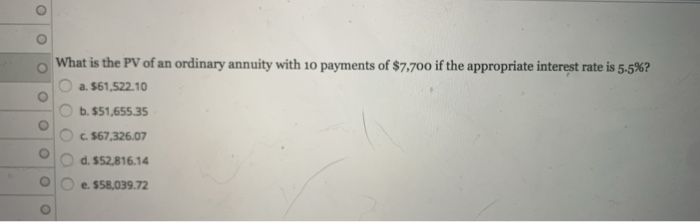

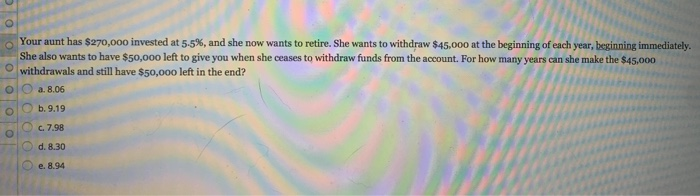

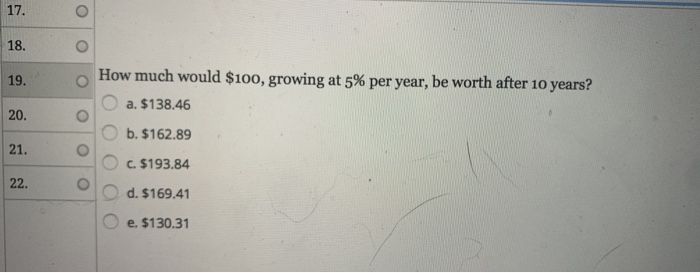

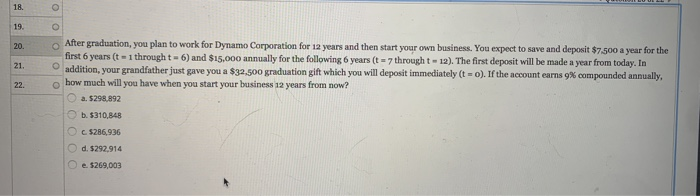

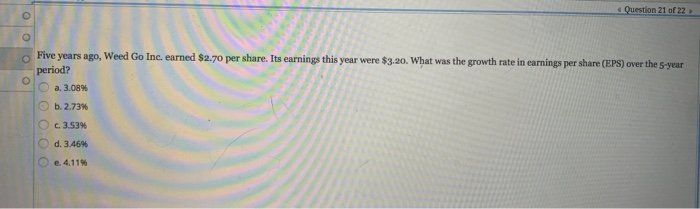

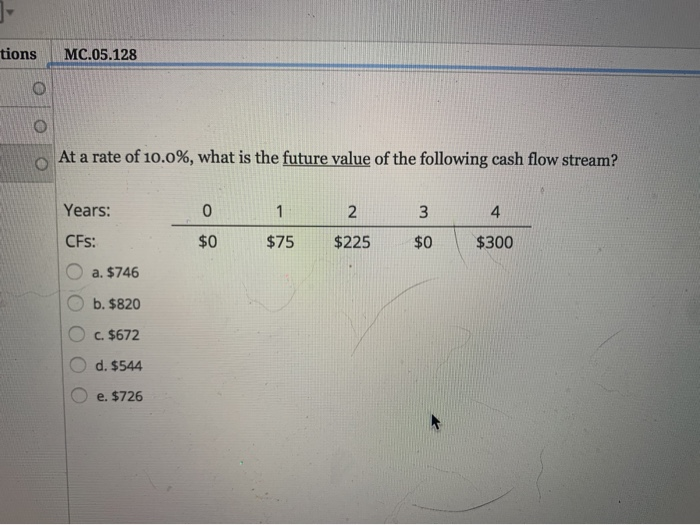

o o o o If Do = $1.75.8 (which is constant) - 3.6%, and Po = $40.00, then what is the stock's expected total return for the coming year? . 7.48 . 9.92% . 7.64 Od. 8.13% . 642 o Save Submit Test for Grading MC05.069 Question 12 of 22 o o o o o O Suppose you have $2,000 and plan to purchase a 10-year certificate of deposit (CD) that pays 11.1% interest, compounded annually. How much will you have when the CD matures? a. $6,303.23 b.57,105.46 c. $4,526.87 d. $5,730.21 e. $6,818.95 o o o o o o D have a 15-year maturity, an annual coupon of $85, and a par value of $1,000. What is their Adams Enterprises noncallable bonds currently sell for yield to maturity? o 2.9.66% Olo b. 11.21% O c. 8.60% S d .7.34 ble. 9.95% o O Kebt Corporation's Class Semi bonds have a 12-year maturity and an 8.50% coupon paid semiannually (4.25% each 6 months), and those bonds sell at their $1,000 par value. The firm's Class Ann bonds have the same risk, maturity, nominal interest rate, and par value, but these bonds pay interest annually. Neither bond is callable. At what price should the annual payment bond sell? a. $986.86 b. 5878.30 C. $957.25 d. 5907.91 o o o e. $1.164.49 o o o o Whited Inc.'s stock currently sells for $35.25 per share. The dividend is projected to increase at a constant rate of 5-25% per year. The required rate of return on the stock, Ts, is 11.50%. What is the stock's expected price 5 years from now? a. 552.81 b. $40.06 c.547.80 d. 545.53 o o o o e. $39.15 o You plan to invest in securities that pay 11.2%, compounded annually. If you invest $5,000 today, how many years will it take for your investment to grow to 59,140.20? ocass . 568 66 deo o o o o o What is the PV of an ordinary annuity with 10 payments of $7,700 if the appropriate interest rate is 5.5%? . $61,S22.10 . 351,65535 cs67,32607 Od. 352816.14 e. sss.o392 o o o Your aunt has $270,000 invested at 5.5%, and she now wants to retire. She wants to withdraw $45,000 at the beginning of each year, beginning immediately. She also wants to have $50,000 left to give you when she ceases to withdraw funds from the account. For how many years can she make the $45,000 withdrawals and still have $50,000 left in the end? o a. 8.06 O b.9.19 O O c.7.98 d. 8.30 e. 8.94 17. 0 How much would $100, growing at 5% per year, be worth after 10 years? a. $138.46 b. $162.89 O c. $193.84 O d. $169.41 O e. $130.31 After graduation, you plan to work for Dynamo Corporation for 12 years and then start your own business. You expect to save and deposit $7.500 a year for the first 6 years (t = 1 through t-6) and $15.000 annually for the following 6 years (t = 7 through t - 12). The first deposit will be made a year from today. In addition, your grandfather just gave you a $32.500 graduation gift which you will deposit immediately ( t o). If the account earns 9% compounded annually, o how much will you have when you start your business 12 years from now? a. $298,892 b. $310,848 $286.936 d. 5292,914 e. 5269,003 Question 21 of 22 000 Five years ago, Weed Go Inc. earned $2.70 per share. Its earnings this year were $320. What was the growth rate in earnings per share (EPS) over the 5-year period? a. 3.08% b. 2.73% .3.53% d. 3.46% O e. 4.11% ooooo tions MC.05.128 At a rate of 10.0%, what is the future value of the following cash flow stream? 0 $0 1 $75 2 $225 3 $0 4 $300 Years: CFS: O a. $746 O b. $820 O c. $672 O d. $544 O e. $726

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts