Question: . O rices decrease and when the market interest the bond prices increases. Question 3: Proficient-level: Describe the differences in interest payments and bond prices

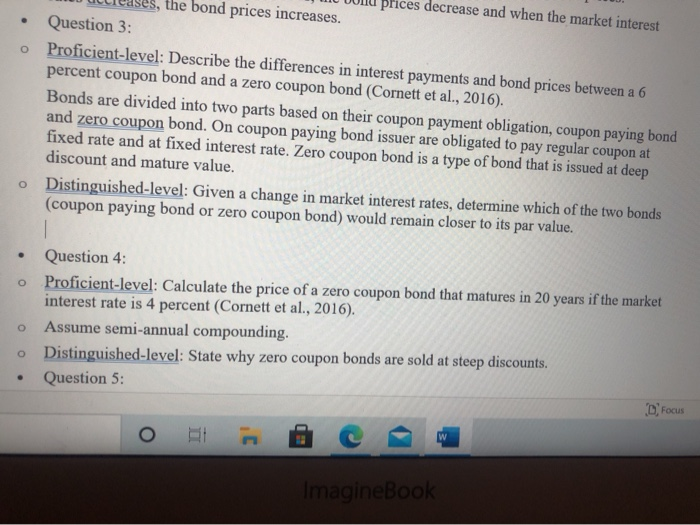

. O rices decrease and when the market interest the bond prices increases. Question 3: Proficient-level: Describe the differences in interest payments and bond prices between a 6 percent coupon bond and a zero coupon bond (Cornett et al., 2016). Bonds are divided into two parts based on their coupon payment obligation, coupon paying bond and zero coupon bond. On coupon paying bond issuer are obligated to pay regular coupon at fixed rate and at fixed interest rate. Zero coupon bond is a type of bond that is issued at deep discount and mature value. Distinguished-level: Given a change in market interest rates, determine which of the two bonds (coupon paying bond or zero coupon bond) would remain closer to its par value. O O o Question 4: Proficient-level: Calculate the price of a zero coupon bond that matures in 20 years if the market interest rate is 4 percent (Cornett et al., 2016). Assume semi-annual compounding. Distinguished-level: State why zero coupon bonds are sold at steep discounts. Question 5: D. Focus o . ImagineBook

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts