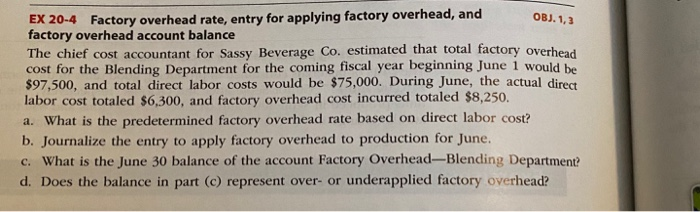

Question: OBJ. 1,3 EX 20-4 Factory overhead rate, entry for applying factory overhead, and factory overhead account balance The chief cost accountant for Sassy Beverage Co.

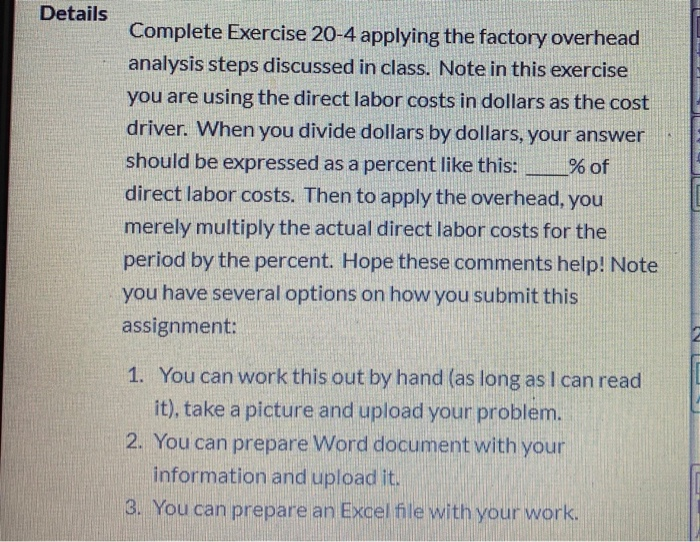

OBJ. 1,3 EX 20-4 Factory overhead rate, entry for applying factory overhead, and factory overhead account balance The chief cost accountant for Sassy Beverage Co. estimated that total factory overhead cost for the Blending Department for the coming fiscal year beginning June 1 would be $97,500, and total direct labor costs would be $75,000. During June, the actual direct labor cost totaled $6,300, and factory overhead cost incurred totaled $8,250. a. What is the predetermined factory overhead rate based on direct labor cost? b. Journalize the entry to apply factory overhead to production for June. c. What is the June 30 balance of the account Factory Overhead-Blending Department? d. Does the balance in part (c) represent over- or underapplied factory overhead? Details Complete Exercise 20-4 applying the factory overhead analysis steps discussed in class. Note in this exercise you are using the direct labor costs in dollars as the cost driver. When you divide dollars by dollars, your answer should be expressed as a percent like this: % of direct labor costs. Then to apply the overhead, you merely multiply the actual direct labor costs for the period by the percent. Hope these comments help! Note you have several options on how you submit this assignment: 1. You can work this out by hand (as long as I can read it), take a picture and upload your problem. 2. You can prepare Word document with your information and upload it. 3. You can prepare an Excel file with your work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts