Question: Obj. 1,2 2.A. Manufacturing margin, $37,440 PR 20-3B Absorption and variable costing income statements for two months and analysis During the first month of operations

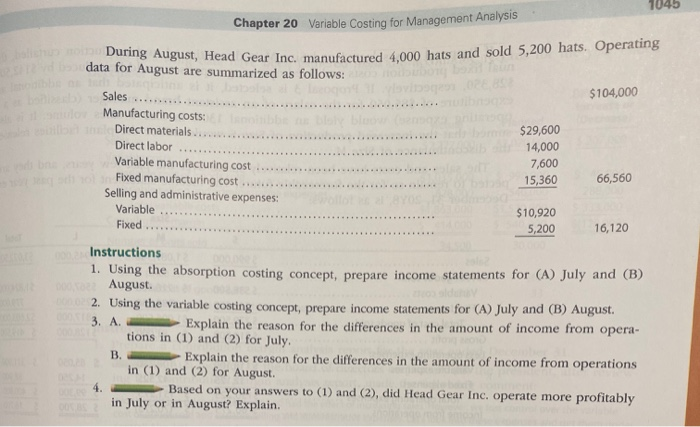

Obj. 1,2 2.A. Manufacturing margin, $37,440 PR 20-3B Absorption and variable costing income statements for two months and analysis During the first month of operations ended July 31, Head Gear Inc, manufactured 6,400 hats. which 5,200 were sold. Operating data for the month are summarized as follows: Sales $104,000 Manufacturing costs: Direct materials. $47,360 Direct labor.... 22,400 Variable manufacturing cost 12,160 Fored manufacturing cost Selling and administrative expenses: 15,360 97,280 Variable Fixed $10,920 5,200 16,120 SHOW ME 1045 Chapter 20 Variable Costing for Management Analysis During August, Head Gear Inc. manufactured 4,000 hats and ead Gear Inc. manufactured 4,000 hats and sold 5,200 hats. Operating data for August are summarized as follows: $104,000 Sales ............. Manufacturing costs: Direct materials ........ $29,600 Direct labor ...... 14,000 Variable manufacturing cost .............. 7,600 ......... . Fixed manufacturing cost 15,360 66,560 Selling and administrative expenses: Variable ....... $10,920 Fixed ... 5,200 16,120 Instructions 1. Using the absorption costing concept, prepare income statements for (A) July and (B) August. 2. Using the variable costing concept, prepare income statements for (A) July and (B) August 3. A. Explain the reason for the differences in the amount of income from opera tions in (1) and (2) for July. Explain the reason for the differences in the amount of income from operations in (1) and (2) for August. Based on your answers to (1) and (2), did Head Gear Inc. operate more profitably in July or in August? Explain. 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts