Question: OAG201 / HRM110 | Take home assignment 1 Course Code: Course Name: Semester: Assignment: OAG 201 / HRM 110 Accounting for the Office Assistant /

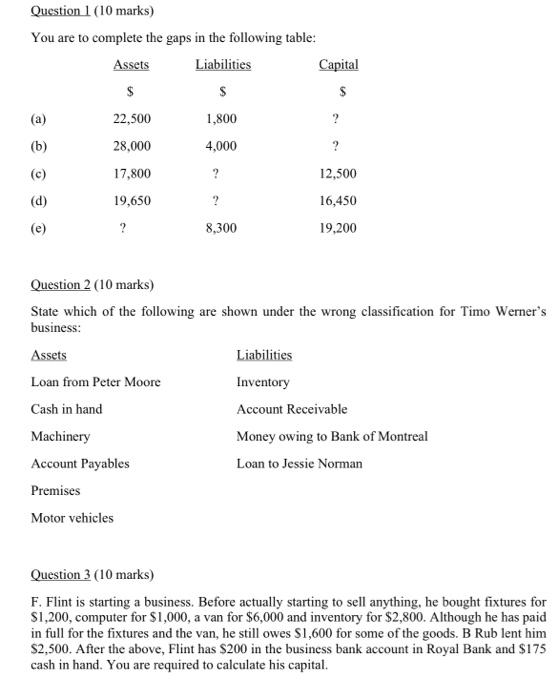

Question 1 (10 marks) You are to complete the gaps in the following table: Assets Liabilities Capital $ $ $ (a) 22,500 1,800 ? (b) 28,000 4,000 ? (c) 17,800 ? 12,500 19,650 ? 16,450 (d) (e) ? 8,300 19,200 Question 2 (10 marks) State which of the following are shown under the wrong classification for Timo Werner's business: Assets Liabilities Loan from Peter Moore Inventory Cash in hand Account Receivable Machinery Money owing to Bank of Montreal Account Payables Loan to Jessie Norman Premises Motor vehicles Question 3 (10 marks) F. Flint is starting a business. Before actually starting to sell anything, he bought fixtures for $1,200, computer for $1,000, a van for $6,000 and inventory for $2,800. Although he has paid in full for the fixtures and the van, he still owes S1,600 for some of the goods. B Rub lent him $2,500. After the above, Flint has $200 in the business bank account in Royal Bank and $175 cash in hand. You are required to calculate his capital

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts