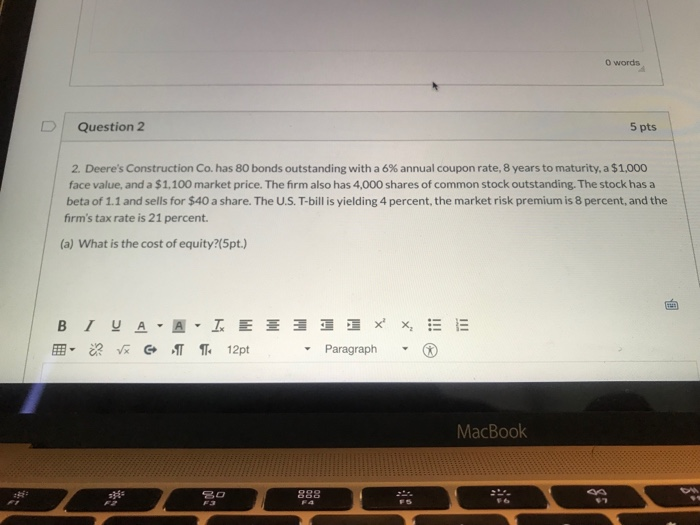

Question: O words Question 2 5 pts 2. Deere's Construction Co. has 80 bonds outstanding with a 6% annual coupon rate, 8 years to maturity, a

O words Question 2 5 pts 2. Deere's Construction Co. has 80 bonds outstanding with a 6% annual coupon rate, 8 years to maturity, a $1,000 face value, and a $1,100 market price. The firm also has 4,000 shares of common stock outstanding. The stock has a beta of 1.1 and sells for $40 a share. The U.S. T-bill is yielding 4 percent, the market risk premium is 8 percent, and the firm's tax rate is 21 percent. (a) What is the cost of equity?(5pt.) A - IX EE311 x'x, E ? V GT 12pt Paragraph MacBook 20 F3 888 FA Question 3 (b) What is the pre-tax cost of debt?(5pt.) NM I VA - A - IX Ex - V GT 12pt Paragraph Question 4 (c) What are the capital structure weights?(5pt.) B I VA -A- IX E 1 1 1 - V GT 12pt Paragraph O words Question 5 5 pts (d) What is the firm's weighted average cost of capital assuming its earnings are sufficient to classify all interest as a tax-deductible expense?(5pt.) BIVA - A - I E3311X , SE ? V GT 12pt Paragraph

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts