Question: O Topic Week 14 Disc x 0 Mail -lisa-ellisonce x )eText x Page 342, Fundame X content-43581/address/390 Doost me saies or s exisung hoor Hones

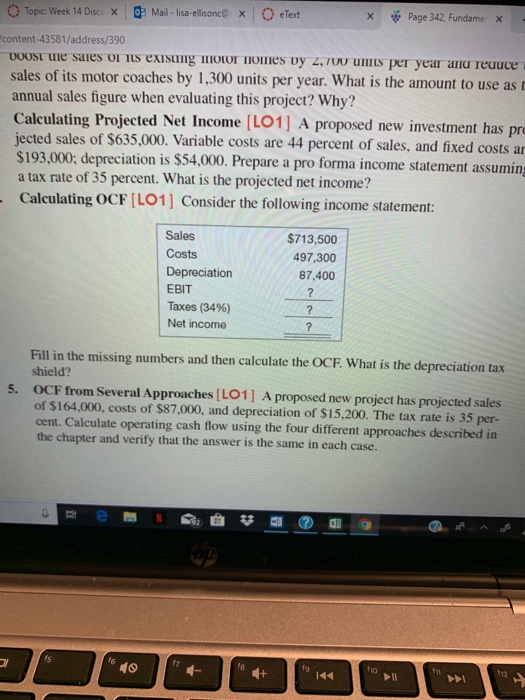

O Topic Week 14 Disc x 0 Mail -lisa-ellisonce x )eText x Page 342, Fundame X content-43581/address/390 Doost me saies or s exisung hoor Hones Dy , us per year and reauce sales of its motor coaches by 1,300 units per year. What is the amount to use annual sales figure when evaluating this project? Why? Calculating Projected Net Income [LO1] A proposed new investment has jected sales of $635,000. Variable costs are 44 percent of sales, and fixed costs an $193,000; depreciation is $54,000. Prepare a pro forma income statement assuming a tax rate of 35 percent. What is the projected net income? Calculating OCF ILO1] Consider the following income statement: Sales Costs Depreciation EBIT Taxes (3496) Net income $713,500 497,300 87,400 Fill in the missing numbers and then calculate the OCF. What is the depreciation tax shield? 0CF from Several Approaches [ LOI ] A proposed new project has projected sales of $164,000, costs of $87.000, and depreciation of $15,200. The tax rate is 35 per- cent. Calculate operating cash flow using the four different approaches described in the chapter and verify that the answer is the same in each case. 5. 40 1z fg f1o f12

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts