Question: o P4-38 (final answer) Question Help Lewis & Associates is a law firm specializing in labor relations and Lewis has just completed a review of

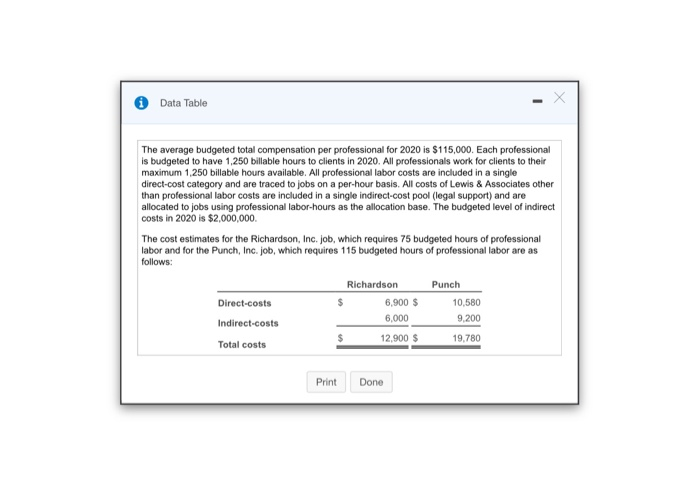

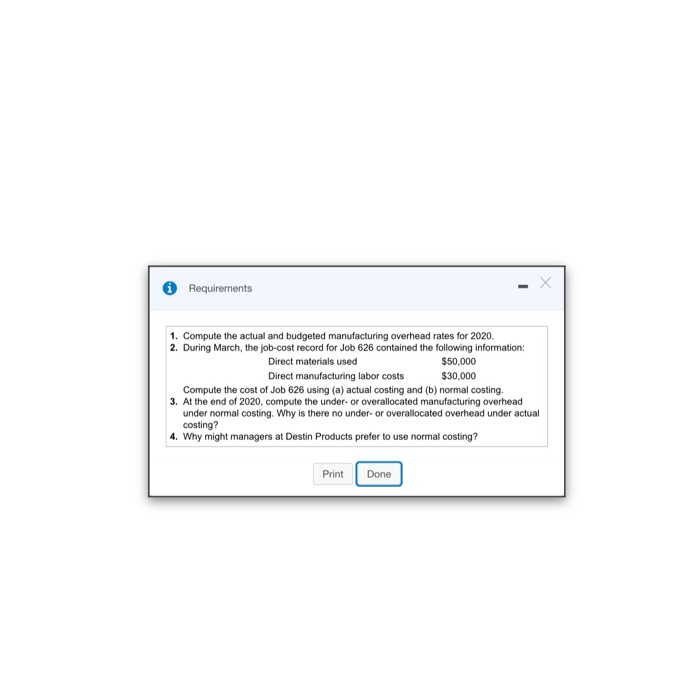

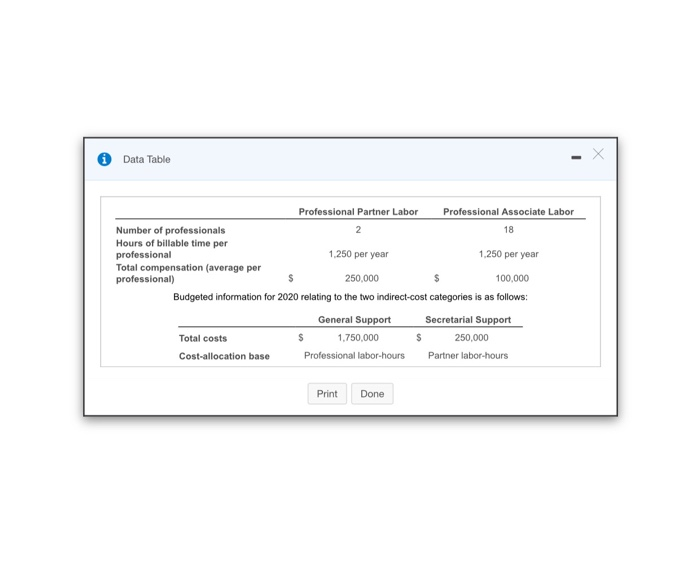

o P4-38 (final answer) Question Help Lewis & Associates is a law firm specializing in labor relations and Lewis has just completed a review of its job-costing system. employee-related work. It employs 20 professionals (2 partners and 18 (Click the icon to view the job-costing review information.) associates) who work directly with its clients. Previously the firm accounted for all Budgeted information for 2020 related to the two direct-cost categories is as professional labor cost in a single direct-cost account and all other costs in a single indirect-cost pool. follows: Click the icon to view the cost information and rates under the previous Click the icon to view the budgeted information.) method.) Read the requirements Requirement 1. Compute the 2020 budgeted direct-cost rates for (a) professional partners and (b) professional associates. Budgeted direct cost rate per hour Partner Associate Data Table The average budgeted total compensation per professional for 2020 is $115,000. Each professional is budgeted to have 1,250 billable hours to clients in 2020. All professionals work for clients to their maximum 1,250 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Lewis & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2020 is $2,000,000 The cost estimates for the Richardson, Inc. job, which requires 75 budgeted hours of professional labor and for the Punch, Inc. job, which requires 115 budgeted hours of professional labor are as follows: Richardson Punch Direct-costs 6,900 $ 10,580 Indirect costs 6,000 9,200 12,900 $ 19.780 Total costs Print Done Requirements 1. Compute the actual and budgeted manufacturing overhead rates for 2020 2. During March, the job-cost record for Job 626 contained the following information: Direct materials used $50,000 Direct manufacturing labor costs $30,000 Compute the cost of Job 626 using (a) actual costing and (b) normal costing, 3. At the end of 2020, compute the under-or overallocated manufacturing overhead under normal costing. Why is there no under-or overallocated overhead under actual costing? 4. Why might managers at Destin Products prefer to use normal costing? Print Done Data Table Professional Partner Labor Professional Associate Labor Number of professionals 2 18 Hours of billable time per professional 1.250 per year 1.250 per year Total compensation (average per professional) 250,000 100,000 Budgeted information for 2020 relating to the two indirect-cost categories is as follows: General Support Secretarial Support Total costs 1,750,000 $ 250,000 Cost-allocation base Professional labor-hours Partner labor-hours Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts