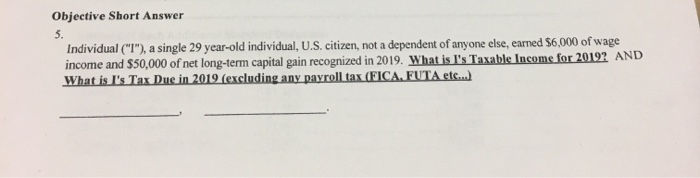

Question: Objective Short Answer Individual (1), a single 29 year-old individual, U.S. citizen, not a dependent of anyone else, earned $6,000 of wage income and $50,000

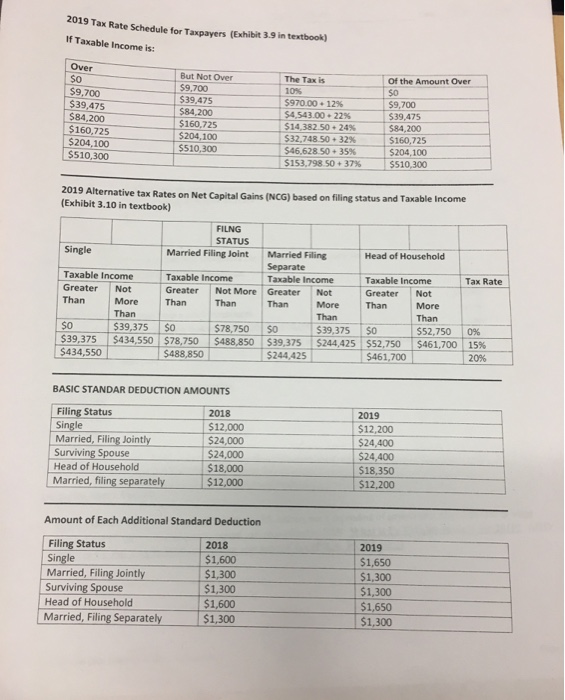

Objective Short Answer Individual ("1"), a single 29 year-old individual, U.S. citizen, not a dependent of anyone else, earned $6,000 of wage income and $50,000 of net long-term capital gain recognized in 2019. What is I's Taxable income for 20192 AND What is I's Tax Due in 2019 (excluding any payroll tax (FICA, FUTA et.... 2019 Tax Rate Schedule for Taxpayers (Exhibit 3.9 in textbook) If Taxable income is: Over The Taxis 10% so $9,700 $39,475 $84,200 $ 160,725 $204,100 $510,300 But Not Over $9,700 $39,475 584,200 $160,725 $ 204,100 $510,300 $970.00.1296 $4530022% $14.382.50 +2495 $32,748 50 32% $46.628 50.35% $153.798 50.37% of the Amount Over $0 $9.700 $39,475 $84.200 $160,725 5204,100 $510,300 2019 Alternative tax Rates on Net Capital Gains NCG) based on filing status and Taxable income (Exhibit 3.10 in textbook) Single Head of Household Tax Rate Taxable income Greater Not Than More Than $39,375 $39,375 $434,550 $434,550 FILNG STATUS Married Filing Joint Married Filing Separate Taxable income Taxable income Greater Not More Greater Not Than Than More Than 50 $78,750 50 $39,375 $78,750 $488,850 $39,375 $244,425 $488,850 $244,425 Taxable income Greater Not Than More Than $0 $52,750 $52,750 $461,700 $461,700 SO 0% 15% 20% BASIC STANDAR DEDUCTION AMOUNTS Filing Status Single Married, Filing Jointly Surviving Spouse Head of Household Married, filing separately 2018 $12,000 $24,000 $24,000 $18,000 $12,000 2019 $12,200 $24.400 $24,400 $18,350 $12,200 Amount of Each Additional Standard Deduction Filing Status 2018 Single $1,600 Married, Filing Jointly $1,300 Surviving Spouse $1,300 Head of Household $1,600 Married, Filing Separately $1,300 2019 $1,650 $1,300 $1,300 $1,650 $1,300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts