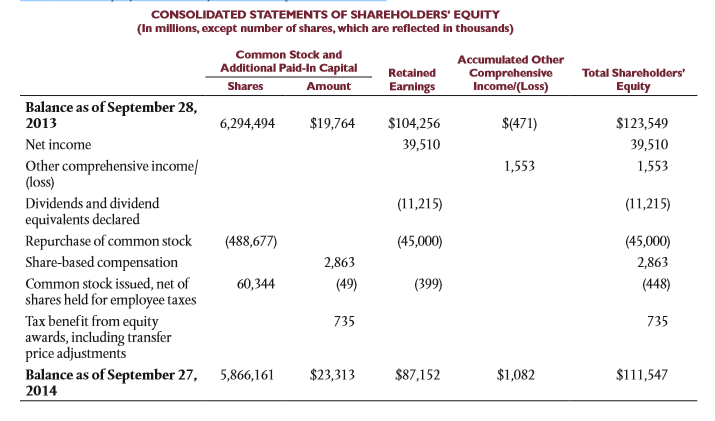

Question: (Objectives 22-3, 22-4) The table below is an excerpt from Apple Inc.s Statement of Shareholders Equity for its fiscal year ended September 27, 2014: a.

(Objectives 22-3, 22-4) The table below is an excerpt from Apple Inc.s Statement of Shareholders Equity for its fiscal year ended September 27, 2014:

a. How would the auditor verify the balances as of September 28, 2013?

b. What would the auditor do to evaluate the amount shown as Net Income?

c. What sources of evidence might the auditor use to satisfy the occurrence objective for each of the following?

(1) Repurchase of common stock

(2) Share-based compensation

(3) Common shares issued

d. How should the amounts shown as of September 27, 2014, relate to the amounts shown in Apples balance sheet as of the same date?

CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares, which are reflected in thousands) Common Stock and Additional Paid-In Cap Accumulated OtherlShareholders Co Retained Comprehensive Total Shareholders' Earnings Shares Amount Income/(Loss) Equity Balance as of September 28, 2013 Net income Other comprehensive incomel (loss) Dividends and dividend equivalents declared 6,294,494 $19,764 $104,256 $(471) $123,549 39,510 1,553 39,510 1,553 (11,215) (45,000) (399) (11,215) (45,000) 2,863 (448) Repurchase of common stock (488,677) Share-based compensation Common stock issued, net of shares held for employee taxes Tax benefit from equity awards, including transfer price adjustments 2,863 (49) 60,344 735 735 $111,547 Balance as of September 27, 5,866,16 2014 $23,313$87,152 $1,082 CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY (In millions, except number of shares, which are reflected in thousands) Common Stock and Additional Paid-In Cap Accumulated OtherlShareholders Co Retained Comprehensive Total Shareholders' Earnings Shares Amount Income/(Loss) Equity Balance as of September 28, 2013 Net income Other comprehensive incomel (loss) Dividends and dividend equivalents declared 6,294,494 $19,764 $104,256 $(471) $123,549 39,510 1,553 39,510 1,553 (11,215) (45,000) (399) (11,215) (45,000) 2,863 (448) Repurchase of common stock (488,677) Share-based compensation Common stock issued, net of shares held for employee taxes Tax benefit from equity awards, including transfer price adjustments 2,863 (49) 60,344 735 735 $111,547 Balance as of September 27, 5,866,16 2014 $23,313$87,152 $1,082

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts