Question: OBJECTIVE 4 TOPIC - The Effect of Stock Splits on Stockholders' Equity NOTE: It is important to distinguish between a stock dividend and a stock

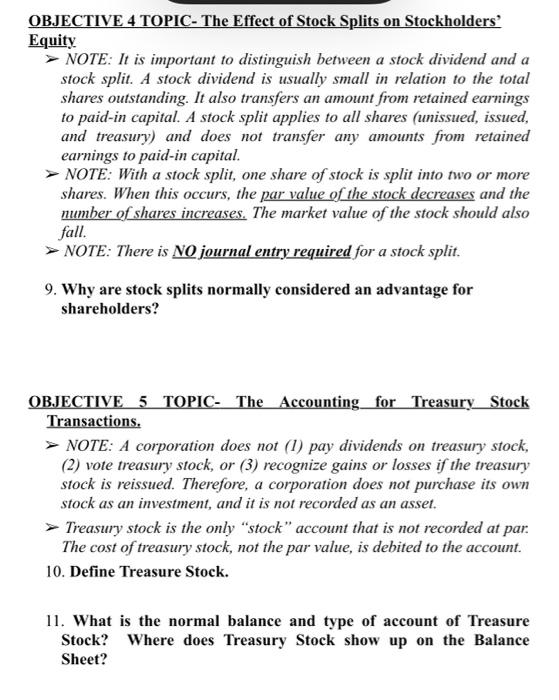

OBJECTIVE 4 TOPIC - The Effect of Stock Splits on Stockholders' Equity NOTE: It is important to distinguish between a stock dividend and a stock split. A stock dividend is usually small in relation to the total shares outstanding. It also transfers an amount from retained earnings to paid-in capital. A stock split applies to all shares (unissued, issued, and treasury) and does not transfer any amounts from retained earnings to paid-in capital. NOTE: With a stock split, one share of stock is split into two or more shares. When this occurs, the par value of the stock decreases and the number of shares increases. The market value of the stock should also fall. NOTE: There is NO journal entry required for a stock split. 9. Why are stock splits normally considered an advantage for shareholders? OBJECTIVE 5 TOPIC- The Accounting for Treasury Stock Transactions. NOTE: A corporation does not (1) pay dividends on treasury stock, (2) vote treasury stock, or (3) recognize gains or losses if the treasury stock is reissued. Therefore, a corporation does not purchase its own stock as an investment, and it is not recorded as an asset. Treasury stock is the only "stock" account that is not recorded at par. The cost of treasury stock, not the par value, is debited to the account. 10. Define Treasure Stock. 11. What is the normal balance and type of account of Treasure Stock? Where does Treasury Stock show up on the Balance Sheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts