Question: O Quiz 1-Final- 3ed - Protected View - Saved to this PC Search References Mailings Review View Help ontain viruses. Unless you need to

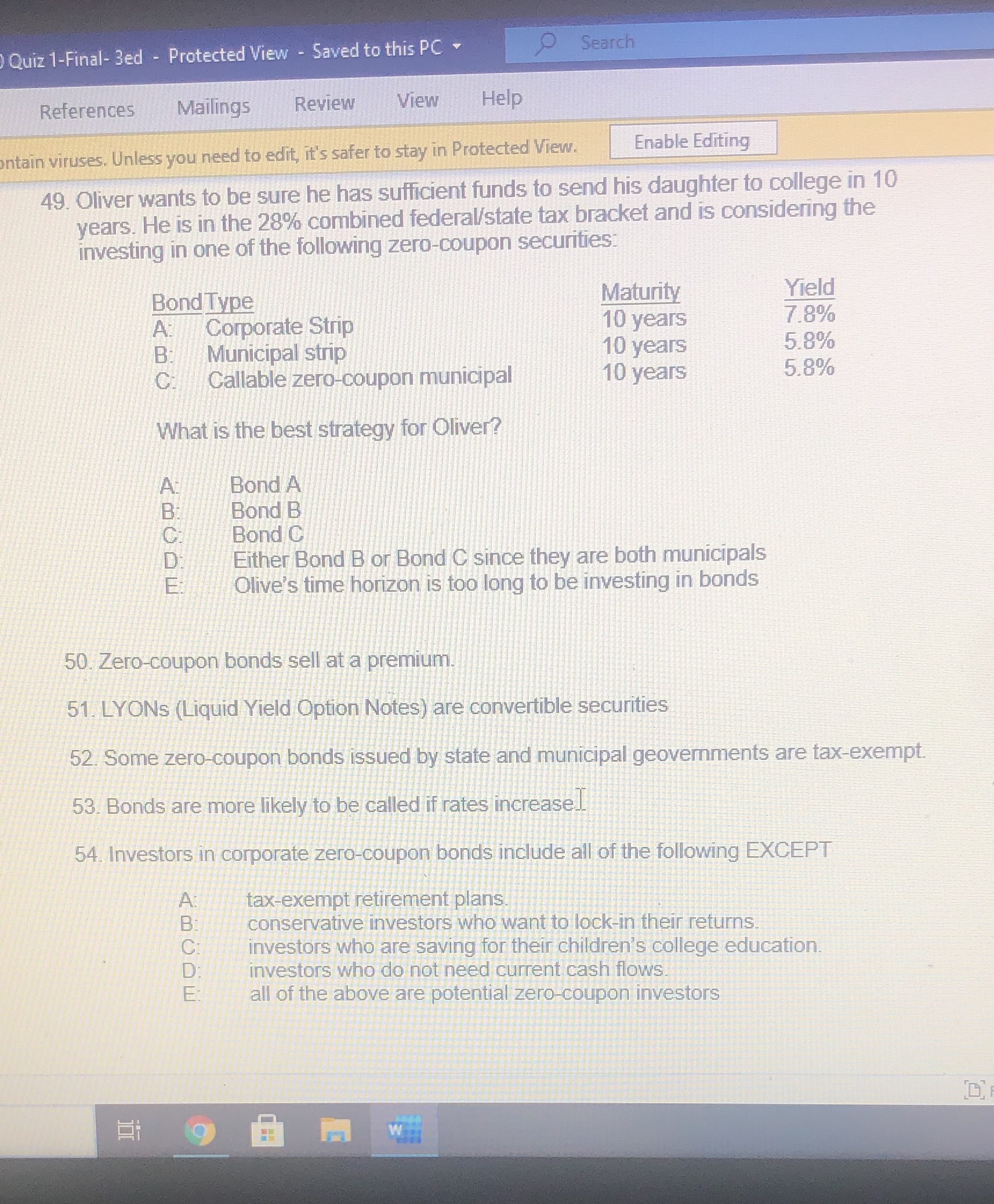

O Quiz 1-Final- 3ed - Protected View - Saved to this PC Search References Mailings Review View Help ontain viruses. Unless you need to edit, it's safer to stay in Protected View. Enable Editing 49. Oliver wants to be sure he has sufficient funds to send his daughter to college in 10 years. He is in the 28% combined federal/state tax bracket and is considering the investing in one of the following zero-coupon securities: Maturity Yield Bond Type A: Corporate Strip 10 years 7.8% C: B: Municipal strip What is the best strategy for Oliver? 10 years 5.8% Callable zero-coupon municipal 10 years 5.8% Bond C B: ABCDE E: A: Bond A Bond B Either Bond B or Bond C since they are both municipals Olive's time horizon is too long to be investing in bonds 50. Zero-coupon bonds sell at a premium. 51. LYONS (Liquid Yield Option Notes) are convertible securities 52. Some zero-coupon bonds issued by state and municipal geovernments are tax-exempt. 53. Bonds are more likely to be called if rates increase] 54. Investors in corporate zero-coupon bonds include all of the following EXCEPT ABCDE A: B: C: D: E: tax-exempt retirement plans. conservative investors who want to lock-in their returns. investors who are saving for their children's college education. investors who do not need current cash flows. all of the above are potential zero-coupon investors Ei D

Step by Step Solution

3.38 Rating (148 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provided below Lets go through each question and deter... View full answer

Get step-by-step solutions from verified subject matter experts