Question: Objectives: 1) to gain proficiency in conceptualizing and constructing a decision mechanism for a capital budgeting scenario, and 2) to gain experience utilizing the financial

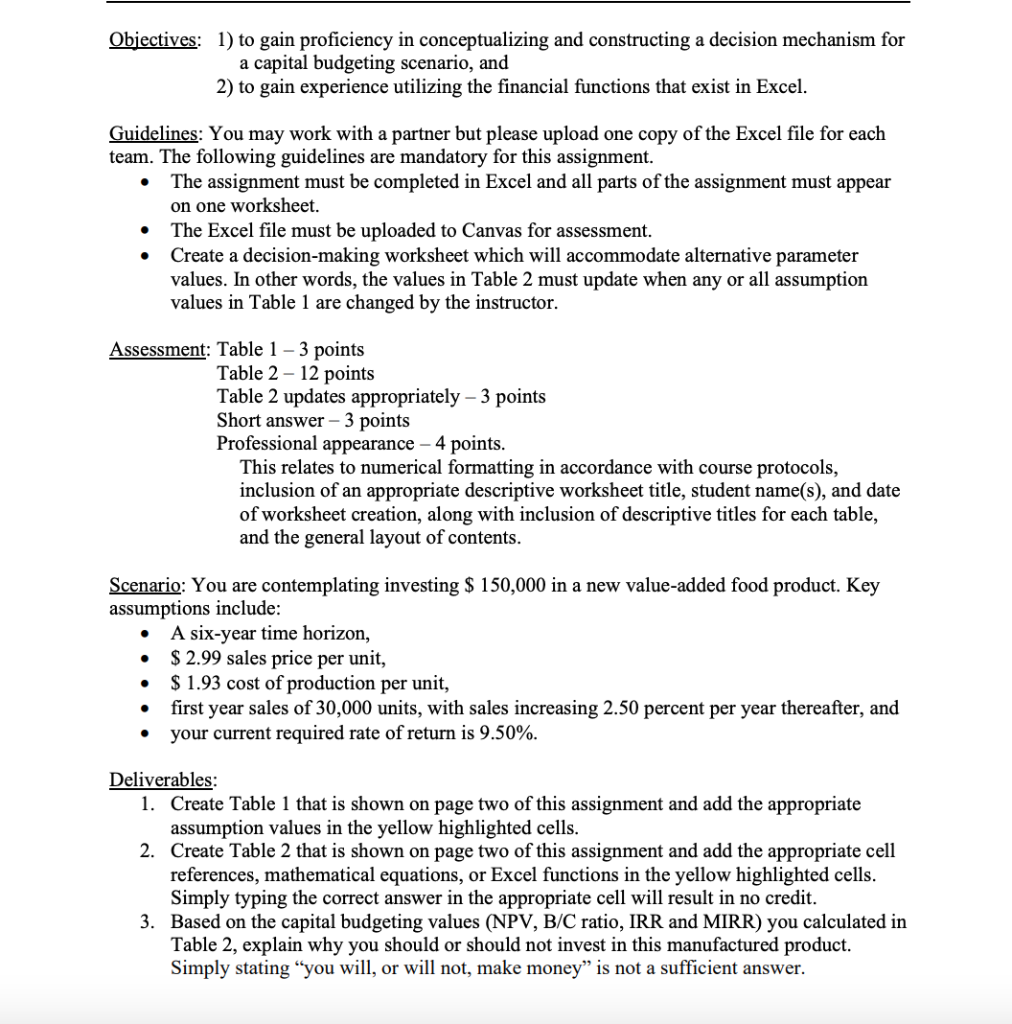

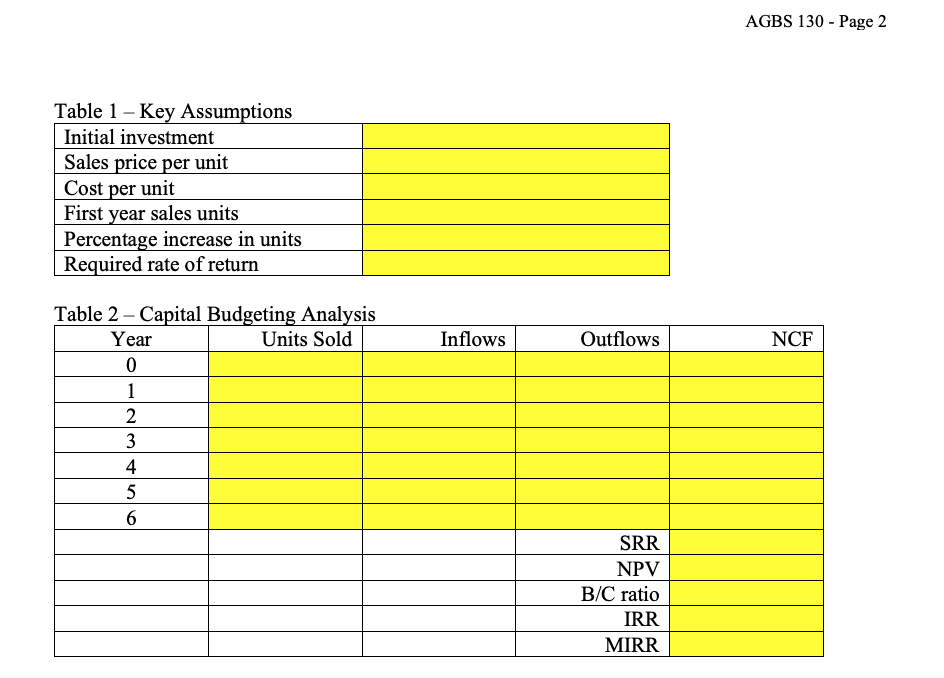

Objectives: 1) to gain proficiency in conceptualizing and constructing a decision mechanism for a capital budgeting scenario, and 2) to gain experience utilizing the financial functions that exist in Excel. Guidelines: You may work with a partner but please upload one copy of the Excel file for each team. The following guidelines are mandatory for this assignment. - The assignment must be completed in Excel and all parts of the assignment must appear on one worksheet. - The Excel file must be uploaded to Canvas for assessment. - Create a decision-making worksheet which will accommodate alternative parameter values. In other words, the values in Table 2 must update when any or all assumption values in Table 1 are changed by the instructor. Assessment: Table 13 points Table 212 points Table 2 updates appropriately -3 points Short answer -3 points Professional appearance -4 points. This relates to numerical formatting in accordance with course protocols, inclusion of an appropriate descriptive worksheet title, student name(s), and date of worksheet creation, along with inclusion of descriptive titles for each table, and the general layout of contents. Scenario: You are contemplating investing $150,000 in a new value-added food product. Key assumptions include: - A six-year time horizon, - $2.99 sales price per unit, - $1.93 cost of production per unit, - first year sales of 30,000 units, with sales increasing 2.50 percent per year thereafter, and - your current required rate of return is 9.50%. Deliverables: 1. Create Table 1 that is shown on page two of this assignment and add the appropriate assumption values in the yellow highlighted cells. 2. Create Table 2 that is shown on page two of this assignment and add the appropriate cell references, mathematical equations, or Excel functions in the yellow highlighted cells. Simply typing the correct answer in the appropriate cell will result in no credit. 3. Based on the capital budgeting values (NPV, B/C ratio, IRR and MIRR) you calculated in Table 2, explain why you should or should not invest in this manufactured product. Simply stating "you will, or will not, make money" is not a sufficient answer. AGBS 130 - Page 2 Table 1 - Kev Assumntions Objectives: 1) to gain proficiency in conceptualizing and constructing a decision mechanism for a capital budgeting scenario, and 2) to gain experience utilizing the financial functions that exist in Excel. Guidelines: You may work with a partner but please upload one copy of the Excel file for each team. The following guidelines are mandatory for this assignment. - The assignment must be completed in Excel and all parts of the assignment must appear on one worksheet. - The Excel file must be uploaded to Canvas for assessment. - Create a decision-making worksheet which will accommodate alternative parameter values. In other words, the values in Table 2 must update when any or all assumption values in Table 1 are changed by the instructor. Assessment: Table 13 points Table 212 points Table 2 updates appropriately -3 points Short answer -3 points Professional appearance -4 points. This relates to numerical formatting in accordance with course protocols, inclusion of an appropriate descriptive worksheet title, student name(s), and date of worksheet creation, along with inclusion of descriptive titles for each table, and the general layout of contents. Scenario: You are contemplating investing $150,000 in a new value-added food product. Key assumptions include: - A six-year time horizon, - $2.99 sales price per unit, - $1.93 cost of production per unit, - first year sales of 30,000 units, with sales increasing 2.50 percent per year thereafter, and - your current required rate of return is 9.50%. Deliverables: 1. Create Table 1 that is shown on page two of this assignment and add the appropriate assumption values in the yellow highlighted cells. 2. Create Table 2 that is shown on page two of this assignment and add the appropriate cell references, mathematical equations, or Excel functions in the yellow highlighted cells. Simply typing the correct answer in the appropriate cell will result in no credit. 3. Based on the capital budgeting values (NPV, B/C ratio, IRR and MIRR) you calculated in Table 2, explain why you should or should not invest in this manufactured product. Simply stating "you will, or will not, make money" is not a sufficient answer. AGBS 130 - Page 2 Table 1 - Kev Assumntions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts