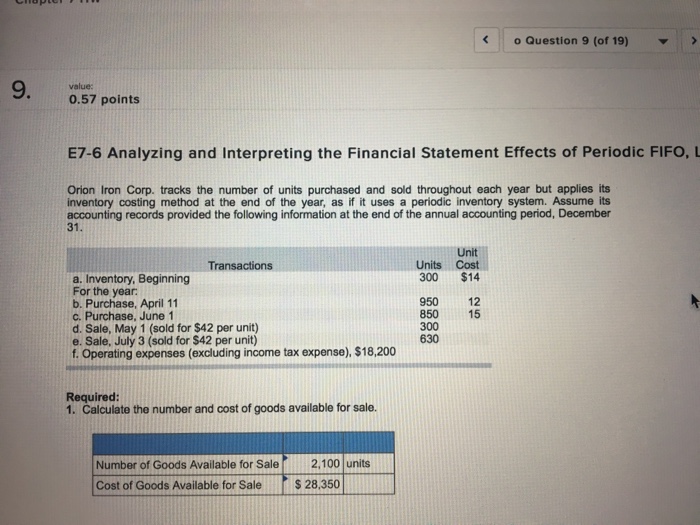

Question: o Question 9 (of 19)> 9 value: 0.57 points E7-6 Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, L Orion Iron Corp. tracks

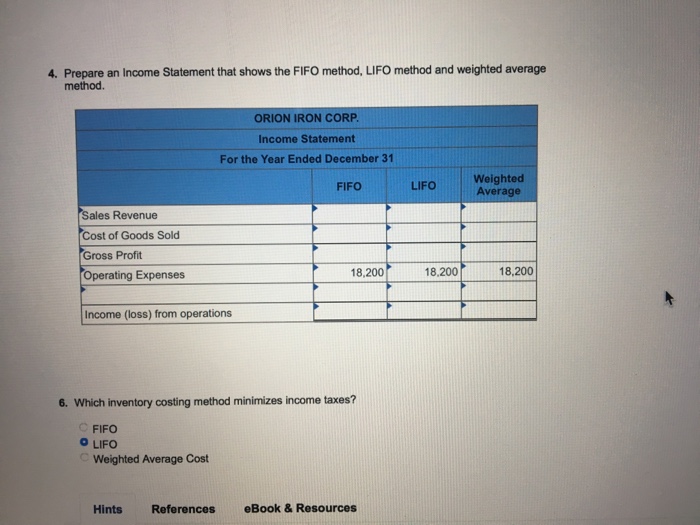

o Question 9 (of 19)> 9 value: 0.57 points E7-6 Analyzing and Interpreting the Financial Statement Effects of Periodic FIFO, L Orion Iron Corp. tracks the number of units purchased and sold throughout each year but applies its inventory costing method at the end of the year, as if it uses a periodic inventory system. Assume its accounting records provided the following information at the end of the annual accounting period, December 31. Unit Units Cost 300 $14 Transactions a. Inventory, Beginning For the year b. Purchase, April 11 c. Purchase, June 1 d. Sale, May 1 (sold for $42 per unit) e. Sale, July 3 (sold for $42 per unit) f. Operating expenses (excluding income tax expense), $18,200 12 15 950 850 300 630 Required: 1. Calculate the number and cost of goods available for sale. Number of Goods Available for Sale2.100 units Cost of Goods Availeble for Sale$28.350

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts