Question: - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3

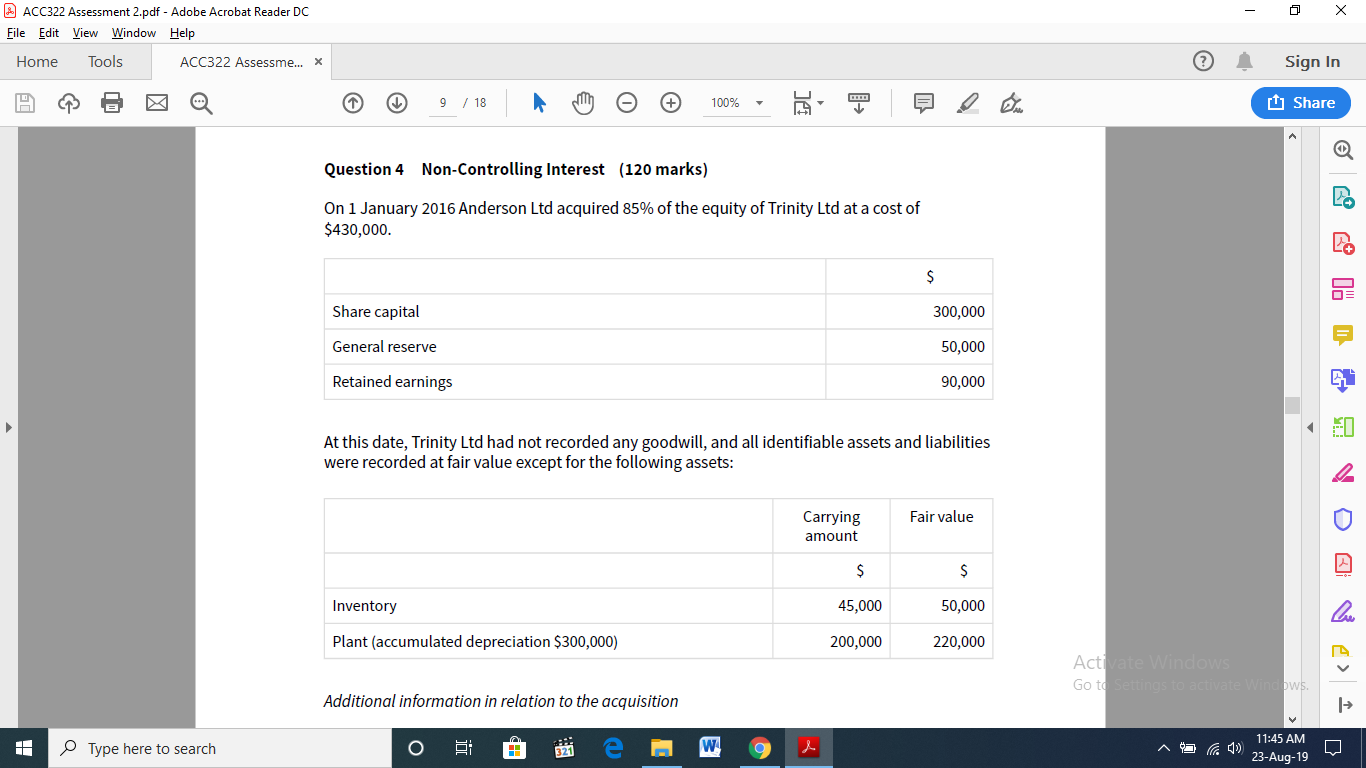

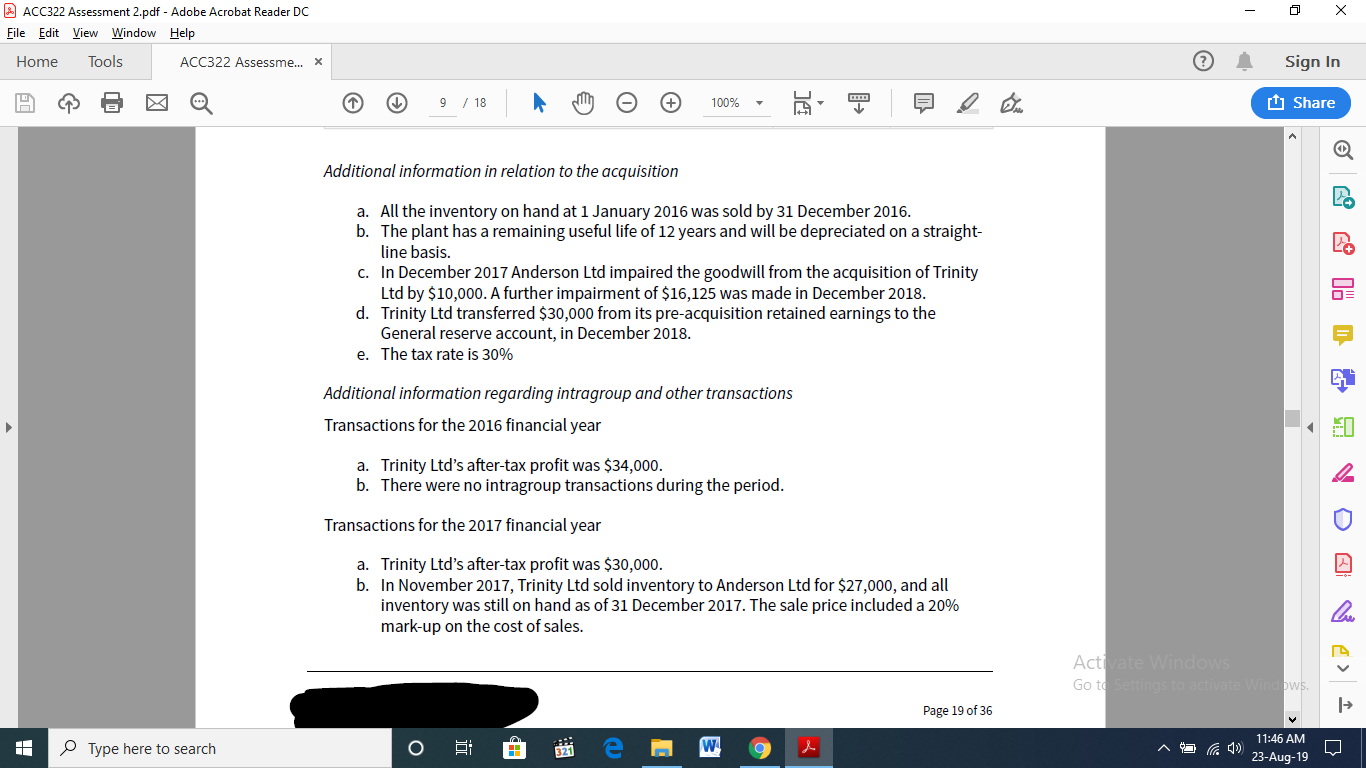

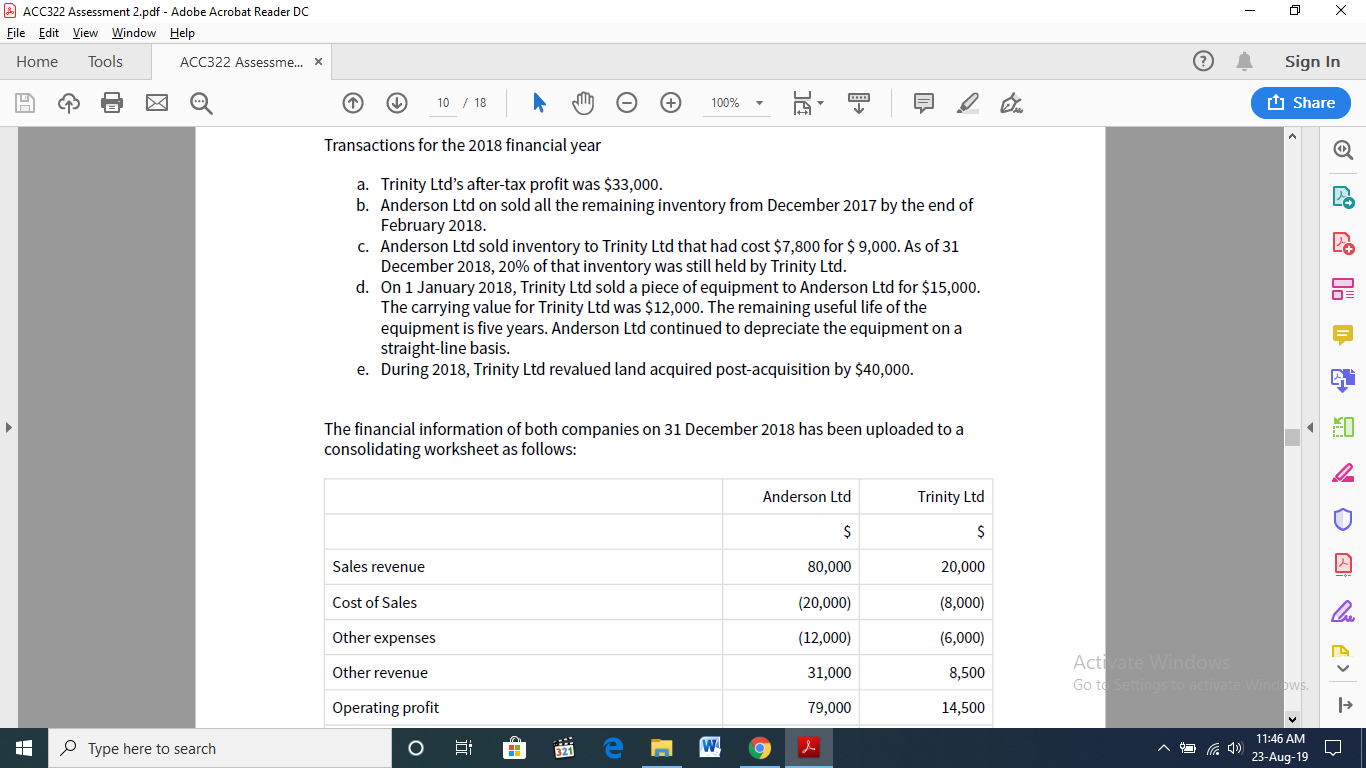

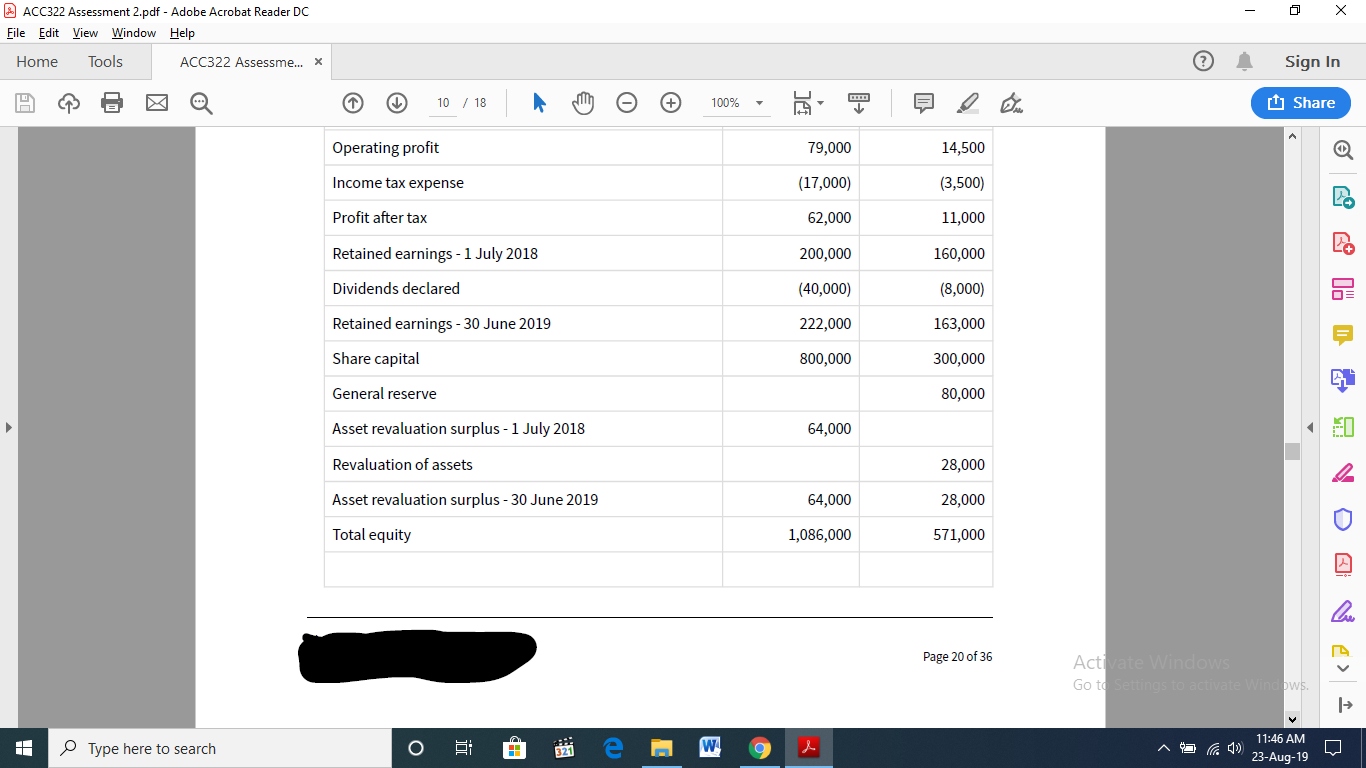

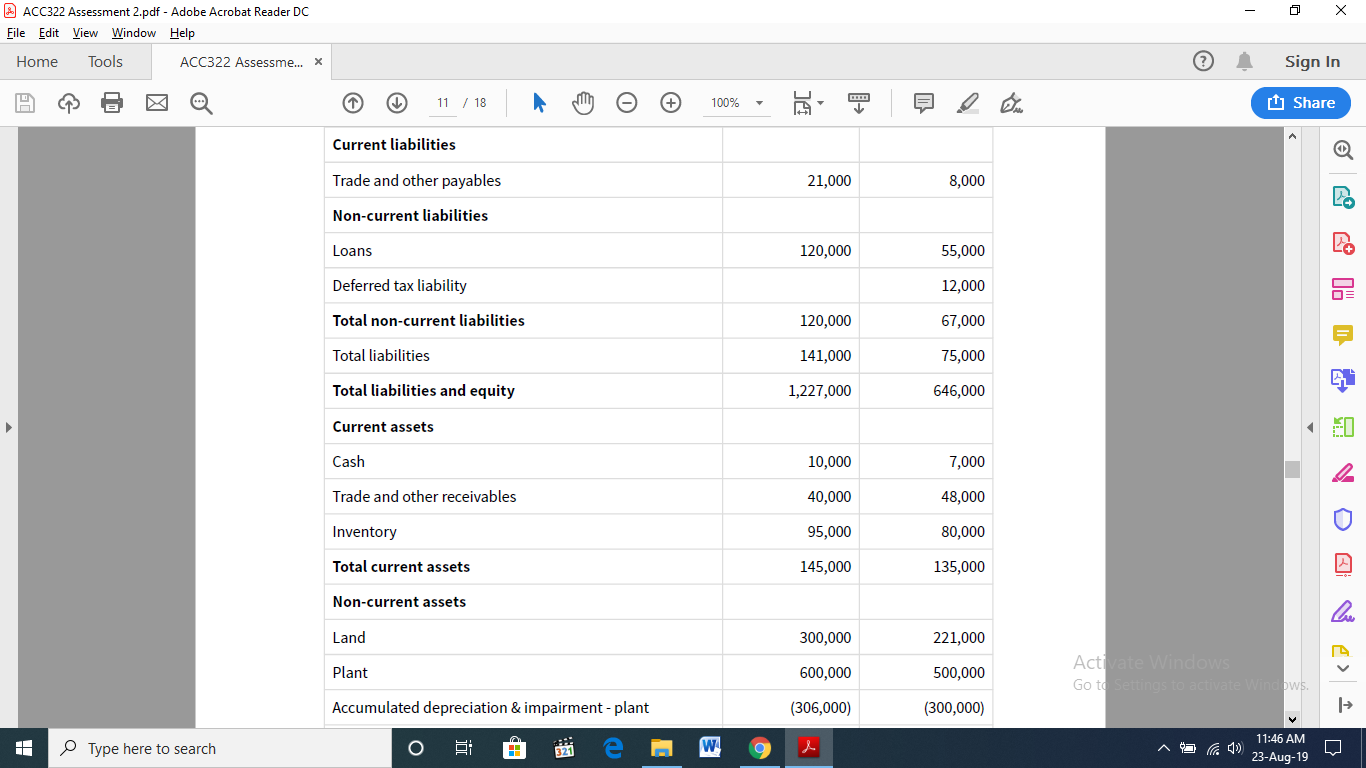

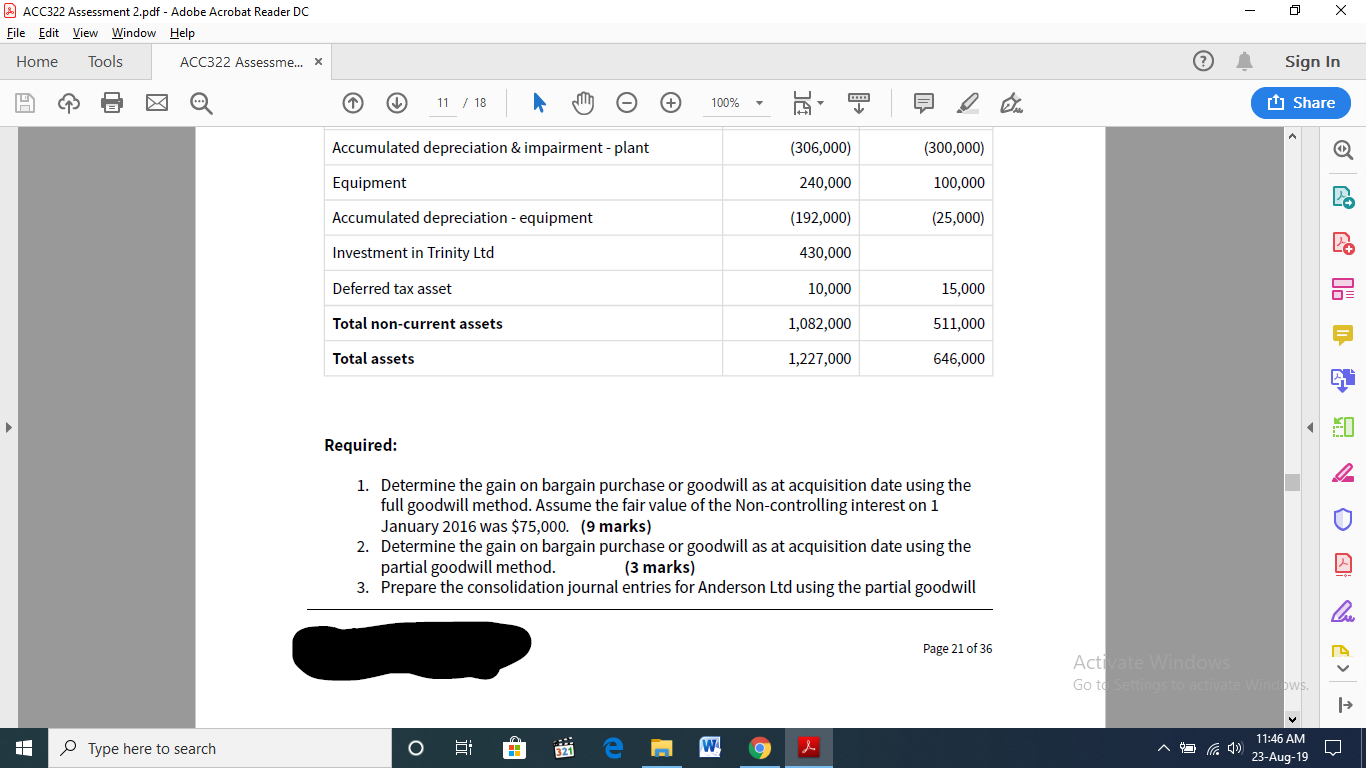

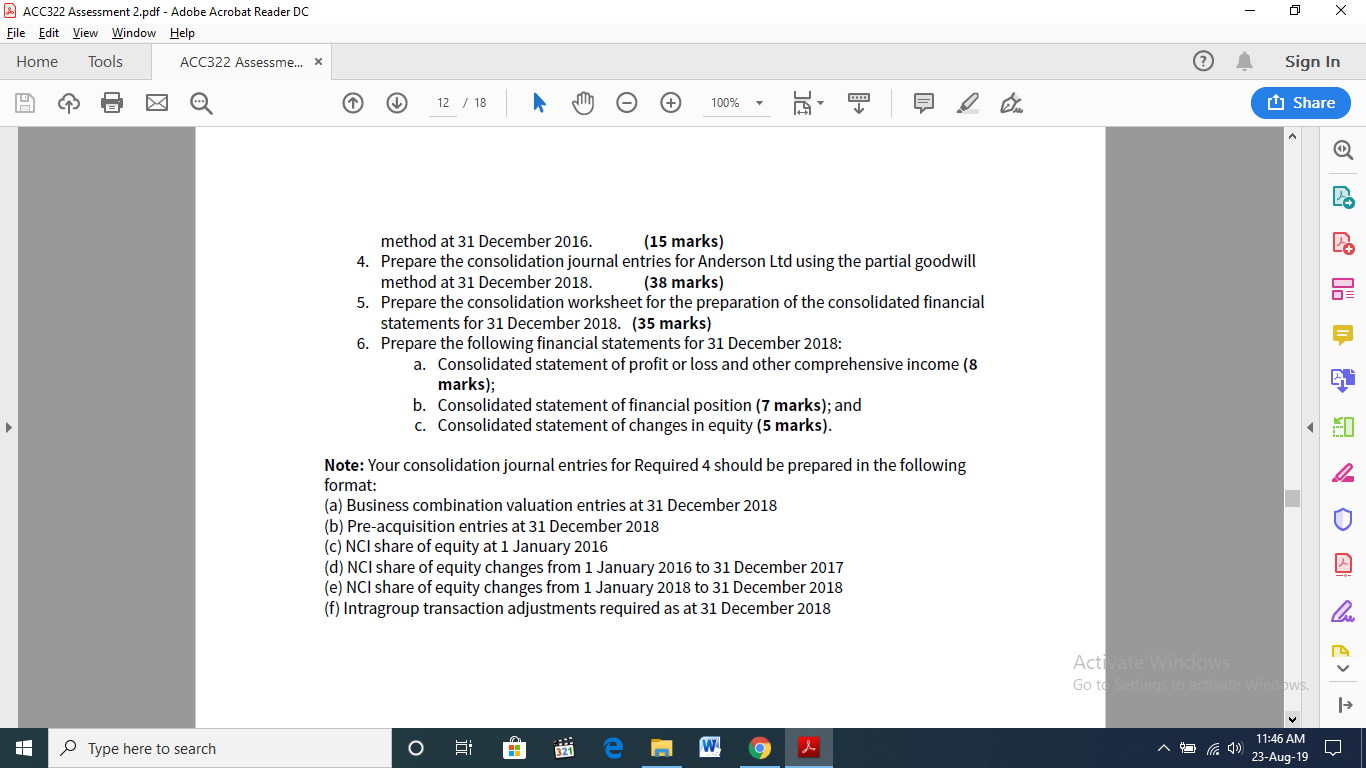

- o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 9 / 18Ah o 100% lie U Share Question 4 Non-Controlling Interest (120 marks) On 1 January 2016 Anderson Ltd acquired 85% of the equity of Trinity Ltd at a cost of $430,000. Share capital 300,000 General reserve 50,000 Retained earnings 90,000 At this date, Trinity Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the following assets: Fair value Carrying amount Inventory 45,000 50,000 Plant (accumulated depreciation $300,000) 200,000 220,000 Acti ate Windows Go to Settings to activate Winews. Additional information in relation to the acquisition 11:45 AM Type here to search ^ 0 23-Aug-19 0 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 9 / 18 A n o 100% - Over U Share Additional information in relation to the acquisition a. All the inventory on hand at 1 January 2016 was sold by 31 December 2016. b. The plant has a remaining useful life of 12 years and will be depreciated on a straight- line basis. C. In December 2017 Anderson Ltd impaired the goodwill from the acquisition of Trinity Ltd by $10,000. A further impairment of $16,125 was made in December 2018. d. Trinity Ltd transferred $30,000 from its pre-acquisition retained earnings to the General reserve account, in December 2018. e. The tax rate is 30% Additional information regarding intragroup and other transactions Transactions for the 2016 financial year a. Trinity Ltd's after-tax profit was $34,000. b. There were no intragroup transactions during the period. Transactions for the 2017 financial year a. Trinity Ltd's after-tax profit was $30,000. b. In November 2017, Trinity Ltd sold inventory to Anderson Ltd for $27,000, and all inventory was still on hand as of 31 December 2017. The sale price included a 20% mark-up on the cost of sales. Acti ate Windows Go to Settings to activate Winw5. Page 19 of 36 Type here to search o i jie w 9 ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 10 / 18A m o 100% in 9 ore U Share Transactions for the 2018 financial year a. Trinity Ltd's after-tax profit was $33,000. b. Anderson Ltd on sold all the remaining inventory from December 2017 by the end of February 2018. C. Anderson Ltd sold inventory to Trinity Ltd that had cost $7,800 for $ 9,000. As of 31 December 2018, 20% of that inventory was still held by Trinity Ltd. d. On 1 January 2018, Trinity Ltd sold a piece of equipment to Anderson Ltd for $15,000. The carrying value for Trinity Ltd was $12,000. The remaining useful life of the equipment is five years. Anderson Ltd continued to depreciate the equipment on a straight-line basis. e. During 2018, Trinity Ltd revalued land acquired post-acquisition by $40,000. The financial information of both companies on 31 December 2018 has been uploaded to a consolidating worksheet as follows: Anderson Ltd Trinity Ltd Sales revenue 80,000 20,000 Cost of Sales (20,000) (8,000) Other expenses (12,000) (6,000) Other revenue 31,000 8,500 Acti ate Windows Go to Settings to activate Winw5. 79,000 14,500 Operating profit o Type here to search @ e w 9 ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 10 / 18 A NT o 100% - 9 onte U Share Operating profit 79,000 14,500 Income tax expense (17,000) (3,500) Profit after tax 62,000 11,000 Retained earnings - 1 July 2018 200,000 160,000 Dividends declared (40,000) (8,000) Retained earnings - 30 June 2019 222,000 163,000 Share capital 800,000 300,000 General reserve 80,000 Asset revaluation surplus - 1 July 2018 64,000 Revaluation of assets 28,000 Asset revaluation surplus - 30 June 2019 64,000 28,000 Total equity 1,086,000 571,000 Page 20 of 36 Acti ate Windows Go to Settings to activate Winw5. 11:46 AM Type here to search o e si e W 9 ^ 0 23-Aug-19 0 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 11 / 18A uno o 100% - 9 One U Share Current liabilities Trade and other payables 21,000 8,000 Non-current liabilities Loans 120,000 55,000 Deferred tax liability 12,000 Total non-current liabilities 120,000 67,000 Total liabilities 141,000 75,000 Total liabilities and equity 1,227,000 646,000 Current assets Cash 10,000 7,000 Trade and other receivables 40,000 48,000 Inventory 95,000 80,000 Total current assets 145,000 135,000 Non-current assets Land 300,000 221,000 Plant 600,000 500,000 Acti ate Windows Go to Settings to activate Winw5. Accumulated depreciation & impairment-plant (306,000) (300,000) Type here to search ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 11 / 18A Thog 100% - 7 eur U Share Accumulated depreciation & impairment-plant (306,000) Equipment 240,000 (300,000) 100,000 (25,000) Accumulated depreciation - equipment (192,000) Investment in Trinity Ltd 430,000 Deferred tax asset 10,000 15,000 Total non-current assets 1,082,000 511,000 Total assets 1,227,000 646,000 Required: 1. Determine the gain on bargain purchase or goodwill as at acquisition date using the full goodwill method. Assume the fair value of the Non-controlling interest on 1 January 2016 was $75,000. (9 marks) 2. Determine the gain on bargain purchase or goodwill as at acquisition date using the partial goodwill method. (3 marks) 3. Prepare the consolidation journal entries for Anderson Ltd using the partial goodwill Page 21 of 36 Acti ate Windows Go to Settings to activate Winw5. Type here to search 11:46 AM ^ o e se mw 92 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 6 Q 12 / 18 A n o 100% - 7 eur U Share method at 31 December 2016. (15 marks) 4. Prepare the consolidation journal entries for Anderson Ltd using the partial goodwill method at 31 December 2018. (38 marks) 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for 31 December 2018. (35 marks) 6. Prepare the following financial statements for 31 December 2018: a. Consolidated statement of profit or loss and other comprehensive income (8 marks); b. Consolidated statement of financial position (7 marks); and C. Consolidated statement of changes in equity (5 marks). Note: Your consolidation journal entries for Required 4 should be prepared in the following format: (a) Business combination valuation entries at 31 December 2018 (b) Pre-acquisition entries at 31 December 2018 (c) NCI share of equity at 1 January 2016 (d) NCI share of equity changes from 1 January 2016 to 31 December 2017 (e) NCI share of equity changes from 1 January 2018 to 31 December 2018 (f) Intragroup transaction adjustments required as at 31 December 2018 Activate Windows Go to Settings to activate Winw5. Type here to search 11:46 AM ^ o e se mw 92 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 9 / 18Ah o 100% lie U Share Question 4 Non-Controlling Interest (120 marks) On 1 January 2016 Anderson Ltd acquired 85% of the equity of Trinity Ltd at a cost of $430,000. Share capital 300,000 General reserve 50,000 Retained earnings 90,000 At this date, Trinity Ltd had not recorded any goodwill, and all identifiable assets and liabilities were recorded at fair value except for the following assets: Fair value Carrying amount Inventory 45,000 50,000 Plant (accumulated depreciation $300,000) 200,000 220,000 Acti ate Windows Go to Settings to activate Winews. Additional information in relation to the acquisition 11:45 AM Type here to search ^ 0 23-Aug-19 0 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 9 / 18 A n o 100% - Over U Share Additional information in relation to the acquisition a. All the inventory on hand at 1 January 2016 was sold by 31 December 2016. b. The plant has a remaining useful life of 12 years and will be depreciated on a straight- line basis. C. In December 2017 Anderson Ltd impaired the goodwill from the acquisition of Trinity Ltd by $10,000. A further impairment of $16,125 was made in December 2018. d. Trinity Ltd transferred $30,000 from its pre-acquisition retained earnings to the General reserve account, in December 2018. e. The tax rate is 30% Additional information regarding intragroup and other transactions Transactions for the 2016 financial year a. Trinity Ltd's after-tax profit was $34,000. b. There were no intragroup transactions during the period. Transactions for the 2017 financial year a. Trinity Ltd's after-tax profit was $30,000. b. In November 2017, Trinity Ltd sold inventory to Anderson Ltd for $27,000, and all inventory was still on hand as of 31 December 2017. The sale price included a 20% mark-up on the cost of sales. Acti ate Windows Go to Settings to activate Winw5. Page 19 of 36 Type here to search o i jie w 9 ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 10 / 18A m o 100% in 9 ore U Share Transactions for the 2018 financial year a. Trinity Ltd's after-tax profit was $33,000. b. Anderson Ltd on sold all the remaining inventory from December 2017 by the end of February 2018. C. Anderson Ltd sold inventory to Trinity Ltd that had cost $7,800 for $ 9,000. As of 31 December 2018, 20% of that inventory was still held by Trinity Ltd. d. On 1 January 2018, Trinity Ltd sold a piece of equipment to Anderson Ltd for $15,000. The carrying value for Trinity Ltd was $12,000. The remaining useful life of the equipment is five years. Anderson Ltd continued to depreciate the equipment on a straight-line basis. e. During 2018, Trinity Ltd revalued land acquired post-acquisition by $40,000. The financial information of both companies on 31 December 2018 has been uploaded to a consolidating worksheet as follows: Anderson Ltd Trinity Ltd Sales revenue 80,000 20,000 Cost of Sales (20,000) (8,000) Other expenses (12,000) (6,000) Other revenue 31,000 8,500 Acti ate Windows Go to Settings to activate Winw5. 79,000 14,500 Operating profit o Type here to search @ e w 9 ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 10 / 18 A NT o 100% - 9 onte U Share Operating profit 79,000 14,500 Income tax expense (17,000) (3,500) Profit after tax 62,000 11,000 Retained earnings - 1 July 2018 200,000 160,000 Dividends declared (40,000) (8,000) Retained earnings - 30 June 2019 222,000 163,000 Share capital 800,000 300,000 General reserve 80,000 Asset revaluation surplus - 1 July 2018 64,000 Revaluation of assets 28,000 Asset revaluation surplus - 30 June 2019 64,000 28,000 Total equity 1,086,000 571,000 Page 20 of 36 Acti ate Windows Go to Settings to activate Winw5. 11:46 AM Type here to search o e si e W 9 ^ 0 23-Aug-19 0 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 11 / 18A uno o 100% - 9 One U Share Current liabilities Trade and other payables 21,000 8,000 Non-current liabilities Loans 120,000 55,000 Deferred tax liability 12,000 Total non-current liabilities 120,000 67,000 Total liabilities 141,000 75,000 Total liabilities and equity 1,227,000 646,000 Current assets Cash 10,000 7,000 Trade and other receivables 40,000 48,000 Inventory 95,000 80,000 Total current assets 145,000 135,000 Non-current assets Land 300,000 221,000 Plant 600,000 500,000 Acti ate Windows Go to Settings to activate Winw5. Accumulated depreciation & impairment-plant (306,000) (300,000) Type here to search ^ 11:46 AM 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 DQ 11 / 18A Thog 100% - 7 eur U Share Accumulated depreciation & impairment-plant (306,000) Equipment 240,000 (300,000) 100,000 (25,000) Accumulated depreciation - equipment (192,000) Investment in Trinity Ltd 430,000 Deferred tax asset 10,000 15,000 Total non-current assets 1,082,000 511,000 Total assets 1,227,000 646,000 Required: 1. Determine the gain on bargain purchase or goodwill as at acquisition date using the full goodwill method. Assume the fair value of the Non-controlling interest on 1 January 2016 was $75,000. (9 marks) 2. Determine the gain on bargain purchase or goodwill as at acquisition date using the partial goodwill method. (3 marks) 3. Prepare the consolidation journal entries for Anderson Ltd using the partial goodwill Page 21 of 36 Acti ate Windows Go to Settings to activate Winw5. Type here to search 11:46 AM ^ o e se mw 92 0 23-Aug-19 - o x ACC322 Assessment 2.pdf - Adobe Acrobat Reader DC File Edit View Window Help Home Tools ACC322 Assessme... X Sign In A 3 6 Q 12 / 18 A n o 100% - 7 eur U Share method at 31 December 2016. (15 marks) 4. Prepare the consolidation journal entries for Anderson Ltd using the partial goodwill method at 31 December 2018. (38 marks) 5. Prepare the consolidation worksheet for the preparation of the consolidated financial statements for 31 December 2018. (35 marks) 6. Prepare the following financial statements for 31 December 2018: a. Consolidated statement of profit or loss and other comprehensive income (8 marks); b. Consolidated statement of financial position (7 marks); and C. Consolidated statement of changes in equity (5 marks). Note: Your consolidation journal entries for Required 4 should be prepared in the following format: (a) Business combination valuation entries at 31 December 2018 (b) Pre-acquisition entries at 31 December 2018 (c) NCI share of equity at 1 January 2016 (d) NCI share of equity changes from 1 January 2016 to 31 December 2017 (e) NCI share of equity changes from 1 January 2018 to 31 December 2018 (f) Intragroup transaction adjustments required as at 31 December 2018 Activate Windows Go to Settings to activate Winw5. Type here to search 11:46 AM ^ o e se mw 92 0 23-Aug-19

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts