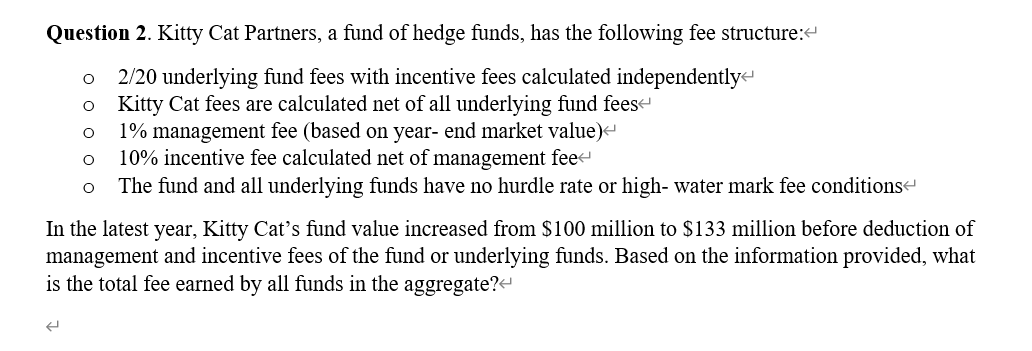

Question: o O o Question 2. Kitty Cat Partners, a fund of hedge funds, has the following fee structure:- 2/20 underlying fund fees with incentive fees

o O o Question 2. Kitty Cat Partners, a fund of hedge funds, has the following fee structure:- 2/20 underlying fund fees with incentive fees calculated independently Kitty Cat fees are calculated net of all underlying fund fees 1% management fee (based on year-end market value) 10% incentive fee calculated net of management fee The fund and all underlying funds have no hurdle rate or high-water mark fee conditions In the latest year, Kitty Cat's fund value increased from $100 million to $133 million before deduction of management and incentive fees of the fund or underlying funds. Based on the information provided, what is the total fee earned by all funds in the aggregate? O O o O o Question 2. Kitty Cat Partners, a fund of hedge funds, has the following fee structure:- 2/20 underlying fund fees with incentive fees calculated independently Kitty Cat fees are calculated net of all underlying fund fees 1% management fee (based on year-end market value) 10% incentive fee calculated net of management fee The fund and all underlying funds have no hurdle rate or high-water mark fee conditions In the latest year, Kitty Cat's fund value increased from $100 million to $133 million before deduction of management and incentive fees of the fund or underlying funds. Based on the information provided, what is the total fee earned by all funds in the aggregate? O O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts