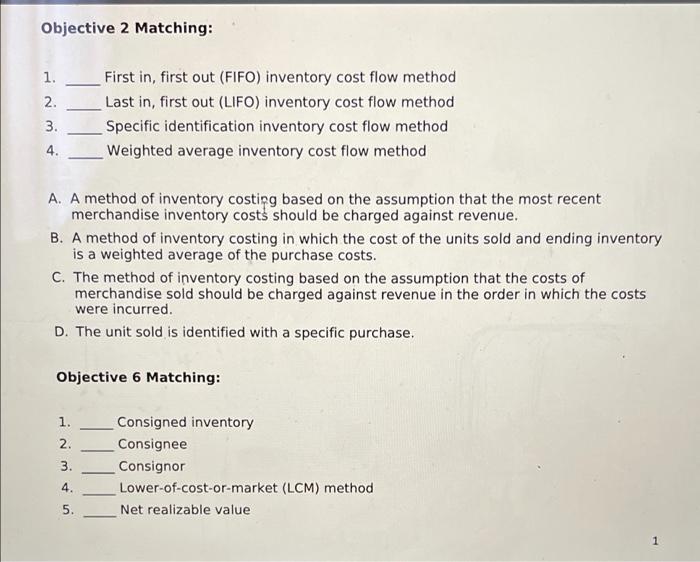

Question: Objective 2 Matching: 1. 2. First in, first out (FIFO) inventory cost flow method Last in, first out (LIFO) inventory cost flow method Specific identification

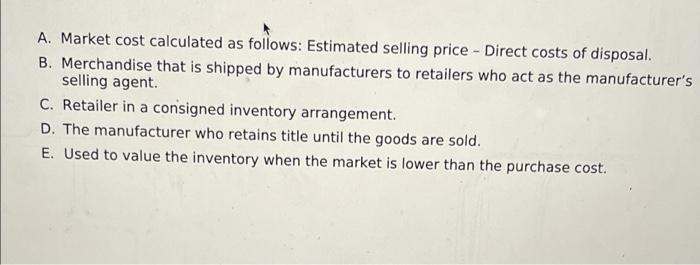

Objective 2 Matching: 1. 2. First in, first out (FIFO) inventory cost flow method Last in, first out (LIFO) inventory cost flow method Specific identification inventory cost flow method Weighted average inventory cost flow method 3. 4. A. A method of inventory costig based on the assumption that the most recent merchandise inventory costs should be charged against revenue. B. A method of inventory costing in which the cost of the units sold and ending inventory is a weighted average of the purchase costs. C. The method of inventory costing based on the assumption that the costs of merchandise sold should be charged against revenue in the order in which the costs were incurred. D. The unit sold is identified with a specific purchase. Objective 6 Matching: 1. 2. 3. Consigned inventory Consignee Consignor Lower-of-cost-or-market (LCM) method Net realizable value 4. 5. 1 A. Market cost calculated as follows: Estimated selling price - Direct costs of disposal. B. Merchandise that is shipped by manufacturers to retailers who act as the manufacturer's selling agent. C. Retailer in a consigned inventory arrangement. D. The manufacturer who retains title until the goods are sold. E. Used to value the inventory when the market is lower than the purchase cost

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts