Question: O points Save Answer QUESTION 4 04: Version #1 3pts each, 4 questions, Total 12pts assigned. Direction: Carefully observe the following information, and provide your

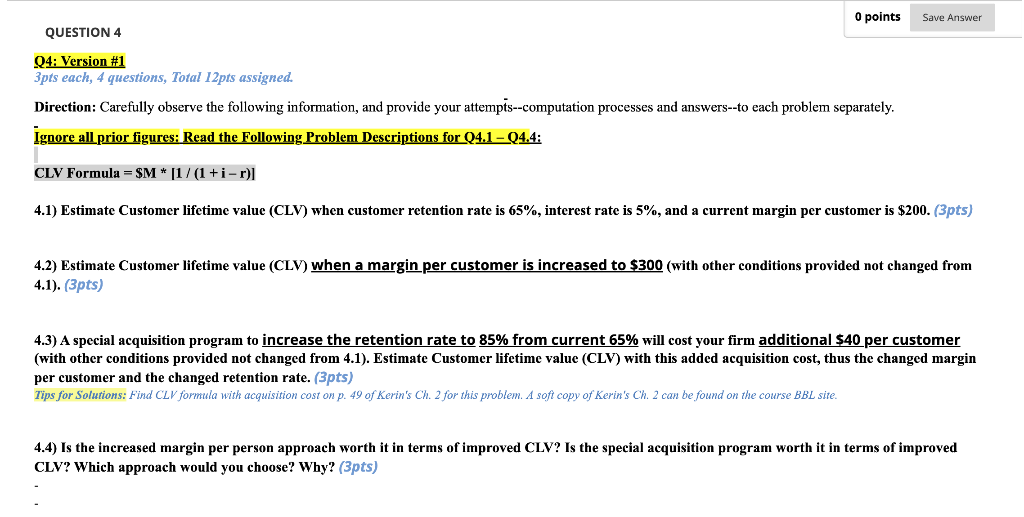

O points Save Answer QUESTION 4 04: Version #1 3pts each, 4 questions, Total 12pts assigned. Direction: Carefully observe the following information, and provide your attempts--computation processes and answers--to each problem separately. Ignore all prior figures: Read the following Problem Descriptions for 24.1 - Q4.4: CLV Formula = $M [1/(1 + i -r) 4.1) Estimate Customer lifetime value (CLV) when customer retention rate is 65%, interest rate is 5%, and a current margin per customer is $200. (3pts) 4.2) Estimate Customer lifetime value (CLV) when a margin per customer is increased to $300 (with other conditions provided not changed from 4.1). (3pts) 4.3) A special acquisition program to increase the retention rate to 85% from current 65% will cost your firm additional $40 per customer (with other conditions provided not changed from 4.1). Estimate Customer lifetime value (CLV) with this added acquisition cost, thus the changed margin per customer and the changed retention rate. (3pts) Tips for Solutions: Find CLV formula with acquisition cost on p. 49 of Kerin's Ch. 2 for this problem. A soft copy of Kerin's Ch. 2 can be found on the course BBL site. 4.4) Is the increased margin per person approach worth it in terms of improved CLV? Is the special acquisition program worth it in terms of improved CLV? Which approach would you choose? Why? (3pts) O points Save Answer QUESTION 4 04: Version #1 3pts each, 4 questions, Total 12pts assigned. Direction: Carefully observe the following information, and provide your attempts--computation processes and answers--to each problem separately. Ignore all prior figures: Read the following Problem Descriptions for 24.1 - Q4.4: CLV Formula = $M [1/(1 + i -r) 4.1) Estimate Customer lifetime value (CLV) when customer retention rate is 65%, interest rate is 5%, and a current margin per customer is $200. (3pts) 4.2) Estimate Customer lifetime value (CLV) when a margin per customer is increased to $300 (with other conditions provided not changed from 4.1). (3pts) 4.3) A special acquisition program to increase the retention rate to 85% from current 65% will cost your firm additional $40 per customer (with other conditions provided not changed from 4.1). Estimate Customer lifetime value (CLV) with this added acquisition cost, thus the changed margin per customer and the changed retention rate. (3pts) Tips for Solutions: Find CLV formula with acquisition cost on p. 49 of Kerin's Ch. 2 for this problem. A soft copy of Kerin's Ch. 2 can be found on the course BBL site. 4.4) Is the increased margin per person approach worth it in terms of improved CLV? Is the special acquisition program worth it in terms of improved CLV? Which approach would you choose? Why? (3pts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts