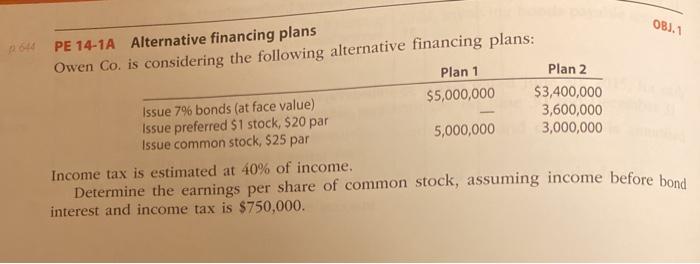

Question: OBJ. Plan 2 64 PE 14-1A Alternative financing plans Owen Co. is considering the following alternative financing plans: Plan 1 Issue 7% bonds (at face

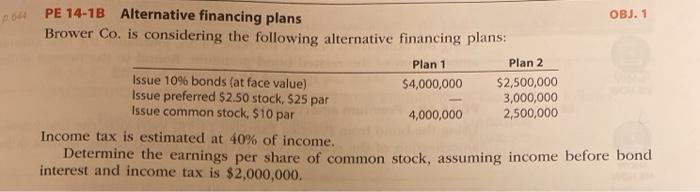

OBJ. Plan 2 64 PE 14-1A Alternative financing plans Owen Co. is considering the following alternative financing plans: Plan 1 Issue 7% bonds (at face value) $5,000,000 $3,400,000 Issue preferred $1 stock, $20 par 3,600,000 Issue common stock, $25 par 5,000,000 3,000,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming income before bond interest and income tax is $750,000. 4 PE 14-1B Alternative financing plans OBJ. 1 Brower Co. is considering the following alternative financing plans: Plan 1 Plan 2 Issue 10% bonds (at face value) $4,000,000 $2,500,000 Issue preferred $2.50 stock, 525 par 3,000,000 Issue common stock, $10 par 4,000,000 2,500,000 Income tax is estimated at 40% of income. Determine the earnings per share of common stock, assuming income before bond interest and income tax is $2,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts