Question: Simic & Nikolic Ltd Statement of Profit & Loss for the year ended 30 June 2016 Sales revenue Gain from sale of land Gain

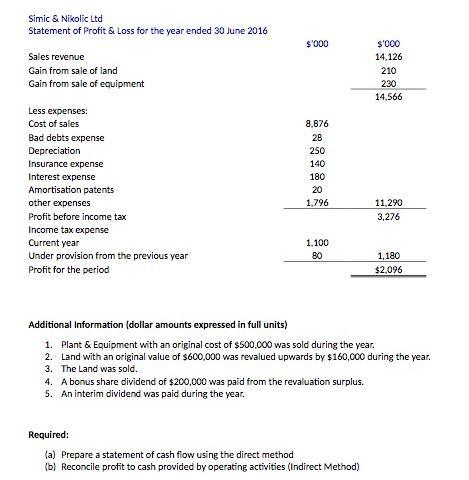

Simic & Nikolic Ltd Statement of Profit & Loss for the year ended 30 June 2016 Sales revenue Gain from sale of land Gain from sale of equipment Less expenses: Cost of sales Bad debts expense Depreciation Insurance expense Interest expense Amortisation patents other expenses $'000 $'000 14,126 210 230 14,566 8,876 28 250 140 180 20 1,796 11,290 Profit before income tax 3,276 Income tax expense Current year 1,100 Under provision from the previous year 80 1,180 Profit for the period $2,096 Additional Information (dollar amounts expressed in full units) 1. Plant & Equipment with an original cost of $500,000 was sold during the year. 2. Land with an original value of $600,000 was revalued upwards by $160,000 during the year. 3. The Land was sold. 4. A bonus share dividend of $200,000 was paid from the revaluation surplus. 5. An interim dividend was paid during the year. Required: (a) Prepare a statement of cash flow using the direct method (b) Reconcile profit to cash provided by operating activities (Indirect Method)

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

ANSWER Simic and Nikolic Ltd Statement of cash flows direct method for the year ended 30th June 2016 ... View full answer

Get step-by-step solutions from verified subject matter experts