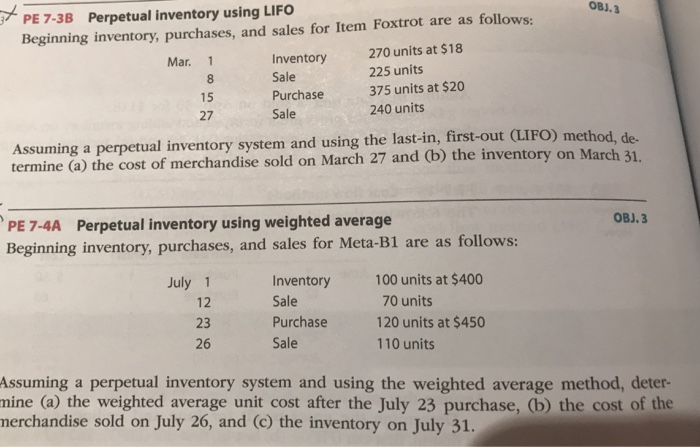

Question: OBJ.3 PE 7-3B Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item Foxtrot are as follows: 270 units at $18 Inventory Sale Purchase

OBJ.3 PE 7-3B Perpetual inventory using LIFO Beginning inventory, purchases, and sales for Item Foxtrot are as follows: 270 units at $18 Inventory Sale Purchase Sale Mar. 1 225 units 375 units at $20 240 units 15 27 Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, de. termine (a) the cost of merchandise sold on March 27 and ( b) the inventory on March 31. PE 7-4A Perpetual inventory using weighted average Beginning inventory, purchases, and sales for Meta-B1 are as follows: OBJ.3 July 1 12 23 26 Inventory Sale Purchase Sale 100 units at $400 70 units 120 units at $450 110 units Assuming a perpetual inventory system and using the weighted average method, deter- mine (a) the weighted average unit cost after the July 23 purchase, (b) the cost of the merchandise sold on July 26, and (c) the inventory on July 31. rag ni ely 2 purchase, 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts