Question: o ... Tutorial 1 A212 Question-new.docx QUESTION 3- QUESTION 8 SS Bhd acquired 70% interest in the equity capital of TT Bhd on 1 January

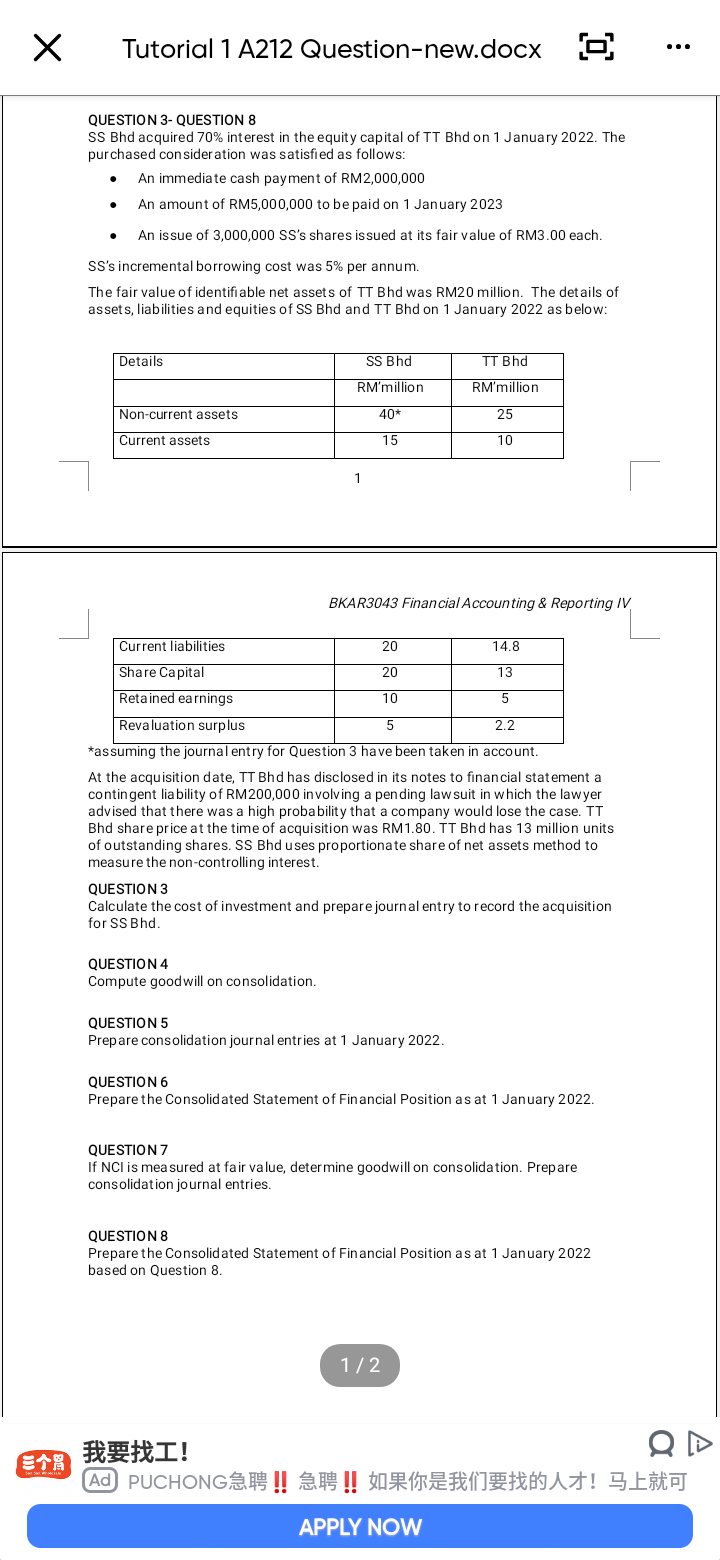

o ... Tutorial 1 A212 Question-new.docx QUESTION 3- QUESTION 8 SS Bhd acquired 70% interest in the equity capital of TT Bhd on 1 January 2022. The purchased consideration was satisfied as follows: An immediate cash payment of RM2,000,000 An amount of RM5,000,000 to be paid on 1 January 2023 . . An issue of 3,000,000 SS's shares issued at its fair value of RM3.00 each. SS's incremental borrowing cost was 5% per annum. The fair value of identifiable net assets of TT Bhd was RM20 million. The details of assets, liabilities and equities of SS Bhd and TT Bhd on 1 January 2022 as below: Details SS Bhd TT Bhd RM'million RM million Non-current assets 40* 25 Current assets 15 10 1 BKAR3043 Financial Accounting & Reporting IV Current liabilities 20 14.8 Share Capital 20 13 Retained earnings 10 5 Revaluation surplus 5 2.2 *assuming the journal entry for Question 3 have been taken in account. At the acquisition date, TT Bhd has disclosed in its notes to financial statement a contingent liability of RM200,000 involving a pen ding law suit in which the lawyer advised that there was a high probability that a company would lose the case. TT Bhd share price at the time of acquisition was RM1.80. TT Bhd has 13 million units of outstanding shares. SS Bhd uses proportionate share of net assets method to measure the non-controlling interest. QUESTION 3 Calculate the cost of investment and prepare journal entry to record the acquisition for SS Bhd. QUESTION 4 4 Compute goodwill on consolidation QUESTION 5 Prepare consolidation journal entries at 1 January 2022. QUESTION 6 Prepare the Consolidated Statement of Financial Position as at 1 January 2022 QUESTION 7 If NCI is measured at fair value, determine goodwill on consolidation. Prepare consolidation journal entries. QUESTIONS Prepare the Consolidated Statement of Financial Position as at 1 January 2022 based on Question 8. 1/2 11 ! OD Ad PUCHONGS !! !! DARE2A5+! SERTAJ APPLY NOW o ... Tutorial 1 A212 Question-new.docx QUESTION 3- QUESTION 8 SS Bhd acquired 70% interest in the equity capital of TT Bhd on 1 January 2022. The purchased consideration was satisfied as follows: An immediate cash payment of RM2,000,000 An amount of RM5,000,000 to be paid on 1 January 2023 . . An issue of 3,000,000 SS's shares issued at its fair value of RM3.00 each. SS's incremental borrowing cost was 5% per annum. The fair value of identifiable net assets of TT Bhd was RM20 million. The details of assets, liabilities and equities of SS Bhd and TT Bhd on 1 January 2022 as below: Details SS Bhd TT Bhd RM'million RM million Non-current assets 40* 25 Current assets 15 10 1 BKAR3043 Financial Accounting & Reporting IV Current liabilities 20 14.8 Share Capital 20 13 Retained earnings 10 5 Revaluation surplus 5 2.2 *assuming the journal entry for Question 3 have been taken in account. At the acquisition date, TT Bhd has disclosed in its notes to financial statement a contingent liability of RM200,000 involving a pen ding law suit in which the lawyer advised that there was a high probability that a company would lose the case. TT Bhd share price at the time of acquisition was RM1.80. TT Bhd has 13 million units of outstanding shares. SS Bhd uses proportionate share of net assets method to measure the non-controlling interest. QUESTION 3 Calculate the cost of investment and prepare journal entry to record the acquisition for SS Bhd. QUESTION 4 4 Compute goodwill on consolidation QUESTION 5 Prepare consolidation journal entries at 1 January 2022. QUESTION 6 Prepare the Consolidated Statement of Financial Position as at 1 January 2022 QUESTION 7 If NCI is measured at fair value, determine goodwill on consolidation. Prepare consolidation journal entries. QUESTIONS Prepare the Consolidated Statement of Financial Position as at 1 January 2022 based on Question 8. 1/2 11 ! OD Ad PUCHONGS !! !! DARE2A5+! SERTAJ APPLY NOW

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts