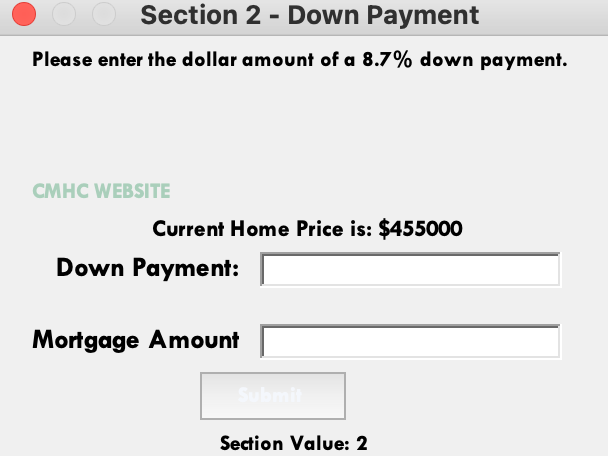

Question: . O O Section 2 - Down Payment Please enter the dollar amount of a 8.7% down payment. CMHC WEBSITE Current Home Price is: $455000

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock