Question: O X 1 1 . 1 . 2 . 1 . 3 . 1 . 4 . 1 . 5 . 1 . 6 .

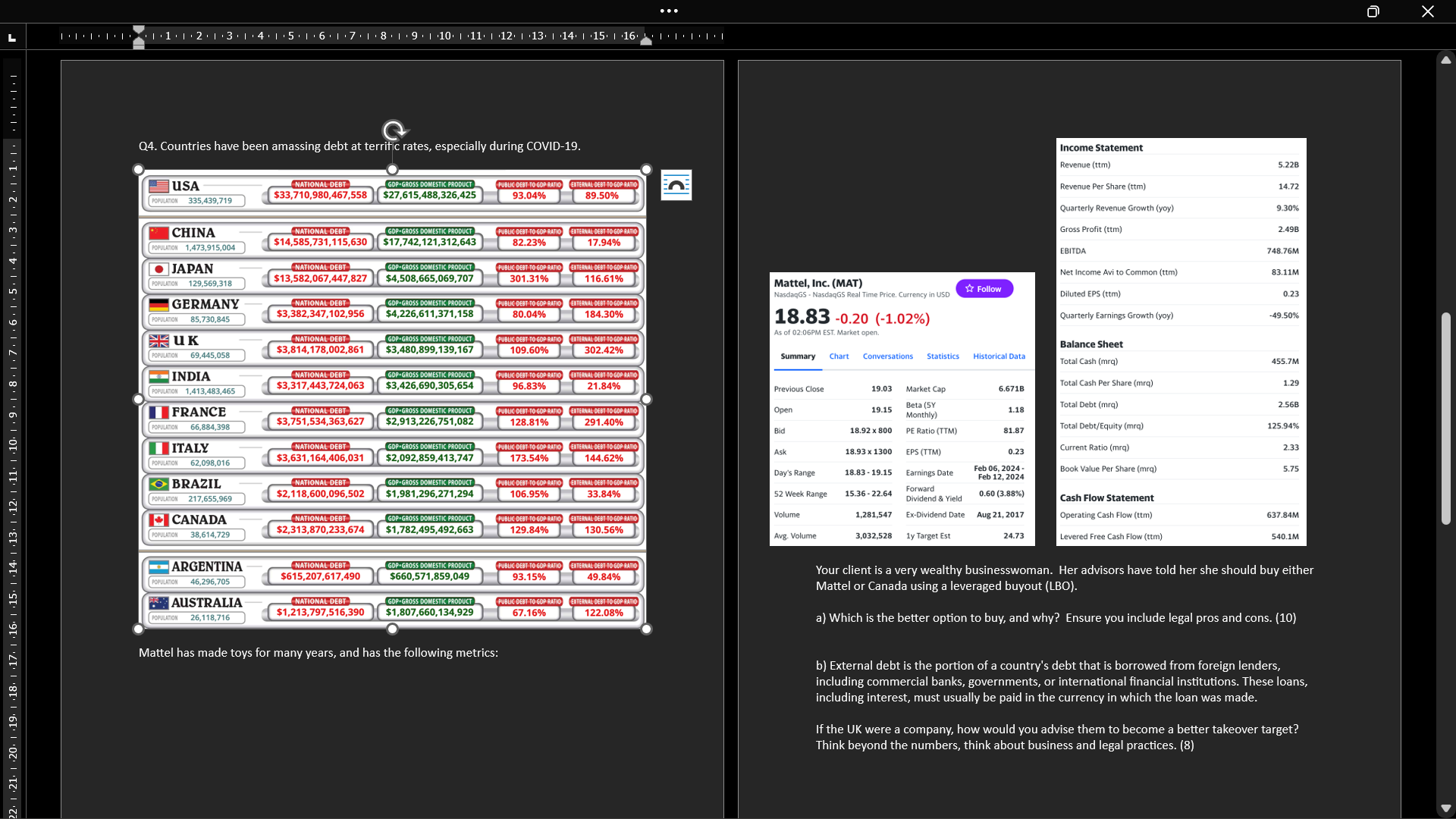

O X 1 1 . 1 . 2 . 1 . 3 . 1 . 4 . 1 . 5 . 1 . 6 . 1 . 7 . 1 . 8 . 1 . 9 . 1 .10. 1 11 . 1 .12. 1 .13. 1 14 1 .15. 1 16.. 1. . . 1 . 1 Q Q4. Countries have been amassing debt at terrific rates, especially during COVID-19. ncome Statement Revenue (ttm) 5.228 USA NATIONAL DEBT GDP .GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Revenue Per Share (ttm) 14.72 POPULATION 335,439,719 $33,710,980,467,558 $27,615,488,326,425 93.04% 89.50% Quarterly Revenue Growth (yoy) 9.30% CHINA NATIONAL DEBT GDP .GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Gross Profit (ttm) 2.49B POPULATION 1,473,915,004 $14,585,731,115,630 $17,742,121,312,643 82.23% 17.94% EBITDA 748.76M . JAPAN NATIONAL DEBT GDP . GROSS DOMEST PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Net Income Avi to Common (ttm) POPULATION 129,569,318 $13,582,067,447,827 83.11M $4,508,665,069,707 301.31% 116.61% Mattel, Inc. (MAT) NasdaqGS . NasdaqGS Real Time Price. Currency in USD Follow Diluted EPS (ttm) 0.23 GERMANY NATIONAL DEBT GDP . GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO POPULATION 85,730,845 $3,382,347,102,956 $4,226,611,371,158 80.04% 184.30% 18.83 -0.20 (-1.02%) Quarterly Earnings Growth (yoy) 49.50% GDP .GROSS DOMESTIC PRODUCT EXTERNAL DEBT TO GOP RATIO As of 02:06PM EST. Market open KUK NATIONAL DEBT PUBLIC DEBT TO GOP RATIO $3,814,178,002,861 $3,480,899,139,167 109.60% 302.42% Balance Sheet POPULATION 69,445,058 Summary Chart Conversations Statistics Historical Data Total Cash (mrq) 455.7M INDIA NATIONAL DEBT GDP. GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO POPULATION 1,413,483,465 $3,317,443,724,063 $3,426,690,305,654 96.83% 21.84% Previous Close 19.03 Market Cap 6.671B Total Cash Per Share (mrq) 1.29 NATIONAL DEBT Open 1.18 2.56B GDP . GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO 19.15 Beta (5Y FRANCE Total Debt (mrq) POPULATION 66,884,398 $3,751,534,363,627 $2,913,226,751,082 Monthly) 128.81% 291.40% Bid 18.92 x 800 PE Ratio (TTM) 31.87 Total Debt/Equity (mrq) 125.94% 2. 1 .21. 1 .20. 1 .19. 1 .18. 1 .17. 1 .16. 1 .15. 1 .14. 1 .13. 1 .12. 1 11. 1 10. 1 . 9 . 1 . 8 . 1 . 7 . 1 . 6 . 1 . 5 . 1 . 4 . 1 .3 . 1 . 2 . 1 . 1 . 1. . . . .) ITALY NATIONAL DEBT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Ask 18.93 x 1300 EPS (TTM) 0.23 Current Ratio (mrq) 2.33 POPULATION 62,098,016 $3,631,164,406,031 $2,092,859,413,747 173.54% 144.62% Day's Range 18.83 - 19.15 Earnings Date Feb 06, 2024 - Book Value Per Share (mrq) 5.75 BRAZIL NATIONAL DEBT GDP.GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Feb 12, 2024 POPULATION 217,655,969 $2,118,600,096,502 $1,981,296,271,294 106.95% 33.84% 52 Week Range 15.36 - 22.64 Forward Dividend

O X 1 1 . 1 . 2 . 1 . 3 . 1 . 4 . 1 . 5 . 1 . 6 . 1 . 7 . 1 . 8 . 1 . 9 . 1 .10. 1 11 . 1 .12. 1 .13. 1 14 1 .15. 1 16.. 1. . . 1 . 1 Q Q4. Countries have been amassing debt at terrific rates, especially during COVID-19. ncome Statement Revenue (ttm) 5.228 USA NATIONAL DEBT GDP .GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Revenue Per Share (ttm) 14.72 POPULATION 335,439,719 $33,710,980,467,558 $27,615,488,326,425 93.04% 89.50% Quarterly Revenue Growth (yoy) 9.30% CHINA NATIONAL DEBT GDP .GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Gross Profit (ttm) 2.49B POPULATION 1,473,915,004 $14,585,731,115,630 $17,742,121,312,643 82.23% 17.94% EBITDA 748.76M . JAPAN NATIONAL DEBT GDP . GROSS DOMEST PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Net Income Avi to Common (ttm) POPULATION 129,569,318 $13,582,067,447,827 83.11M $4,508,665,069,707 301.31% 116.61% Mattel, Inc. (MAT) NasdaqGS . NasdaqGS Real Time Price. Currency in USD Follow Diluted EPS (ttm) 0.23 GERMANY NATIONAL DEBT GDP . GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO POPULATION 85,730,845 $3,382,347,102,956 $4,226,611,371,158 80.04% 184.30% 18.83 -0.20 (-1.02%) Quarterly Earnings Growth (yoy) 49.50% GDP .GROSS DOMESTIC PRODUCT EXTERNAL DEBT TO GOP RATIO As of 02:06PM EST. Market open KUK NATIONAL DEBT PUBLIC DEBT TO GOP RATIO $3,814,178,002,861 $3,480,899,139,167 109.60% 302.42% Balance Sheet POPULATION 69,445,058 Summary Chart Conversations Statistics Historical Data Total Cash (mrq) 455.7M INDIA NATIONAL DEBT GDP. GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO POPULATION 1,413,483,465 $3,317,443,724,063 $3,426,690,305,654 96.83% 21.84% Previous Close 19.03 Market Cap 6.671B Total Cash Per Share (mrq) 1.29 NATIONAL DEBT Open 1.18 2.56B GDP . GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO 19.15 Beta (5Y FRANCE Total Debt (mrq) POPULATION 66,884,398 $3,751,534,363,627 $2,913,226,751,082 Monthly) 128.81% 291.40% Bid 18.92 x 800 PE Ratio (TTM) 31.87 Total Debt/Equity (mrq) 125.94% 2. 1 .21. 1 .20. 1 .19. 1 .18. 1 .17. 1 .16. 1 .15. 1 .14. 1 .13. 1 .12. 1 11. 1 10. 1 . 9 . 1 . 8 . 1 . 7 . 1 . 6 . 1 . 5 . 1 . 4 . 1 .3 . 1 . 2 . 1 . 1 . 1. . . . .) ITALY NATIONAL DEBT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Ask 18.93 x 1300 EPS (TTM) 0.23 Current Ratio (mrq) 2.33 POPULATION 62,098,016 $3,631,164,406,031 $2,092,859,413,747 173.54% 144.62% Day's Range 18.83 - 19.15 Earnings Date Feb 06, 2024 - Book Value Per Share (mrq) 5.75 BRAZIL NATIONAL DEBT GDP.GROSS DOMESTIC PRODUCT PUBLIC DEBT TO GOP RATIO EXTERNAL DEBT TO GOP RATIO Feb 12, 2024 POPULATION 217,655,969 $2,118,600,096,502 $1,981,296,271,294 106.95% 33.84% 52 Week Range 15.36 - 22.64 Forward Dividend

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts