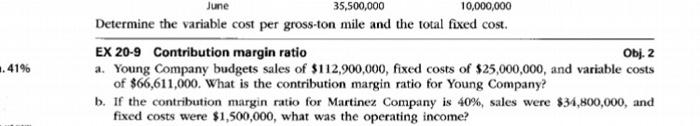

Question: Obj. 2 1.419 June 35,500,000 10,000,000 Determine the variable cost per gross-ton mile and the total fixed cost. EX 20-9 Contribution margin ratio a. Young

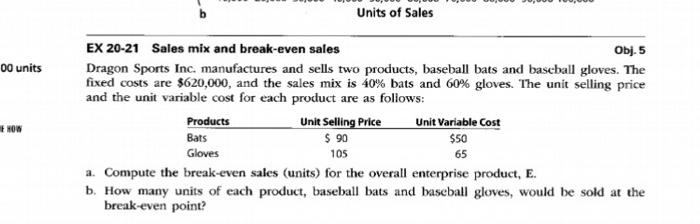

Obj. 2 1.419 June 35,500,000 10,000,000 Determine the variable cost per gross-ton mile and the total fixed cost. EX 20-9 Contribution margin ratio a. Young Company budgets sales of $112,900,000, fixed costs of $25,000,000, and variable costs of $66,611,000. What is the contribution margin ratio for Young Company? b. If the contribution margin ratio for Martinez Company is 40%, sales were $34,800,000, and fixed costs were $1,500,000, what was the operating income? Units of Sales 00 units HOW EX 20-21 Sales mix and break-even sales Obj. 5 Dragon Sports Inc. manufactures and sells two products, baseball bats and baseball gloves. The fixed costs are $620,000, and the sales mix is 40% bats and 60% gloves. The unit selling price and the unit variable cost for each product are as follows: Products Unit Selling Price Unit Variable Cost Bats $ 90 $50 Gloves 105 65 a. Compute the break-even sales (units) for the overall enterprise product, E. b. How many units of each product, baseball bats and baseball gloves, would be sold at the break-even point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts