Question: O True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock

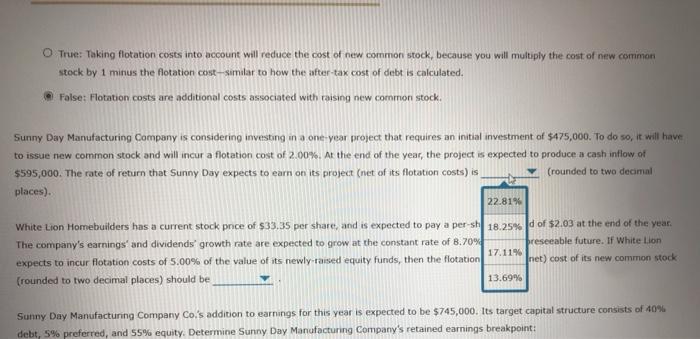

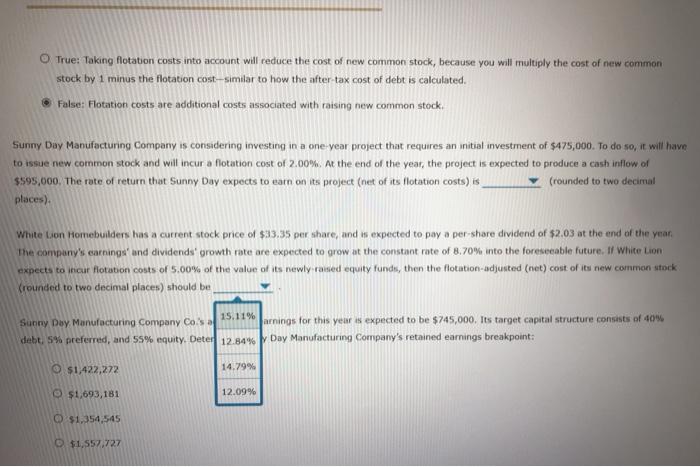

O True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock by 1 minus the flotation cost-similar to how the after-tax cost of debt is calculated. False: Flotation costs are additional costs associated with raising new common stock Sunny Day Manufacturing Company is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Sunny Day expects to earn on its project (niet of its flotation costs) is (rounded to two decimal places). 22.819 White Lion Homebuilders has a current stock pnce of $33.35 per share, and is expected to pay a per sh 18.25%d of $2.03 at the end of the year. The company's earnings and dividends' growth rate are expected to grow at the constant rate of 8.70% preseeable future. If White Lion 17.11% expects to incur flotation costs of 5.00% of the value of ats newly raised equity funds, then the flotation net) cost of its new common stock (rounded to two decimal places) should be 13.69% Sunny Day Manufacturing Company Co.'s addition to earnings for this year is expected to be $745,000. Its target capital structure consists of 40% debt, 5% preferred, and 55% equity. Determine Sunny Day Manufacturing Company's retained earnings breakpoint: True: Taking flotation costs into account will reduce the cost of new common stock, because you will multiply the cost of new common stock by 1 minus the flotation cost-similar to how the after tax cost of debt is calculated False: Flotation costs are additional costs associated with raising new common stock Sunny Day Manufacturing Company is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Sunny Day expects to earn on its project (net of its flotation costs) is (rounded to two decimal places) White Lion Homebuilders has a current stock price of $33.35 per share, and is expected to pay a per-share dividend of $2.03 at the end of the year The company's earnings and dividends' growth rate are expected to grow at the constant rate of 8.70% into the foreseeable future. If White Lion expects to incur flotation costs of 5.00% of the value of its newly raned equity fundi, then the flotation-adjusted (net) cost of its new common stock Krounded to two decimal places) should be 15.11% Sunny Day Manufacturing Company Coi's a arnings for this year is expected to be $745,000. Its target capital structure consists of 40% debt, 5% preferred, and 55% equity. Deter 12.84% Day Manufacturing Company's retained earnings breakpoint: O $1,422,272 14.79% $1,693,181 12.09% Q $1,354,545 $1,557,727 False: Flotation costs are additional costs associated with raising new common stock, Sunny Day Manufacturing Company is considering investing in a one-year project that requires an initial investment of $475,000. To do so, it will have to issue new common stock and will incur a flotation cost of 2.00%. At the end of the year, the project is expected to produce a cash inflow of $595,000. The rate of return that Sunny Day expects to earn on its project (net of its flotation costs) is (rounded to two decimal places). White Lion Homebuilders has a current stock price of $33.35 per share, and is expected to pay a per share dividend of $2.03 at the end of the year, The company's earning and dividends' growth rate are expected to grow at the constant rate of 8.70% into the foreseeable future. If White Lion expects to incur flotation costs of 5.00% of the value of its newly raised equity fonds, then the flotation adjusted (net) cost of its new common stock (rounded to two decimal places) should be Sunny Day Manufacturing Company Co s addition to earnings for this year is expected to be $745,000. Its target capital structure consists of 40% debt, 5% preferred, and 55% equity. Determine Sunny Dany Manufacturing Company's retained earnings breakpoint: O $1,422,272 $1,693,181 $1,354,545 O $1,557,727

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts